Demand for the United States Mint’s American Silver Eagle bullion coins has been off the charts since the beginning of the year. After running out of the silver bullion coins last year, 2013 opening day sales of the Silver Eagles were the largest on record with sales of 3,937,000 coins. First day sales of the silver coins amounted to an astonishing 12% of last year’s total sales of 33,742,500 coins.

Demand for the United States Mint’s American Silver Eagle bullion coins has been off the charts since the beginning of the year. After running out of the silver bullion coins last year, 2013 opening day sales of the Silver Eagles were the largest on record with sales of 3,937,000 coins. First day sales of the silver coins amounted to an astonishing 12% of last year’s total sales of 33,742,500 coins.

Coin Update reports on the rush to Silver Eagles and the likelihood of product allocation once the U.S. Mint is able to catch up with demand.

The US Mint expects the temporary sell out of the 2013-dated coins to last until on or about the week of January 28, 2013. At that point, sales will be resumed under an allocation process. During previous periods of strong demand for gold and silver bullion coins, the Mint has used an allocation process to ration available supplies amongst their primary distributors.

Periodic suspensions and rationing of Silver Eagle bullion coins had become almost commonplace between the years of 2008 and 2010. This situation would led to the cancellation of collector versions of the coins in 2009 and a 2010 Congressional hearing which highlighted the inefficiencies of the Mint’s bullion coin programs. The Mint managed to work its way out of these problems by implementing process improvements at the West Point Mint, increasing the number of precious metals blank suppliers, and adding supplemental Silver Eagle production at the San Francisco Mint, while at the same time demand for silver bullion coins had lessened. For much of 2011 and 2012, the Mint had managed to keep up with demand for their bullion coins and had resumed the traditional numismatic offerings.

The past month seems to be a return to the times of old. The US Mint has not been able to keep up with higher levels of demand, and once again resorted to sales suspensions and rationing as they try to catch up.

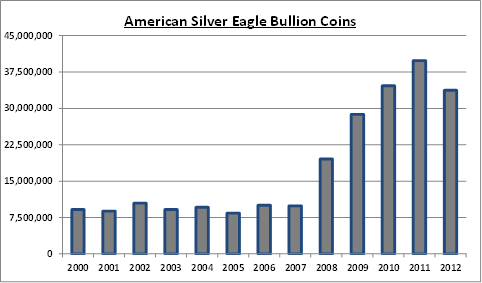

Sales of the American Silver Eagle bullion coins has climbed steadily since 2007. Although total sales for 2012 were below the prior year’s total, they might have hit record highs except for the fact that demand depleted the Mint’s supply of the coins in mid December. Investors who have steadily accumulated the silver bullion coins are sitting on huge gains, with silver up by double digits for seven of the last ten years.

Investors have purchased almost a quarter billion Silver Eagles since 2000. The total value of the beautiful one ounce coins are now worth over $7 billion dollars at current market prices.

The premium on the Silver Eagles has increased dramatically after the U.S. Mint announced that it was sold out. Yesterday, one of the dealers I purchase bullion coins from was pricing the 2013 Silver Eagles as low as $2.69 over spot – today the price is $3.99 over spot – a huge increase of 48%.

Speak Your Mind