Sales of both the American Eagle gold and silver bullion coins soared in February compared to the previous year.

Sales of both the American Eagle gold and silver bullion coins soared in February compared to the previous year.

According to the U.S. Mint, sales of the American Eagle gold bullion coin totaled 80,500 ounces in February, up 283% from comparable sales of 21,000 ounces during February 2012. During January, the Mint sold 150,000 ounces of the gold bullion coins compared to 127,000 ounces during January 2012. January gold bullion sales were the six largest on record and the most since July 2010 when the Mint sold 151,500 ounces.

Total 2013 sales of the American Eagle gold bullion coin through February are up 56% over the comparable period for last year. Year to date, the U.S. Mint has sold 230,500 ounces of gold bullion coins compared to a total of 148,000 ounces during the first two months of 2012.

The American Eagle gold bullion coin is available in one ounce, one-half ounce, one quarter ounce and one-tenth ounce versions. The vast majority of gold bullion coins are purchased as one ounce coins as can be seen from the February sales breakdown listed below.

| FEB 2013 GOLD BULLION SALES | ||

| OUNCES | # COINS | |

| ONE | 68,000 | 68,000 |

| HALF | 2,500 | 5,000 |

| QUARTER | 3,000 | 12,000 |

| TENTH | 7,000 | 70,000 |

| 80,500 | 155,000 | |

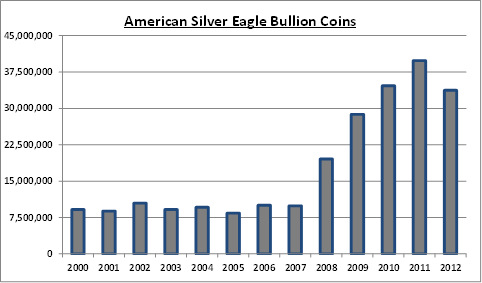

Sales of the American Eagle silver bullion coin also remained robust after last month’s record shattering sales total. During January, the U.S. Mint sold 7,498,000 silver bullion coins as public demand for physical silver coin soared. The huge demand for the American Eagle silver coins forced the U.S. Mint to suspend sales twice as they sought to ramp up production to meet demand. Ever since the financial crisis and the subsequent open ended money printing operations by the Federal Reserve, demand for physical silver has continued strong. Prior to 2008, total annual sales of the silver bullion coins averaged only around 9.5 million coins. During 2012, the U.S. Mint sold 33,742,500 silver bullion coins.

During February, the U.S. Mint reported that 3,368,500 American Eagle silver bullion coins were sold, an increase of 126% over sales of 1,490,000 ounces during February 2012. Year to date sales of the silver bullion coins through February total 10,866,500, up by 43% over the comparable two month period during 2012 when 7,597,000 silver bullion coins were sold.

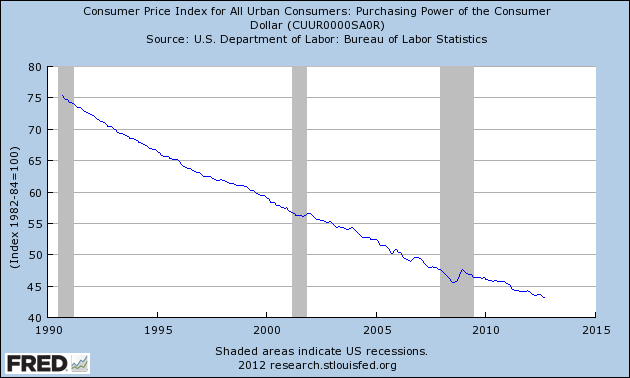

Long term investors are taking advantage of temporary price weakness in precious metals to add to positions (see APMEX Reports Sales Spike). Virtually every major central bank in the world is now engaged in open ended money printing operations and blatant attempts to competitively devalue their currencies. The public is not stupid and continued demand for physical gold and silver proves that gold and silver are becoming the default store of value.

