According to the latest production figures from the U.S. Mint, January sales of American Gold Eagle bullion coins soared by 93.8% over the previous month.

According to the latest production figures from the U.S. Mint, January sales of American Gold Eagle bullion coins soared by 93.8% over the previous month.

A total of 127,000 ounces were sold in January compared to 65,500 ounces in December 2011. The surge in demand for gold bullion coins is now at the highest level since January 2011 when 133,500 ounces were sold.

Investors are taking opportunity of the bargain price of gold which remains below last year’s high. After hitting a London PM Fix price of $1,895 on September 6, 2011, gold sold off by 19.2% to a closing low of $1,531.00 on December 29, 2011.

Since the beginning of the year, the price of gold has steadily advanced. The closing London PM Fix price of $1,744.00 on January 31st represents a gain of $213 per ounce for the month, up 13.9% from the 2011 year end price. The price of silver has also advanced strongly in 2012 with a gain of 26.8% from last year’s low amid record breaking demand for the American Silver Eagle bullion coins.

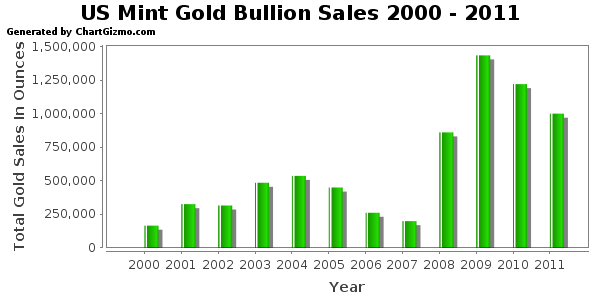

Sales of the American Gold Eagle bullion coins hit an all time record in 2009 when 1,435,000 ounces were sold. A summary of annual gold bullion sales since 2000 is shown below.

Total yearly gold bullion coin sales from January 1, 2000 to January 31, 2012 are shown below.

| Gold Bullion U.S. Mint Sales By Year | ||

| Year | Total Ounces Sold | |

| 2000 | 164,500 | |

| 2001 | 325,000 | |

| 2002 | 315,000 | |

| 2003 | 484,500 | |

| 2004 | 536,000 | |

| 2005 | 449,000 | |

| 2006 | 261,000 | |

| 2007 | 198,500 | |

| 2008 | 860,500 | |

| 2009 | 1,435,000 | |

| 2010 | 1,220,500 | |

| 2011 | 1,000,000 | |

| 2012 | 127,000 | |

| 7,376,500 | ||

| Note: 2012 total through January 31, 2012 | ||

The huge demand during 2009 for gold bullion coins came in the wake of the 2008 financial system meltdown as investors sought a safe haven from paper assets. Here we are four years later and the financial system is more fragile than ever with insolvent banks and governments being propped up by central banks that are printing money on a scale previously unimaginable.

Although I have been a precious metals investor for many years (more sometimes than I care to think about), many of the people I deal with on a personal and professional level seemed to be totally confident holding only paper assets, even after the financial system came very close to a total collapse in 2008.

That confidence now seems to be slowly but persistently eroding and I am seeing many people enter the precious metals market for the first time. It is not an “all in” seismic shift but rather a thoughtful and fundamental portfolio reallocation based on the growing realization that paper dollars are being constantly debased.

A one time bout of money printing by the Federal Reserve to “save the system” can perhaps be quickly forgotten, but a persistent and deliberate effort to debase the currency is another matter. The growing realization that the Federal Reserve is deliberately destroying the integrity of the dollar will be the basis for continual future demand for the only real money left – gold.

The growing movement to reallocate wealth into gold is still in its infancy which implies a future gold value many thousands of dollars higher than today’s price.

The US Mint’s published sales figures for the month of August show a stunning decline in the level of gold bullion sales. The monthly sales for their popular American Gold Eagle bullion coins measured just 41,500 ounces. This represents the lowest monthly total since June 2008, before the financial crisis took hold and led to a surge in bullion sales.

The US Mint’s published sales figures for the month of August show a stunning decline in the level of gold bullion sales. The monthly sales for their popular American Gold Eagle bullion coins measured just 41,500 ounces. This represents the lowest monthly total since June 2008, before the financial crisis took hold and led to a surge in bullion sales. Through June 30, 2010, the United States Mint has sold 18,168,500 ounces of silver bullion and 833,500 ounces of gold bullion. If the current pace is maintained for the rest of the year, US Mint silver bullion sales will break another record and gold will be within the top four annual sales totals.

Through June 30, 2010, the United States Mint has sold 18,168,500 ounces of silver bullion and 833,500 ounces of gold bullion. If the current pace is maintained for the rest of the year, US Mint silver bullion sales will break another record and gold will be within the top four annual sales totals. Closely behind the release of the

Closely behind the release of the  Today on April 29, 2010, the United States Mint

Today on April 29, 2010, the United States Mint