Benjamin Franklin, one of the most eloquent wordsmiths in American history, coined one of the most famous quotations of all time in a letter to Jean-Baptiste Leroy in 1789.

Benjamin Franklin, one of the most eloquent wordsmiths in American history, coined one of the most famous quotations of all time in a letter to Jean-Baptiste Leroy in 1789.

“Our new Constitution is now established, and has an appearance that promises permanency; but in this world nothing can be said to be certain, except death and taxes.”

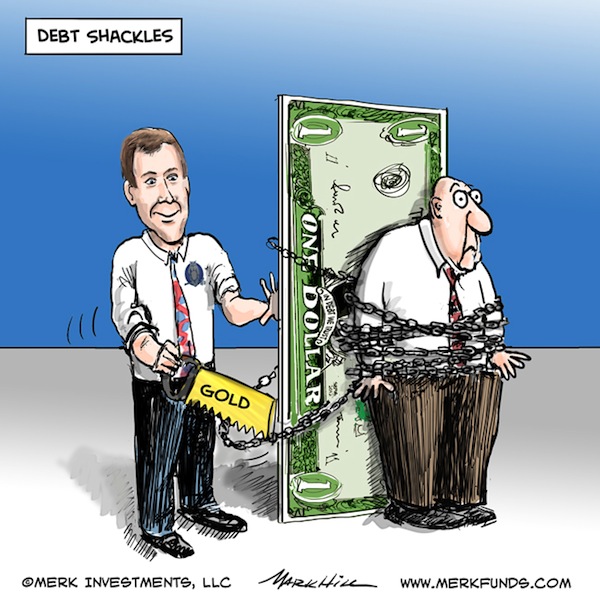

Contemplating the nation’s growing indebtedness lead me to wonder what immortal phrase Ben Franklin would conjure up to describe the current state of our financial affairs.

Recently and without much public drama, the national debt ticked up by another trillion dollars. Including off balance sheet liabilities for social security, medicare and a host of other government guarantees brings the true national debt figure up to around a cool $70 trillion.

The majority of the public is either unable to comprehend how much a trillion is or doesn’t much care. One way or the other, however, the debt falls upon the backs of American families who are already being crushed by zero rates on savings, job losses, lower income and a higher cost of living. Viewing the debt burden per household gives us a perspective on how bleak our economic future may become.

The official national debt per America’s approximately 118 million households is $136,000. Throw in the off balance sheet liabilities and we get up to $593,000. Consider that the median annual household income is only $49,445 and has been declining for the past 20 years.

Are things really as hopeless as they look? Doesn’t the United States hold the world’s largest amount of gold reserves? The good news first – yes the U.S. owns 8,133.5 metric tonnes of gold, more than twice as much as second place Germany with 3,395 metric tonnes. The bad news is that at today’s undervalued gold price, total U.S. gold reserves are only worth $454 billion. Gold reserves per American households amount to only $3,847, a fraction (0.65%) of total household debt.

Exactly how the Fed’s Frankenstein experiment in fiat money creation will end, nobody knows – but it won’t end well for most of us. Right now, increases in both the value of gold and the amount of debt seem as certain as death and taxes. I wonder how Ben Franklin would have phrased it?

By Axel Merk

By Axel Merk

At the end of a two day Federal Reserve policy meeting, Fed Chairman Bernanke has scheduled a news conference on Wednesday that has the potential to rattle markets worldwide. Every analyst and investor at the news conference is certain to focus their questions on Fed plans after the scheduled completion of QE2 in June.

At the end of a two day Federal Reserve policy meeting, Fed Chairman Bernanke has scheduled a news conference on Wednesday that has the potential to rattle markets worldwide. Every analyst and investor at the news conference is certain to focus their questions on Fed plans after the scheduled completion of QE2 in June.