Bull markets are born from underlying macro economic trends that take decades to fully play out. The bull market in gold has lasted barely ten years, yet analyst after analyst from the conventional press argue vehemently that gold is in bubble territory and dangerously overpriced.

Bull markets are born from underlying macro economic trends that take decades to fully play out. The bull market in gold has lasted barely ten years, yet analyst after analyst from the conventional press argue vehemently that gold is in bubble territory and dangerously overpriced.

The voices proclaiming a “gold bubble” do not understand why gold has appreciated for ten years, have never owned gold and have kept their clients out of the best performing asset class of the past decade.

The goldandsilverblog.com has previously argued that given the current fiscal, political and monetary circumstances, there is currently no upside limit for the price of gold. Those exiting the gold market now will be missing the most explosive and profitable part of the gold bull market.

If the gold bull market duplicates other major bull markets, investors in gold can look forward to decades of continued price appreciation. Consider the duration and price appreciation of the following asset classes.

United States Housing Bubble

The bull market in housing prices began in the early 1970’s. The nominal price of a house rose from $25,000 in 1972 to $250,000 in 2006 for a 1,000% gain over 34 years.

NASDAQ Stock Bubble

The NASDAQ rose virtually uninterrupted for 26 years from 55 in 1974 to 4,570 in 2000 for a gain of 8,300%.

30 Year U.S. Treasury Bubble

The price of the U.S. 30 year treasury bond has risen continuously since the mid 1980’s and yields have reached 60 year lows.

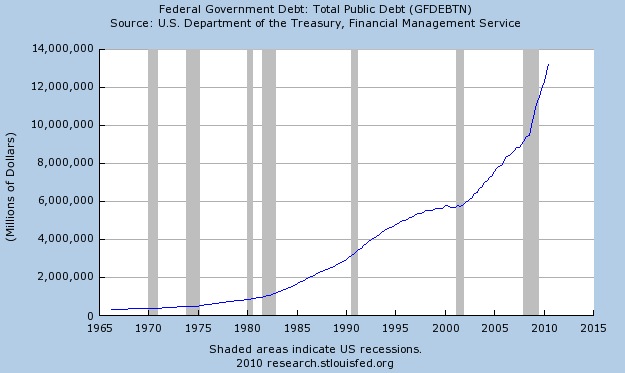

U.S. Debt Bubble

We consider last, the greatest bubble in all of recorded financial history which is the bubble in U.S. debt. U.S. debt has increased by almost 3,000% since the early 1970’s. The increase in borrowings by the United States has gone absolutely parabolic and is unsustainable. The duration of the U.S. debt bubble cannot be predicted, but when this bubble bursts, the repercussions will be devastating to the global economy. Astute readers will notice that the genesis of the housing, NASDAQ and U.S. debt bubbles coincide perfectly with the end of the gold standard.

The bubbles cited above lasted an average of 31 years. The average percentage gain for housing, the NASDAQ and U.S. debt bubbles is 4,100%. Extrapolating from past historical bubbles, the gold bull market should last another 20 plus years with a price target of over $12,000.