The third quarter 2012 Investment Statistics Commentary released today by the World Gold Council summarizes the performance of gold in various currencies and explores reasons why demand for gold should continue to increase.

The third quarter 2012 Investment Statistics Commentary released today by the World Gold Council summarizes the performance of gold in various currencies and explores reasons why demand for gold should continue to increase.

Highlights of the Q3 2012 Report

During the third quarter, gold had a return of over 11% as central banks expanded measures to stimulate the economy. The correlation of gold to other assets exhibited similar characteristics as those seen during the previous quarter.

Unconventional expansionary monetary policies were continued during the third quarter and are expected to increase going forward. The primary goal of central bank policies include lowering borrowing costs and re inflating asset prices.

While financial assets have surged based on central bank monetary measures, gold has exhibited the strongest correlation to quantitative easing.

The World Gold Council expects investment demand for gold will remain strong based on the following four factors:

– Inflation risk

– Medium-term tail-risk from imbalances

– Currency debasement and uncertainty

– Low real rates and emerging market real rate differentials

The full report from the World Gold Council can be viewed at gold.org.

Gold has made what appears to be a triple bottom over the past year in the $1,580 range. A breakout above last year’s high of $1,900 could wind up signaling the next phase of the gold bull market.

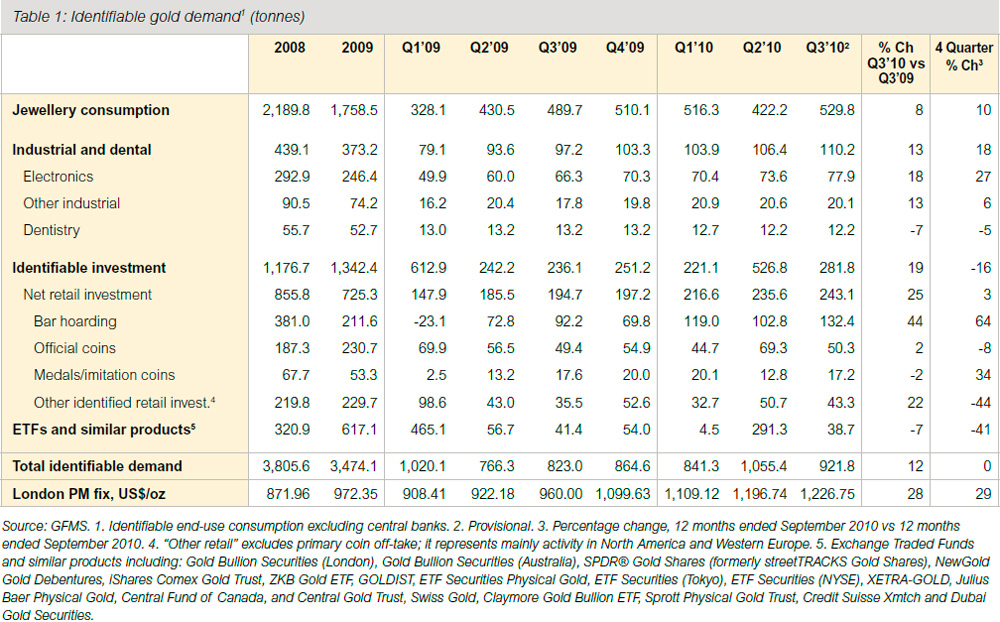

Total identifiable gold demand for the third quarter showed an increase of 12% above year ago levels at 921.8 tonnes. Increases in demand from jewelry consumption, industrial sectors, and net retail investment more than offset a decline in demand from electronically traded funds, according to information published by the

Total identifiable gold demand for the third quarter showed an increase of 12% above year ago levels at 921.8 tonnes. Increases in demand from jewelry consumption, industrial sectors, and net retail investment more than offset a decline in demand from electronically traded funds, according to information published by the

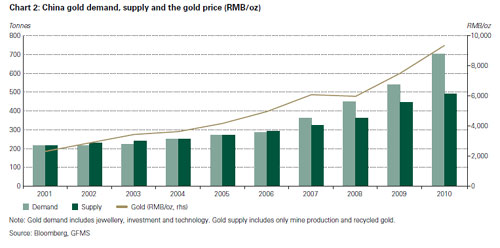

Not surprisingly, gold demand for the second quarter of 2010 was up significantly compared to the year ago period, according to the recently released Gold Demand Trends report from the

Not surprisingly, gold demand for the second quarter of 2010 was up significantly compared to the year ago period, according to the recently released Gold Demand Trends report from the