Big money managers are bullish on gold according to the pros interviewed in Barron’s latest fall survey. A resounding 69% of big money managers are bullish on gold and 22% forecast that precious metals will be the best performing asset class over the next six to twelve months.

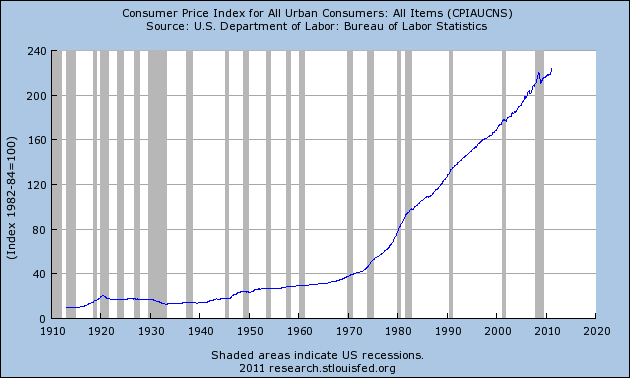

The big money is bearish on Federal Reserve strategy with over 60% of poll respondents disapproving of the Fed’s current interest rate policy. Reinforcing their low opinion of Fed strategy, an overwhelming 78% of the pros believe that additional Fed easing policies will be counter productive. Summing up the general opinion on Ben Bernanke’s money printing schemes, one money pro said “The Fed is well past the point of interest-rate policy having any meaningful impact on the economy. Bernanke & Co. now risk damage to both the dollar and the Fed’s own balance sheet. This is the biggest misallocation of capital in the history of mankind.”

Not surprisingly, the overwhelming consensus (89%) of the big money pros think that treasuries are severely overvalued. Although the pros don’t see interest rates rising significantly in the next six months, Barron’s notes that even a small increase in interest rates would result in losses to bondholders. The Fed has manipulated interest rates to such a low level, that few money pros see any value in treasuries. One money pro noted that without massive security purchases by the Fed, the 10 year bond would currently yield 5%, representing a real yield of 2% plus 3% for inflation. Absent Fed efforts to suppress free market yields on treasuries, bondholders would be faced with shocking losses as interest rates rose.

The big money bearish sentiment on Bernanke and bullish forecast for gold tells us that the pros don’t expect implementation of sound monetary policy by the Fed any time soon.

By Axel Merk

By Axel Merk