India may increase the import tax on gold for the third time this year in an attempt to shore up the weak rupee. Purchases of gold and silver account for a huge 12.5% of all Indian imports and are contributing to a record current-account deficit according to Bloomberg.

India may increase the import tax on gold for the third time this year in an attempt to shore up the weak rupee. Purchases of gold and silver account for a huge 12.5% of all Indian imports and are contributing to a record current-account deficit according to Bloomberg.

“The government may look at increasing the duty to 7.5 percent,” Prithviraj Kothari, president of the Bombay Bullion Association, said in a phone interview. D.S. Malik, a finance ministry spokesman in New Delhi, declined to comment.

The tax on bars and coins was doubled to 4 percent in March after imports jumped to a record 969 metric tons in 2011. A further increase may deter jewelry buyers and investors during India’s festival season, which starts this month, as a decline in the rupee against the dollar boosts domestic gold prices to an all-time high. Imports plunged 42 percent to 340 tons in the first half, according to the producer-funded World Gold Council.

Curbing shipments of gold will help the country to narrow the current-account deficit as the drop in rupee boosts the cost of crude-oil purchases, according to the finance ministry. The shortfall widened to a record 4.2 percent of the gross domestic product in the year ended March from 2.7 percent in 2010-2011.

The rise in the deficit, the broadest measure of trade, was due to slower exports and so-called relatively inelastic imports of petroleum products, gold and silver amid a rally in global prices, Finance Minister P. Chidambaram said on Aug. 23.

Will India’s attempt to restrict import of precious metals be successful and what impact will this have on the price of gold and silver? Let’s consider the following:

1. The Indian government should know better. In 1962, India passed the Gold Control Act which prohibited Indian citizens from owning gold bars and coins. The result was the instant creation of a huge black market that continued to supply gold and silver throughout India.

The (Gold Act) legislation killed the official gold market and a large unofficial market sprung up dealing in cash only. The gold was smuggled in and sold through the unofficial channel wherein, many jewelers and bullian traders traded in smuggled gold. A huge black market developed for gold.

In 1990, India had a major foreign exchange problems and was on verge of default on external liabilities. The Indian Govt. pledged 40 tons gold from their reserves with the Bank of England and saved the day. Subsequently, India embarked upon the path of economic liberalization. The era of licencing was gradually dissolved. The gold market also benefited because the government abolished the 1962 Gold Control Act in 1992 and liberalized the gold import into India on payment of a duty of Rs.250 per ten grams. The government thought it more prudent to allow free imports and earn the taxes rather than to lose it all to unofficial channel.

2. India should be more concerned with maintaining a currency that offers their population a stable store of value rather than depriving their citizens of viable alternate currencies such as gold and silver.

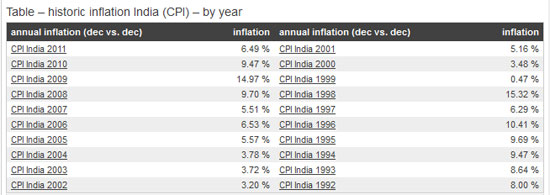

3. The centuries old tradition in India of holding gold and silver as a source of liquidity and for capital preservation is unlikely to change. The rupee, like most other paper currencies, has been systematically debased. Inflation in India over the past decade has made holding rupees a losing proposition.

4. The reduction in gold demand during the first half of the year by both China and India has been widely touted in the mainstream press as a reason for a continued sell off in the precious metal markets. Right. Despite the reduction in gold demand by China and India, gold based out in the $1,600 range before rallying sharply to $1,697. Gold is now $99 or 6.2% higher than it was on the first trading day of 2012.

5. By attempting to restrict gold purchases, India has simply advertised the rupee’s intrinsic lack of value to their citizens which will ultimately create an even greater demand for gold and silver.

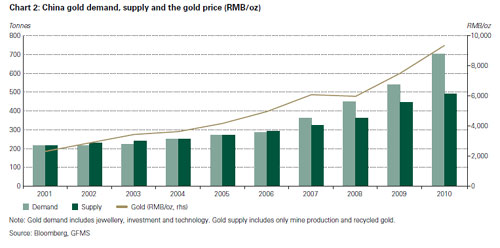

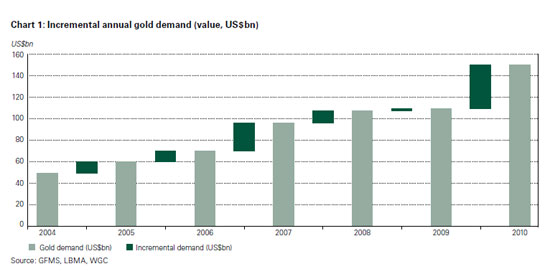

Gold demand increased strongly across all sectors during 2010, as the supply of gold barely increased.

Gold demand increased strongly across all sectors during 2010, as the supply of gold barely increased.

China is the world’s second largest consumer of gold, so their interest in the metal is understandable. It is also the world’s largest producer of the metal. Still, the country is exhibiting a newly invigorated consumer and investor interest in the metal that is bound to capture some attention.

China is the world’s second largest consumer of gold, so their interest in the metal is understandable. It is also the world’s largest producer of the metal. Still, the country is exhibiting a newly invigorated consumer and investor interest in the metal that is bound to capture some attention. So the price of gold has broken the $1,400 mark, whatever. The biggest news is that we shrug off records such as these being broken.

So the price of gold has broken the $1,400 mark, whatever. The biggest news is that we shrug off records such as these being broken.