At the end of a two day Federal Reserve policy meeting, Fed Chairman Bernanke has scheduled a news conference on Wednesday that has the potential to rattle markets worldwide. Every analyst and investor at the news conference is certain to focus their questions on Fed plans after the scheduled completion of QE2 in June.

At the end of a two day Federal Reserve policy meeting, Fed Chairman Bernanke has scheduled a news conference on Wednesday that has the potential to rattle markets worldwide. Every analyst and investor at the news conference is certain to focus their questions on Fed plans after the scheduled completion of QE2 in June.

Current market expectations are that the Fed will not announce a new program of asset purchases and will initiate steps to slowly reduce the size of its bloated $2.5 trillion balance sheet. Through the end of June, the Fed will have purchased $600 billion of treasury debt using newly created dollars, after having purchased $1.7 trillion of assets under QE1.

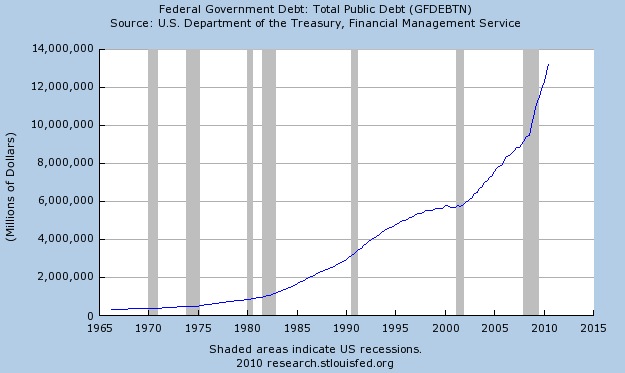

The Federal Reserve has been supporting the skyrocketing federal deficit by purchasing 85% of all new treasury debt since QE2 was initiated. Some analysts think that interest rates on US debt will increase once the largest buyer of treasury debt steps aside. The withdrawal of massive stimulus by the Fed could also cause a sell off in stocks and bonds, and result in lower housing prices and higher unemployment. Under this scenario, another round of quantitative easing by the Fed would become inevitable.

Chairman Bernanke’s comments on the Federal Reserve’s exit strategy from a super easy monetary policy could cause major moves in many markets, especially precious metals. If the markets sense that the Fed may need to initiate another round of quantitative easing, gold and silver prices will explode to the upside. This prediction is based on the results of the current QE2 program which benefited certain asset categories but did little to help the average American.

Since last August when it became clear that the Fed would initiate QE2, we have witnessed the following results.

- Home prices have continued to decline.

- The 30 year mortgage rate has increased from 4.2% to 4.8%.

- New housing starts declined to all time lows.

- The 10 year treasury note rate has increased from 2.6% to 3.4%.

The Fed has continued its policy of near zero short term interest rates at the expense of consumers who receive virtually no return on savings. Banks, meanwhile have increased US treasury and agency securities to a massive $1.7 trillion, benefiting from the spread between short and long rates.

The Fed’s policy of overt currency debasement, while helping to increase exports and earnings for multinational corporations has resulted in the dollar declining to the all time lows reached in early 2008. Foreign countries with dollar reserves are protecting themselves by diversifying out of dollars and into other currencies and hard assets.

The lower value of the US dollar, while helping multinational corporations, has resulted in higher oil and food costs which has put additional strains on consumers already burdened with excessive levels of debt and declining incomes.

Unemployment has remained stubbornly high despite unprecedented fiscal and monetary stimulus. The Fed can print money but it cannot directly create an increase in real incomes for the average American family. Nor can the Fed fool the people – recent Gallup polls show that almost half of the public has little faith in the Federal Reserve’s ability to do the right thing.

The Fed’s explicit policies of dollar debasement and zero interest rates risks triggering a major collapse in the value of the dollar. Since last summer the dollar has seen a decline of 16% as investors do the logical thing and dump dollars.

Huge US budget deficits, uncontrolled spending and money printing by the Fed resulted in a warning by S&P that a credit downgrade on US debt was possible, putting further pressure on the US dollar.

QE2 liquidity did result in higher stock and precious metal prices benefiting a minority of Americans while doing nothing to solve the problem of too much debt and too little income. Reliance on the Fed to come to the rescue with ever increasing amounts of cheap money has become the last resort, self defeating option.

The gold and silver markets are reflecting the failure of unsustainable fiscal and monetary policies which virtually guarantee further appreciation in the precious metals sector. Any pullback in prices should be viewed as a long term buying opportunity.

So the Fed decides that quantitative easing was going to boost the economy, as if the way to prove that you’re really clever is to do the thing that wasn’t working before, just all over again. This is naturally going to give precious metals a boost as investors realize that whether or not QE2 works for the economy, it’s definitely

So the Fed decides that quantitative easing was going to boost the economy, as if the way to prove that you’re really clever is to do the thing that wasn’t working before, just all over again. This is naturally going to give precious metals a boost as investors realize that whether or not QE2 works for the economy, it’s definitely