Demand for physical gold increased in December as buyers took advantage of a recent pullback in gold prices.

Demand for physical gold increased in December as buyers took advantage of a recent pullback in gold prices.

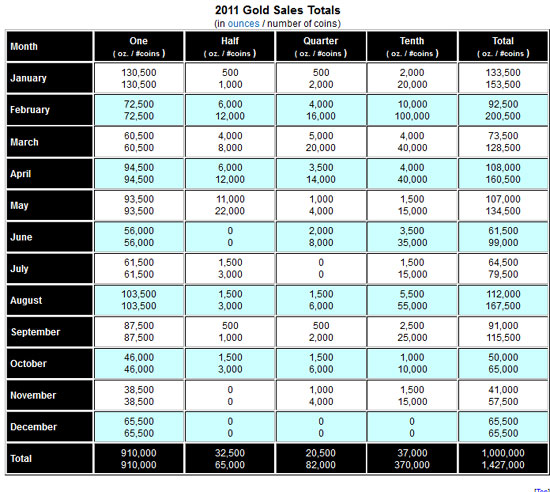

According to production figures from the U.S. Mint, sales of American Gold Eagle bullion coins in December totaled 65,500 ounces, an increase of 9.2% from December 2010. Total sales of gold bullion coins for 2011 declined by 18% from the prior year. For all of 2011, a total of 1,000,000 ounces were sold compared to previous year sales of 1,220,500 ounces.

The sales figures cited above do not include gold numismatic coins sold by the U.S. Mint. Collector versions of gold coins such as the American Buffalo Gold Proof Coin can be purchased directly by the public from the U.S. Mint.

The American Gold Eagle bullion coins cannot be directly purchased by the public from the U.S. Mint. Instead, a network of authorized purchasers (AP’s) buys the coins in bulk from the Mint at a fixed markup. The AP’s in turn resell them to secondary retailers for public sale. The AP distribution system established by the U.S. Mint was determined to be the most efficient method for selling gold bullion coins to the public at competitive prices.

Although sales of gold bullion coins increased during August and September when gold was soaring to all time highs, the largest monthly sales of gold bullion coins occurred in January when gold was trading in the $1,350 range (please see chart below for monthly sales figures).

2011 marks the third year in a row of reduced purchases of gold bullion coins but this is not indicative of an overall reduction in investment gold demand. Competing investments such as gold trust ETFs may be responsible for a large part of reduced demand for physical gold.

Besides much lower transaction costs, investors in gold ETFs or other paper gold products do not have to worry about security and storage costs. Since their launch in 2005, investors have poured billions of dollars into gold trust ETFs. For example, the SPDR Gold Shares Trust (GLD) and the iShares Gold Trust (IAU) now hold gold bullion valued at over $82 billion. By contrast, the approximate value of all American Eagle Gold bullion coins purchased last year amounts to only $1.6 billion.

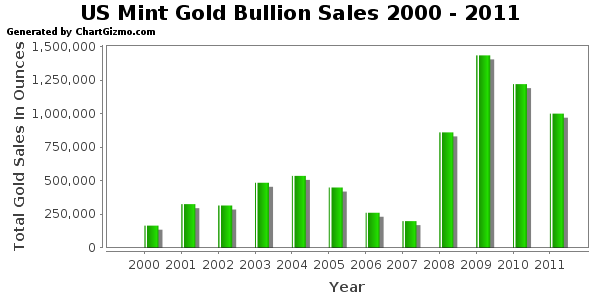

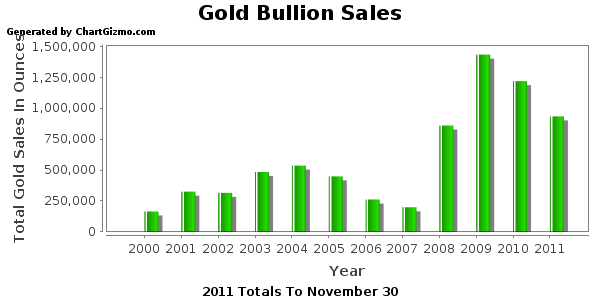

The all time record sales of American Eagle gold bullion coins occurred in 2009 when 1,435,000 ounces were sold.

| Gold Bullion U.S. Mint Sales Since 2000 | ||

| Year | Total Ounces Sold | |

| 2000 | 164,500 | |

| 2001 | 325,000 | |

| 2002 | 315,000 | |

| 2003 | 484,500 | |

| 2004 | 536,000 | |

| 2005 | 449,000 | |

| 2006 | 261,000 | |

| 2007 | 198,500 | |

| 2008 | 860,500 | |

| 2009 | 1,435,000 | |

| 2010 | 1,220,500 | |

| 2011 | 1,000,000 | |

| Total | 7,249,500 | |

Will gold bullion sales continue to decline? The recent implosion of MF Global along with unrestrained money printing by central banks should provoke some clear headed thinking by investors. Customers of MF Global who thought they had warehouse receipts for physical gold and silver were shocked to find that the bankruptcy trustee put all assets into a single pool to cover claims of all customers who have lost billions of dollars.

Paper assets can be vaporized in an instant, even those that are allegedly backed by physical assets such as gold and silver. A question well worth pondering is “Could what happened at MF Global also happen to investors in the gold trust ETFs”?

The recent declines in precious metals seem to have shifted some investors preferences. For the current month to date, US Mint sales of gold bullion sales are on pace for the highest levels of the year, while silver bullion sales remain at typical levels.

The recent declines in precious metals seem to have shifted some investors preferences. For the current month to date, US Mint sales of gold bullion sales are on pace for the highest levels of the year, while silver bullion sales remain at typical levels. The US Mint’s published sales figures for the month of August show a stunning decline in the level of gold bullion sales. The monthly sales for their popular American Gold Eagle bullion coins measured just 41,500 ounces. This represents the lowest monthly total since June 2008, before the financial crisis took hold and led to a surge in bullion sales.

The US Mint’s published sales figures for the month of August show a stunning decline in the level of gold bullion sales. The monthly sales for their popular American Gold Eagle bullion coins measured just 41,500 ounces. This represents the lowest monthly total since June 2008, before the financial crisis took hold and led to a surge in bullion sales. Through June 30, 2010, the United States Mint has sold 18,168,500 ounces of silver bullion and 833,500 ounces of gold bullion. If the current pace is maintained for the rest of the year, US Mint silver bullion sales will break another record and gold will be within the top four annual sales totals.

Through June 30, 2010, the United States Mint has sold 18,168,500 ounces of silver bullion and 833,500 ounces of gold bullion. If the current pace is maintained for the rest of the year, US Mint silver bullion sales will break another record and gold will be within the top four annual sales totals.