Gold news from around the web-

Gold news from around the web-

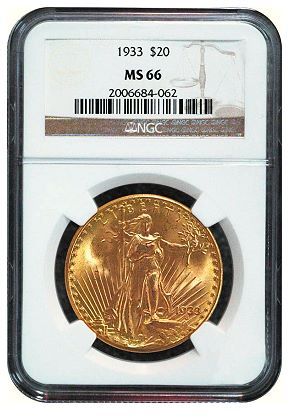

Gold Confiscation?

Are those predicting the confiscation of gold by the U.S. government simply seeking headlines or seriously misguided? Jim Sinclair has the answer.

I am sick of all this confiscation talk of gold and even gold companies. It emanates from gold people who do not know or understand the history of gold. We condemn MSM for inaccurate, false and misleading news. I condemn gold writers who practice sensationalism, who offer their opinions as if they were facts and simply make things up out of thin air as if they were insiders privy to things that no one else is. Right now leaders of this community are printing stuff as misleading as MOPE or MSM ever have.

Eric De Groot put what I have been trying to teach you perfectly today. In the 1930s gold was to the monetary system what QE is today, a means of increasing the supply of money for Fed and Treasury discretionary use. The US Secretary of the Treasury and President Roosevelt set the gold price higher at their daily breakfast together arbitrarily. Higher because to create money then the system required a higher value of gold to have more money outstanding. This is why Roosevelt ordered the confiscation of gold in order to unfold his type of monetary stimulation, his QE. This is what confiscationophiles simply do not know.

Your fears and the outrageous untrue statement by the Scottish hedge fund manager are based on totally wrong reasoning and misunderstanding. Gold was not confiscated because it was going up in price. Gold’s order of confiscation came as a tool of monetary stimulation in order to create monetary creation in order to attempt to increase employment.

So, Exactly Where is Germany’s Gold?

The Germans, tough with monetary policy, turn out to be wimps when it comes to safeguarding their own massive 3,396 ton gold stockpile. Turns out that the Germans, who allegedly hold most of their gold in French, British and U.S. vaults, never even bothered to conduct a physical audit of their holdings – talk about trusting your neighbors! After severe criticism and a national “Bring Back Our Gold” campaign, the Bundesbank is finally promising to conduct audits and bring their gold back home. MarketWatch wonders if the expatriation of German gold may be the beginning of a move to a gold backed currency.

Gold and Silver Technical Charts

Some really amazing gold and silver charts suggest that we may be in the initial stages of a massive gold and silver rally.

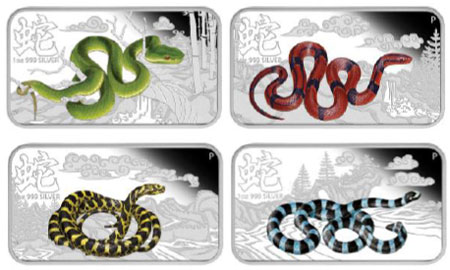

Gold and Silver – The Ideal Holiday Gift

A stunning selection of new gold and silver coins from The Perth Mint provides the answer to “what should I get her for Christmas?” Included in the November product releases are some unique rectangular colored silver coins.

Gold Through the Centuries

One of the largest Roman gold coin hoards every found was discovered in Great Britain. The coins are approximately 1600 years old. Any guesses on what $10,000 of U.S. currency buried today would be worth in the year 3612??

Nothing seems to obsess the U.S. government more than gold. Could this be due to the fact that gold represents an alternative currency to the failing U.S. dollar, despite the assertions of Fed Chairman Bernanke that “

Nothing seems to obsess the U.S. government more than gold. Could this be due to the fact that gold represents an alternative currency to the failing U.S. dollar, despite the assertions of Fed Chairman Bernanke that “

As gold contemplates the $1,000 barrier, here’s a roundup of gold, silver, and precious metals related stories that are interesting for one reason or another. Each headline comes with a snippet of commentary. Enjoy.

As gold contemplates the $1,000 barrier, here’s a roundup of gold, silver, and precious metals related stories that are interesting for one reason or another. Each headline comes with a snippet of commentary. Enjoy. It’s another Gold and Silver Blog Round up, exploring some gold , silver and precious metals related articles and blog posts from around the web.

It’s another Gold and Silver Blog Round up, exploring some gold , silver and precious metals related articles and blog posts from around the web.