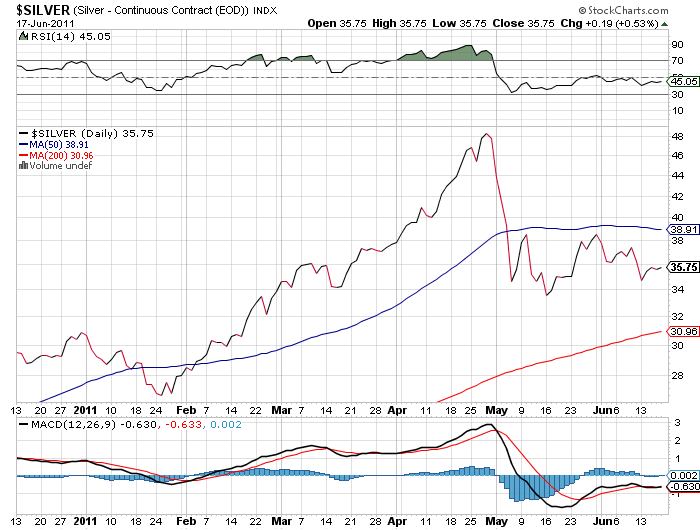

Precious metals gained across the board for the third week in a row. Silver and palladium were the top performers this week with each advancing almost 4%.

Precious metals gained across the board for the third week in a row. Silver and palladium were the top performers this week with each advancing almost 4%.

July has seen an explosive move in the precious metals group as worries intensify about the twin debt crises in Europe and the U.S. In both cases, governments and central banks are avoiding the tough choices that must be made when debt levels reach unsustainable amounts. Common sense dictates that over leveraged borrowers with insufficient income to service debt must eventually default, or gradually reduce the debt through a combination of austerity measures and income growth.

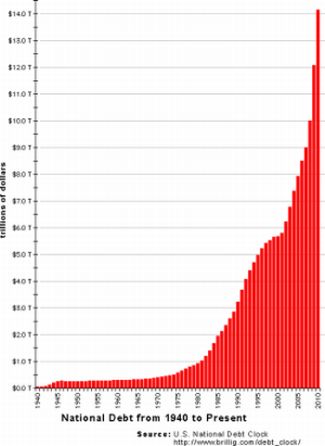

Common sense, however, is a trait sorely lacking in politicians. Nor does preaching austerity to your constituents enhance the odds of being re-elected. The preferred solution, which has been employed since the 1980’s, is to add more debt and let the future take care of itself. What’s different this time is the growing realization that at some point the compounding of debt becomes unsustainable, enslaving future generations and inhibiting economic growth.

The widely discussed study by Rogoff and Reinhart definitively documents that when public sector debt to GDP approaches the 90% level, economic growth slows dramatically – (see This Time Is Different: Eight Centuries of Financial Folly). Since most of the developed world economies are already at or above the 90% debt to GDP ratio, the prognosis for future economic growth to gradually reduce debt levels becomes a tenuous prospect.

Despite the obvious risks of a growing debt burden, a significant number of the Washington elite insist that the debt limit be raised by another $2.5 trillion which would represent a doubling of the national debt in a little over five years.

Raising the debt limit, which became a routine ritual in past years, has suddenly morphed into a potential default situation as a growing number of responsible political leaders refuse to rubber stamp another massive increase in public borrowing. As debt limit negotiations broke down today, the odds of a potential default by the United States became a distinct possibility.

Will a temporary default become a seismic event? Who knows, but if gold had advanced by one dollar per ounce for each time I’ve seen an article predicting financial Armageddon, if the debt limit was not raised, gold would be well over $4,000 per ounce. If the U.S. does “default”, it will not be the end of the world. In the best case scenario, a brush with default may convince more members of our EZ spending Congress to come around to the financial common sense of men such as Ron Paul.

http://youtu.be/sEP8cQF-QC4

Summary of Ron Paul’s comments to Congress:

- Countries that are as indebted as the U.S. always default.

- The real increase in the debt this year, counting entitlements, is $5 trillion.

- In the past 3 years, the dollar has been devalued by 50% against gold.

- Default will be through inflation.

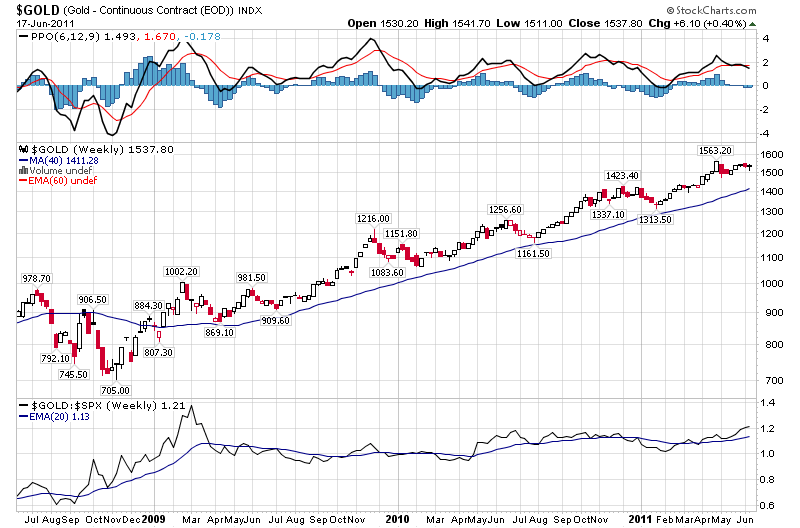

Gold advanced by $15 on the week and is up $119 since July 1st. Silver advanced by $1.50 on the week and has gained $5.82 since July 1st.

Platinum and palladium both advanced on the week by $33 and $30 respectively. Platinum has gained $85 and palladium $57 since the first of the month.

| Precious Metals Prices | |||

| PM Fix | Since Last Recap | ||

| Gold | $1,602.00 | +$15.00 | +0.95% |

| Silver | $39.67 | +$1.50 | +3.93% |

| Platinum | $1,793.00 | +$33.00 | +1.88% |

| Palladium | $807.00 | +$30.00 | +3.86% |

At the end of a two day Federal Reserve policy meeting, Fed Chairman Bernanke has scheduled a news conference on Wednesday that has the potential to rattle markets worldwide. Every analyst and investor at the news conference is certain to focus their questions on Fed plans after the scheduled completion of QE2 in June.

At the end of a two day Federal Reserve policy meeting, Fed Chairman Bernanke has scheduled a news conference on Wednesday that has the potential to rattle markets worldwide. Every analyst and investor at the news conference is certain to focus their questions on Fed plans after the scheduled completion of QE2 in June. To many investors with a sense of history, the four most dangerous words are “this time it’s different”. The phrase is usually evoked in an attempt to justify why a huge price gain in a particular asset class can continue to defy common sense and historical valuation norms. A surfeit of explanations on why “this time is different” is usually enough to send seasoned investors to the exits.

To many investors with a sense of history, the four most dangerous words are “this time it’s different”. The phrase is usually evoked in an attempt to justify why a huge price gain in a particular asset class can continue to defy common sense and historical valuation norms. A surfeit of explanations on why “this time is different” is usually enough to send seasoned investors to the exits.

Another Precious Week

Another Precious Week