Precious metals had a tough week as silver, platinum and palladium all declined, while gold registered a small gain.

Precious metals had a tough week as silver, platinum and palladium all declined, while gold registered a small gain.

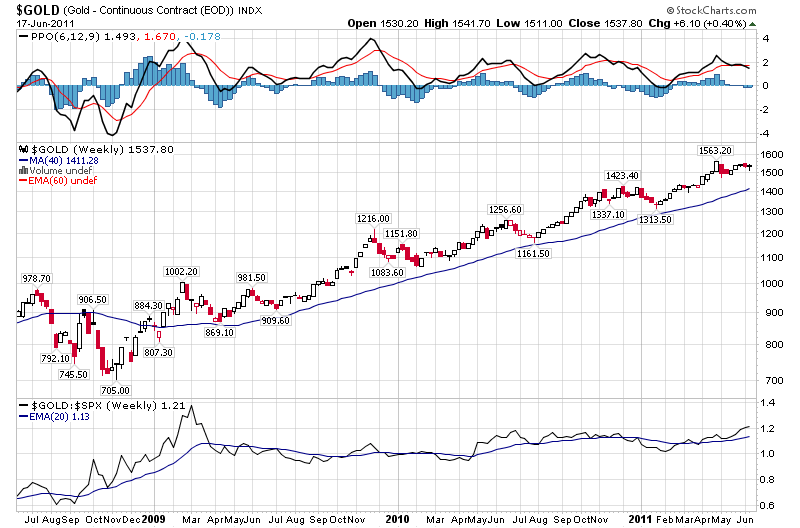

As measured by the closing London PM Fix Price, gold gained $8.25 on the week after declining by $10.75 in the previous week. Gold remains in a solid long term uptrend. Since early 2009, gold has remained above its 40 day moving average and every dip to the 40 day moving average has followed with rallies to new highs for gold.

Gold’s last decline to the 40 day moving average in January of this year was subsequently followed by a rally of over $220 per ounce. A correction to the 40 day moving average would bring gold back to the $1,400 level.

Gold has held above $1,500 as world financial markets, oil and other commodities have declined substantially over economic worries. As the European Central Bank struggles to prevent a Greek default that could trigger a series of other sovereign defaults, debt yields are soaring not only in Greece but also Spain, Portugal, Italy and Ireland.

Markets are beginning to reflect the unavoidable truth that we are reaching an end game where sovereign governments have become the new systemic risk to the financial system. As debt burdened governments face the prospect of financial collapse and political unrest, the only option will be to sell new debt to the central banks who will buy the debt with newly printed money. As central banks worldwide compete with each other in massive currency debasement, gold will soar to new highs beyond predictions of the boldest gold bulls.

As the slow motion collapse in Europe unfolds, investors in the U.S. seem resolute in the belief that “it can’t happen here, we are not Greece.” This argument is rejected by Bill Gross who runs Pimco, one of the largest bond funds in the world. According to Gross, who recently announced that he would stop buying U.S. Treasury debt, the U.S. is actually in worse shape than Greece.

The total debts of the U.S. government, including off balance sheet obligations for open ended social programs, totals $100 trillion. Gross notes that “To think that we can reduce that within the space of a year or two is not a realistic assumption. That’s much more than Greece, that’s much more than almost any other developed country.”

Critics who dismiss the warnings of Bill Gross point to the current level of low yields on U.S. treasury debt. Why would the U.S. be able to sell its debt at such low rates if the finances of the United States are worse than Greece? The answer is that crises develop in a linear fashion. Investors don’t worry about credit risk until the crisis is upon them and suddenly everyone wakes up and panics.

Carmen Reinhart of Harvard and formerly of the IMF correctly predicted that a sovereign debt crisis would follow the financial crisis of 2008. In a study of bond markets as a forecasting tool, Reinhart showed that rates are a poor forecaster of repayment risk. According to Reinhart, “Very often, interest rates are a coincident, rather than a leading indicator” of a looming financial crisis.

Preserving wealth during the next financial meltdown will require taking steps before the inevitable crisis develops.

| Precious Metals Prices | ||

| PM Fix | Since Last Recap | |

| Gold | $1,537.50 | +8.25 (+0.54%) |

| Silver | $35.39 | -1.99(-5.32%) |

| Platinum | $1,751.00 | -78.00 (-4.26%) |

| Palladium | $754.00 | -61.00 (-7.48%) |

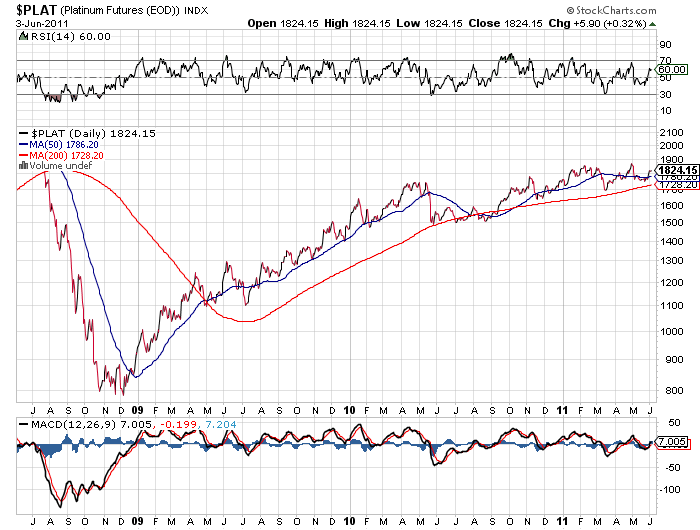

Platinum had a volatile week, declining by $78 on the week to $1,751.00. After moving up by $650 per ounce between July 2009 and May 2010, platinum has been consolidating its gains. During 2011, platinum has remained in a narrow but volatile trading range between $1,700 and $1,850 per ounce as traders try to sort out whether the predominant demand for platinum is industrial usage or investor demand.

Palladium had the biggest decline in the precious metals group, falling by $61 per ounce for a loss of 7.48%. After reaching a high on the year of $858 in February, palladium has been correcting in a sideways pattern.

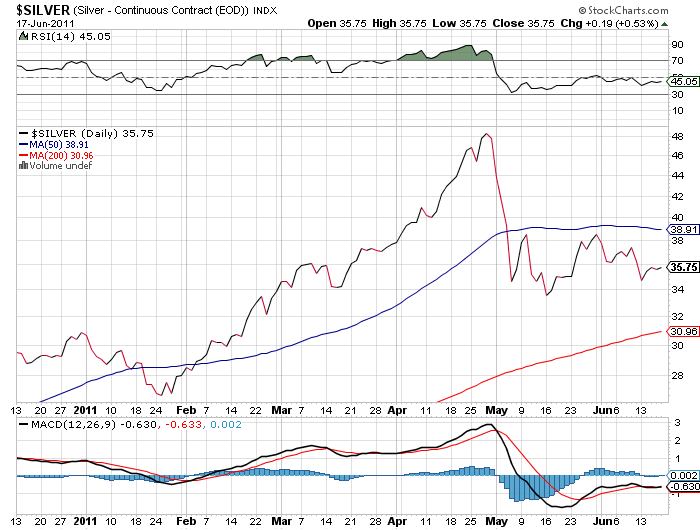

Silver declined by $1.99 on the week to $35.39 after a gain of $2.19 in the previous week. After the sharp decline in early May, silver has been building a base in the $34 to $38 range.