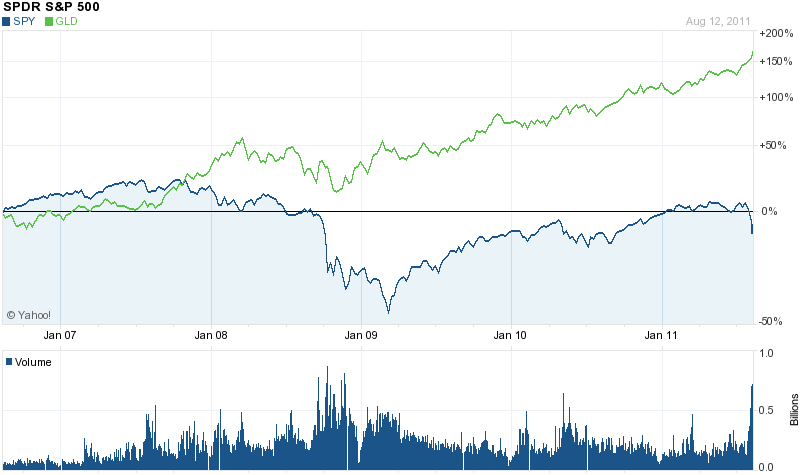

The chronic myth that gold is in a bubble continues to persist, perhaps driven by the fact that gold has risen for the past 11 years.

The chronic myth that gold is in a bubble continues to persist, perhaps driven by the fact that gold has risen for the past 11 years.

The mainstream press has float stories year after year that gold was dangerously overpriced and unsuitable for most investors. This gold bubble mindset, promulgated by “analysts” who have never owned gold has succeeded in keeping the vast majority of investors out of the best performing asset class of the past decade.

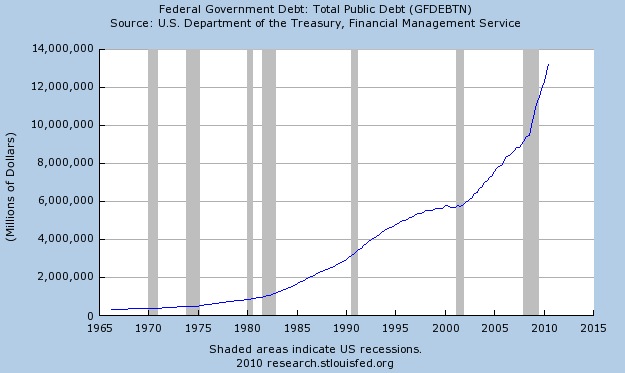

Despite every effort by the Federal Reserve to debase the value of the U.S. dollar, an uninformed and gullible public seems content to hold paper dollars which continue to decline in purchasing power. Worse yet, in an effort to forestall insolvency and reduce the value of debt obligations that are mathematically impossible to repay, the Fed has explicitly adopted a dollar debasement policy.

While the smart money has been moving into gold, the vast majority of investors are under invested in precious metals. The relatively low demand for gold can be seen from the third quarter gold demand and supply statistics from the World Gold Council.

Total gold demand has remained relatively stable for the past four years at approximately 4,000 tonnes. Various categories of gold demand such as bar and coin and ETF rose while jewellery demand actually dropped and technology demand remained relatively unchanged. Total global gold demand of 4,000 tonnes is valued at only about $230 billion. By comparison the market value of Apple is $415 billion, the market value of IBM is $222 billion and the market value of Microsoft is $248 billion.

Meanwhile, monetary authorities world wide are printing money to prop up governments that have reached the limits of taxation and borrowing abilities. This, along with the low level of demand for gold tells us that we are not even close to the ultimate highs that will be seen in the gold market.

