Gold demand increased strongly across all sectors during 2010, as the supply of gold barely increased.

Gold demand increased strongly across all sectors during 2010, as the supply of gold barely increased.

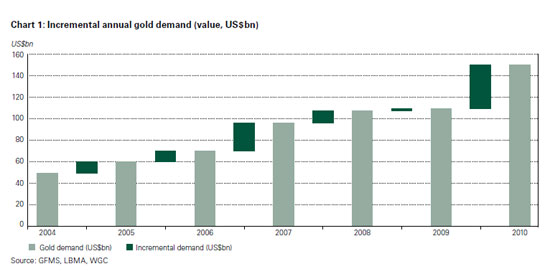

According to the World Gold Council, global demand for gold hit a 10 year high of 3,812.2 tonnes worth $150 billion. The demand for gold hit an all time high in value as gold prices hit a record high of $1,421 per ounce on the London PM fix. Typically, as the price of an item increases demand will decrease, but in the case of gold, it seems that higher gold prices are creating more demand. The risk of sovereign defaults, inflation, economic concerns and weak currencies have convinced many investors that gold is integral to the preservation of wealth.

The demand for gold in 2010 was nothing less than extraordinary considering the 25% increase in gold prices. The London PM Fix price of $1,121.50 at the beginning of 2010 increased steadily throughout the year and closed on December 30, 2010 at $1,405.50.

The World Gold Council noted that key factors affecting the price of gold during 2010 included the following:

- Jewelry demand increased by 17% over 2009, with demand particularly high in both India and China. Asia accounted for 51% of total investment and jewelry demand during 2010.

- For the first time in 21 years, central banks became net purchasers of gold.

- Investment demand for gold during 2010 was actually down by 2% in 2010 to 1,333 tonnes, but was the second highest demand year on record.

The value of gold demand skyrocketed by 38% in 2010 to $150 billion, despite the 40% increase in gold’s value since 2008. The statistics for specific demand categories, according to the World Gold Council were as follows:

- Total gold jewelry demand increased by 17% to 2059.6 tonnes despite increased gold prices. The value of jewelry demand was $81 billion.

- Investment demand for bar and coin and ETFs remained stable in 2010, down only 2% from the previous year. In value terms, demand strongly increased by 23% to $52 billion. Demand for physical bars increased by 56% to 713.2 tonnes.

- ETFs accounted for 9% or 338.0 tonnes of gold during 2010 which was down by 45% from the peak of 617.1 tonnes in 2009. At year end 2010 gold holdings by ETFs amounted to 2,175 tonnes worth $96 billion.

- Gold demand by the technology and electronics industry rose 12.4% to 419.6 tonnes.

- The market with the strongest growth in gold demand was India. Gold demand by Indian consumers increased by 66% to 963.1 tonnes worth $38 billion.

- The market with the strongest investment demand was China which saw a 70% increase in demand for coins and small bars to 179.9 tonnes worth $7 billion.

Total gold supply increased by only 2% as mines struggled to find new deposits and increase production from existing mines. Out of total yearly gold supply, 40% comes from recycled gold.