After what appeared to be a coordinated effort by Europe and the U.S. to print their way to prosperity, Japan quickly joined the race to eternal QE with the surprise announcement of additional monetary easing.

After what appeared to be a coordinated effort by Europe and the U.S. to print their way to prosperity, Japan quickly joined the race to eternal QE with the surprise announcement of additional monetary easing.

TOKYO—The Bank of Japan took surprisingly strong steps to further ease its monetary policy on Wednesday, following similar steps by the Federal Reserve, as it tries to tackle entrenched deflation, an export-sapping strong yen and the impact of slowing global growth.

The central bank’s policy board decided at the end of a two-day meeting to increase the size of its asset-purchase program—the main tool for monetary easing with near-zero interest rates—to ¥80 trillion ($1.01 trillion) from ¥70 trillion.

The move came after the Fed introduced another round of quantitative easing last week, which put renewed upward pressure on the yen.

“These measures in pursuit of powerful monetary easing will make financial conditions for such economic entities as firms and households even more accommodative by further encouraging a decline in longer-term market interest rates and a reduction in risk premiums,” the central bank said in a statement released together with the rate decision.

Board members voted unanimously to expand the scope of the asset-purchase program. The BOJ also decided to leave its policy rate, or the unsecured overnight call loan rate, unchanged in a 0.0%-0.1% range.

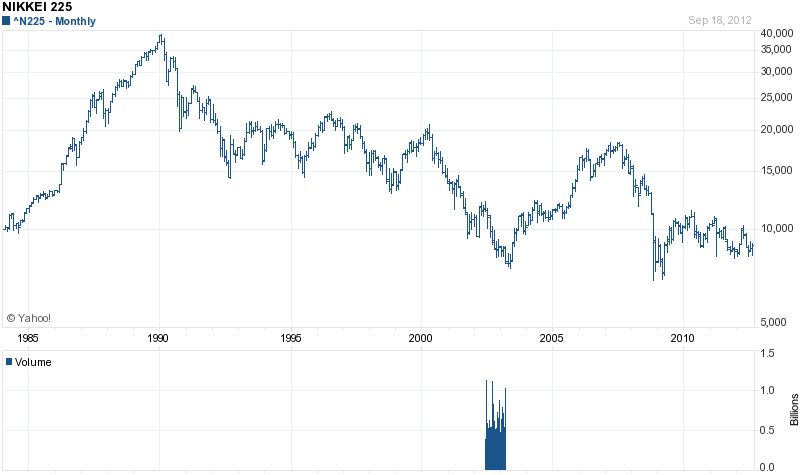

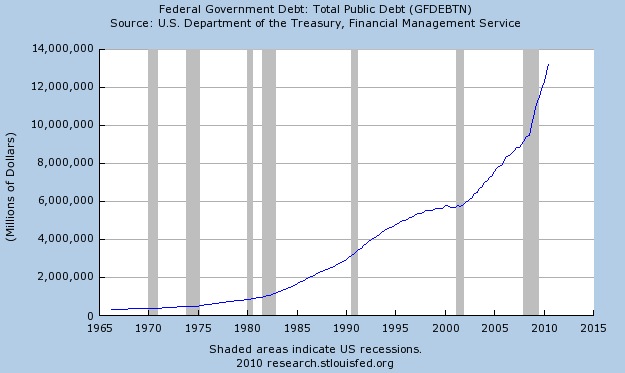

Japan has been in an endless loop of money printing ever since stocks and real estate crashed in the early 1990’s after one of the biggest financial bubbles in history. Twenty years of quantitative easing and monetary stimulus have resulted in stagnant wages, the largest debt to GDP ratio in the world and a stock market that is still off 75% from its high. Except for printing additional money, Japan seems flat out of options for reviving its economy.

Does anyone really expect this desperation tactic to cure Japan’s problems?