Gold Bull Market Could Last Another 20 Year With $12,000 Price Target

Why There Is No Upside Limit For Gold and Silver Prices

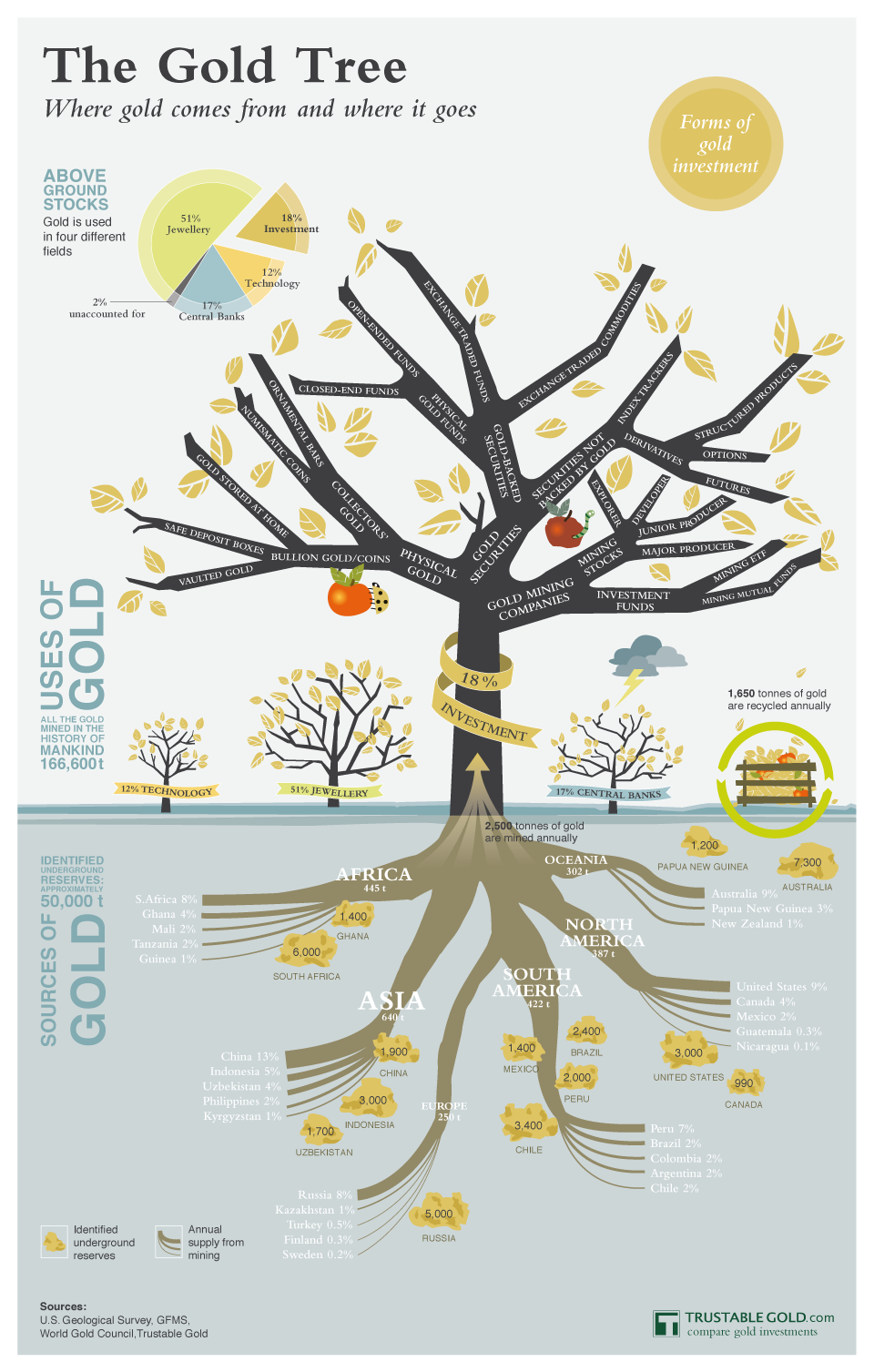

Sources and Demand For Gold

A nifty graphic detailing the sources and demand for gold can be seen below from Trustable Gold, which provides investors with information on gold investment opportunities.