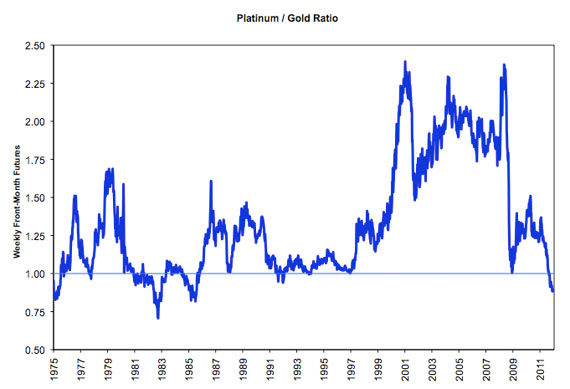

We last examined the dynamics of the platinum market in February when the platinum to gold ratio had declined to levels last seen over two and a half decades ago.

We last examined the dynamics of the platinum market in February when the platinum to gold ratio had declined to levels last seen over two and a half decades ago.

Platinum has extremely volatile price fluctuations due to the fact that 90% of platinum demand is fueled by industrial use and jewelry sales. A weak economy can send the price of platinum plunging as was the case in 2008 when the metal lost almost two thirds of its value. Purchases of jewelry and cars (which require platinum for catalytic converters) are two of the most readily postponed purchases by consumers during a steep recession.

Besides its traditional uses, it now seems that platinum is taking on a new role as a way to profit from further weakness in the European economy. Bearish hedge funds are betting on further declines in platinum prices due to worsening economic conditions in Europe. The Wall Street Journal reports that hedge funds have established the largest short positions ever in the future markets with the expectation that falling car sales will drive the price of platinum lower. The Journal notes that new car registrations have declined by almost 8% this year. Since almost a quarter of annual platinum demand comes from Europe, hedge fund managers have concluded that weak demand will result in lower platinum prices.

With almost everyone leaning in the same direction, will the sudden epiphany by hedge funds on platinum’s future price direction prove correct? Europe’s deep economic problems are old news and if we examine the price charts, declining platinum demand may already be discounted. Last summer, when Wall Street finally took serious notice of Europe’s crumbling economic prospects, the price of platinum plunged from a high of almost $1,900 to $1,354 by the end of 2011.

Here’s where the price action in platinum gets interesting. The economy in Europe has become remarkably worse since last year, with country after country in outright depression (think Greece, Portugal, Spain) and the rest of Europe sliding into recession. Despite the rapid deterioration of Europe’s economy during 2012, the price of platinum has not broken through the lows set last year.

Here are some pros and cons to consider before joining the bearish crowd on platinum.

- The vast majority of platinum deposits are in South Africa and annual production is only about 30 tonnes per year. By way of comparison, gold mining production is about 2,800 tonnes per year.

- Investment demand for platinum constitutes only about 10% of annual demand.

- The gold to platinum ratio is at the lowest since 1985, which may or may not mean very much. Platinum is primarily an industrial metal whereas gold is a currency substitute or monetary metal. Probably the only conclusion one may draw by viewing the long term platinum to gold ratio is that, on a long term basis, platinum turned out to be a good investment in the 1:1 ratio range.

- By the time the average investor hears from the mainstream press about hedge funds betting en masse against platinum, it is probably a safe bet that you are late to the party.

- Although platinum demand is expected to be lower than supply this year, this fact is already well known and discounted.

- The Journal notes that Europe may at some point start to recover as the European Central Bank opens the monetary floodgates with oceans of quantitative easing.

- Platinum is difficult and expensive to mine and at the current price, mining companies are barely breaking even. In June, the fourth largest platinum producer, Aquarius Platinum, suspended mining operations due to low platinum prices.

- Platinum’s lower price may encourage an increase in investor demand for a precious metal that has unique properties and is available in limited quantities.

The U.S. Mint has been producing the Proof American Platinum Eagle since 2009. According to MintNewsBlog, the entire 2009 production of 8,000 Proof Platinum Eagles sold out in a week. During 2010, the U.S. Mint produced 10,000 Proof Platinum coins which also quickly sold out. During 2011, the mintage was set at 15,000 coins but the sales pace slowed considerably with pricing set at $2,092 and the coin has still not sold out with total sales of 14,760 as of the last U.S. Mint report. On August 9th, the U.S. Mint announced that production of the 2012 Proof American Platinum Eagles will be set at 15,000 coins. Orders are limited to 5 per household with initial pricing at $1,692.

Speak Your Mind