Silver has started off the new year with a scorching performance

Silver has started off the new year with a scorching performance

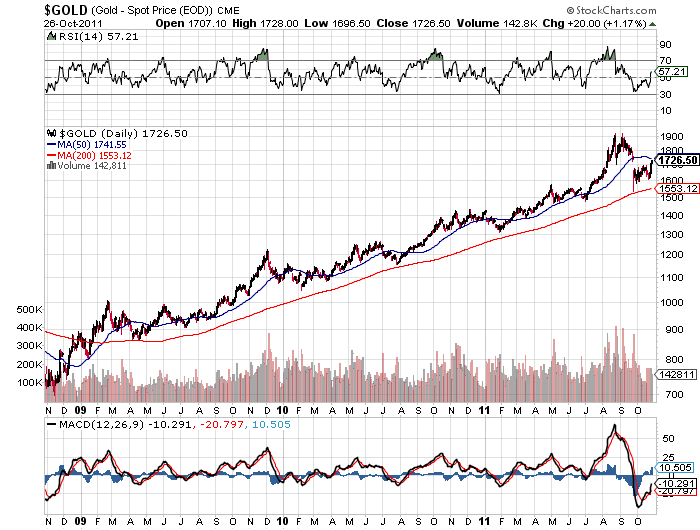

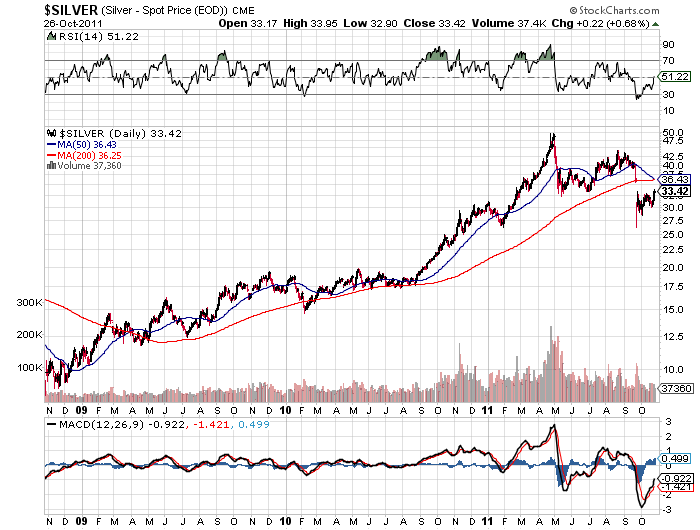

For the month of January, silver gained $5.42 per ounce closing at $33.60, up 19.2% from the 2011 closing price of $28.18. January’s gain has more than erased the 8.1% loss on silver during 2011. Silver has far outperformed gold which closed at $1,738.00 on January 31st, up 10.4% on the month from the 2011 closing price of $1574.50 (all prices from the closing London PM Fix Price).

The large gain in silver’s price has been somewhat of a stealth advance, with little coverage in the press. In addition, an apathetic response to silver by investors can be seen in the volume statistics and bullion holdings of the iShares Silver Trust (SLV).

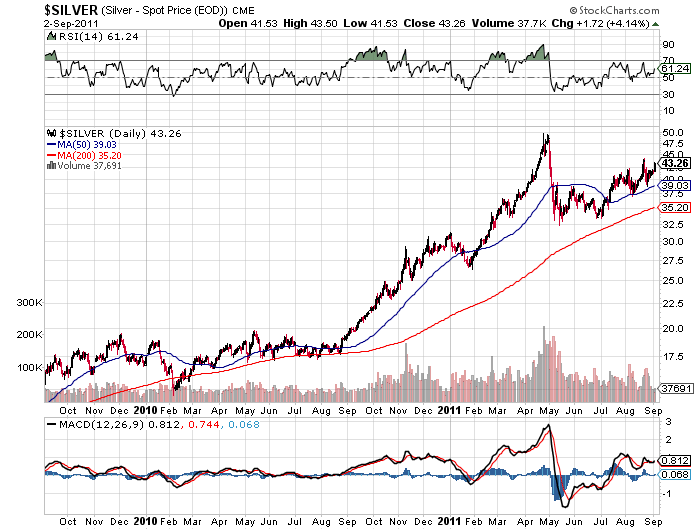

Silver holdings of the iShares Silver Trust reached a record 11,390.06 tonnes on April 25, 2011, shortly before silver reached its peak price of $48.70 on April 28th. The value of silver held by the SLV on April 28th was $17.3 billion compared to its current value of $10.4 billion, representing a decline in both the price of silver and total ounces of silver held by the Silver Trust.

Although silver prices have soared since the beginning of the year, holdings of the SLV have increased only modestly. At the end of 2011, the SLV held 9,605.79 tonnes of silver compared to 9,608.95 on January 31, 2012, a negligible increase of only 3.16 tonnes. The small increase in silver held by the iShares Silver Trust indicates that investors are not participating in the silver rally, a very bullish sign from a contrarian point of view.

The silver ETF is structured in a somewhat complicated manner in which authorized participants (AP) buy or sell shares of the SLV depending on the discount or premium of the SLV to the market price of silver. High buying demand for the SLV results in premium pricing which results in the accumulation of physical silver by the trust due to hedging activity by the APs.

Investor indifference to the silver rally can also be seen in the low volume trading of the iShares Silver Trust. We are nowhere close to the high volume seen last May that preceded the rapid correction in silver prices. The low trading volume in the SLV, despite rising prices, is bullish from a contrary viewpoint since it suggests that many investors are still on the sidelines. As these sideline investors start buying, prices will continue to advance.

Also supporting future price advances by silver is the relentless physical demand for silver as seen in the record purchase volume of the American Silver Eagle bullion coins. Sales of the silver bullion coin hit at all time record of almost 35 million coins during 2011. Large demand continues in January with the U.S. Mint reporting sales of over 6 million ounces. 2012 could turn out to be a sterling year for silver.