Both the American Eagle gold and silver bullion coins are sold to the Mint’s network of authorized purchasers who buy the coins in bulk based on the market value of the precious metals and a markup by the Mint. The public is not allowed to purchase bullion coins directly from the Mint but are allowed to buy numismatic versions of the coins. The gold and silver bullion coins are sold by the authorized purchasers to the public, other bullion dealers and coin dealers. The rationale for the Mint’s use of authorized purchasers is that this method makes the coins widely available to the public with reasonable transaction costs.

Last Wednesday, with New York gold down over $40 per ounce, even long time gold bulls were advising caution before committing to further investment. Some precious metals dealers reported a flood of panic selling by anxious investors who were unloading physical coin and bar.

Last Wednesday, with New York gold down over $40 per ounce, even long time gold bulls were advising caution before committing to further investment. Some precious metals dealers reported a flood of panic selling by anxious investors who were unloading physical coin and bar. Sales of the American Eagle gold bullion coin soared during the first month of the year. According to the US Mint, gold bullion coin sales totaled 150,000 ounces, up 97.4% from December 2012 when 76,000 ounces were sold. Sales for the month were up 18.1% from comparable sales of 127,000 ounces a year ago during January 2012.

Sales of the American Eagle gold bullion coin soared during the first month of the year. According to the US Mint, gold bullion coin sales totaled 150,000 ounces, up 97.4% from December 2012 when 76,000 ounces were sold. Sales for the month were up 18.1% from comparable sales of 127,000 ounces a year ago during January 2012. With two days remaining in the month of January, U.S. Mint sales of the American Silver Eagle bullion coins have already established an all time record high. The latest numbers from the Mint show total sales of 7,420,000 silver bullion coins as January 29, 2013. Total sales during January 2012 amounted to 6,107,000 coins. During January 2011 (the previous monthly record high for silver bullion coin sales) the Mint sold 6,422,000 coins.

With two days remaining in the month of January, U.S. Mint sales of the American Silver Eagle bullion coins have already established an all time record high. The latest numbers from the Mint show total sales of 7,420,000 silver bullion coins as January 29, 2013. Total sales during January 2012 amounted to 6,107,000 coins. During January 2011 (the previous monthly record high for silver bullion coin sales) the Mint sold 6,422,000 coins. According to the latest U.S. Mint report, sales of the American Eagle Gold bullion coins for December 2012 totaled 76,000 ounces, up 16% from December 2011 when 65,500 ounces were sold. Sales for the month were down 44.3% from November sales which totaled 136,500 ounces.

According to the latest U.S. Mint report, sales of the American Eagle Gold bullion coins for December 2012 totaled 76,000 ounces, up 16% from December 2011 when 65,500 ounces were sold. Sales for the month were down 44.3% from November sales which totaled 136,500 ounces. According to

According to

According to the latest report from the U.S. Mint, demand for both gold and silver bullion coins during September surged to the highest levels since January.

According to the latest report from the U.S. Mint, demand for both gold and silver bullion coins during September surged to the highest levels since January. Nothing seems to obsess the U.S. government more than gold. Could this be due to the fact that gold represents an alternative currency to the failing U.S. dollar, despite the assertions of Fed Chairman Bernanke that “

Nothing seems to obsess the U.S. government more than gold. Could this be due to the fact that gold represents an alternative currency to the failing U.S. dollar, despite the assertions of Fed Chairman Bernanke that “

The latest sales figures from the U.S. Mint for August show a significant increase in sales of both gold and silver bullion coins.

The latest sales figures from the U.S. Mint for August show a significant increase in sales of both gold and silver bullion coins.

The latest sales figures from the U.S. Mint show that sales of both gold and silver bullion coins declined dramatically during July. While sales of silver bullion coins have remained at historically high levels, sales of the gold bullion coins have been in a steep decline since 2009.

The latest sales figures from the U.S. Mint show that sales of both gold and silver bullion coins declined dramatically during July. While sales of silver bullion coins have remained at historically high levels, sales of the gold bullion coins have been in a steep decline since 2009.