No bull market goes straight up without normal price corrections along the way. The recent sharp pullback in silver prices and the more subdued correction in gold prices are likely to be viewed in hindsight as a superb buying opportunity.

Simple trend line analysis suggests that current prices for gold and silver are in a buying range. Using the SLV and GLD as proxies for the metals, we can see that the recent sell off has brought prices to trend line support. Combining the “trend is your friend” theory along with solid fundamental underpinnings for gold and silver, higher prices seem inevitable. For patient long term investors, especially in the gold market, every pullback of the last decade has simply been another opportunity to exchange depreciating paper dollars into a better store of value.

The SLV recently hit its trend line in the low 30’s.

The GLD’s long term trend line does not even hint of parabolic price movement, contrary to mainstream press reports warning the public of the dangers of gold investing.

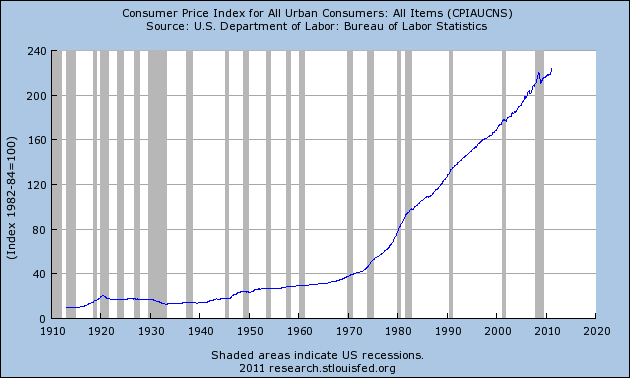

Despite the assertions of Fed Chairman Bernanke that inflation is not a problem, any one outside of the academic inner circle of the Federal Reserve sees inflation everywhere they look. Soaring gasoline and heating costs have decimated family budgets and retail food inflation is projected to hit 4% or higher in 2011. Constantly higher inflation, as measured by the Consumer Price Index, has prevailed ever since the U.S. officially went off the gold standard in the early 1970’s. (See also Why Higher Inflation and $5,000 Gold Are Inevitable).

This week we have seen announcements of higher prices by Starbucks, Smucker Co, Nestle, McDonald’s and Whole Foods. Walmart previously warned that the debasement of the dollar was translating into higher retail prices on imported items. The upward price spiral in the cost of necessities is especially burdensome since incomes for the majority of Americans are not increasing.

In an excellent article in the Wall Street Journal this week, Ronald McKinnon persuasively suggests that the United States is entering 1970’s type stagflation, the result of high inflation, high unemployment and stagnant demand. According to Mr. McKinnon, “the U.S. economy again seems to be entering stagflation. April’s producer price index for finished goods, which excludes services and falling home prices, rose 6.8%. The Bureau of Labor Statistics reports that intermediate goods prices for April were rising at a 9.4% annual clip. Meanwhile the official nationwide unemployment rate is mired close to 9%.”

McKinnon argues that stagflation is being caused by the Fed’s zero interest rate policies (which besides robbing retirees and savers), has cause a global flood of hot money that has resulted in surging inflation in Asia and Latin America and a 40% rise in commodity prices over the past year.

The Federal Reserve’s policy options at this point seem limited to continuing their policies of cheap money and dollar debasement. The Fed cannot produce oil as Bernanke recently commented. Nor can the Fed produce food, jobs or higher housing prices. The one thing the Fed can and has done is to produce paper dollars in extraordinary quantities. Debt, when allowed to expand to levels that make repayment impossible, leaves the debtor with no good options – a point that we are rapidly approaching. (See also Why There Is No Upside Limit To Gold and Silver Prices).