There has been a lot of talk about gold being unavailable to settle futures contracts and the like but that is paper gold they are talking about.

If you love to hold and touch and possess physical gold (who wouldn’t) then yes – you can still buy gold bullion coins at retail but perhaps not for much longer.

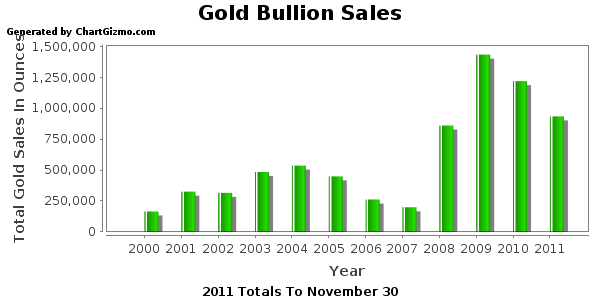

Although you can still buy gold bullion coins, the selection and availability are severely limited due to a huge increase in demand, decreased mine production, and mint closures. Toss in the facts that the world is in an economic depression (by any definition of the word) and governments worldwide are flooding the global economy with helicopter money makes one wonder how much longer it will be before gold coin stocks at dealers are exhausted.

I have been buying gold coins for many years and I have never seen such a limited selection in all categories of gold coins. Other than the American Eagle and the American Buffalo dated 2020 there are no other contemporary US Mint gold coins available! Pre 1933 coins gold coins are available but the selection is sparse.

Here are a few examples from Provident Metals, a leading online retailer of all sorts of bullion and coins. I have always had good experiences buying from Provident but please note that there are also many other reputable dealers out there who are also authorized purchasers from the US Mint.

2020 American Eagle 1 oz Gold Coin BU

In Stock IRA eligible

Item is available and ready to ship!

Pricing and quantity as follows

1-9 coins

$1,905.88 cash

$1,925.74 bitcoin

$1,985.34 credit card

The 2020 American Buffalo 1 zo gold coin BU is also available for pre order with an estimated ship date of April 27th. The pricing on the Gold Buffalo is $180 over spot price and on the Gold Eagle is $160 over spot price.

Given the scarcity of inventory, I am surprised that the premiums are not higher.

The

The

With gold fluctuating around the $900 level, let’s take a look at some thought provoking gold and silver related stories from various blogs and news sites.

With gold fluctuating around the $900 level, let’s take a look at some thought provoking gold and silver related stories from various blogs and news sites. Back in December

Back in December