Over the past five years, gold bullion has dramatically outperformed the average gold stock. Reasons why bullion has outperformed gold stocks include an investor preference for physical gold and the inability of gold miners to produce earnings gains commensurate with the increase in the price of gold.

Over the past five years, gold bullion has dramatically outperformed the average gold stock. Reasons why bullion has outperformed gold stocks include an investor preference for physical gold and the inability of gold miners to produce earnings gains commensurate with the increase in the price of gold.

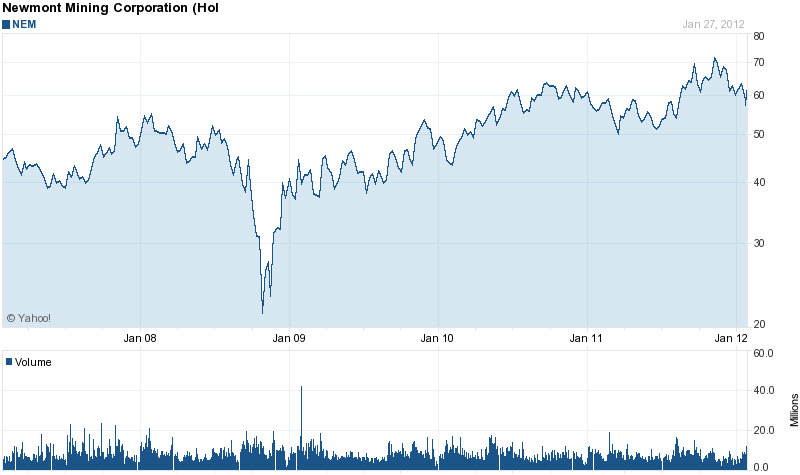

The end result of investor aversion to gold stocks has resulted in many quality gold stocks, such as Newmont Mining (NEM), winding up on the bargain rack. Newmont Mining is one of the world’s largest gold producers that has positioned itself for profitable growth after restructuring its operations. Newmont Mining management is forecasting a 35% increase in gold production to 7 million ounces annually over the next six years.

Revenue growth at Newmont has grown by 10% annually over the past 10 years. Earnings per share increased from $.45 per share in 2002 to $4.68 per share in 2010. For the year ending December 31, 2010, gross margins hit a record 61%, cash holdings increased to $4.1 billion and revenues climbed by 23% to $9.5 billion. Newmont Mining has a dividend yield of 2.3% with a very low payout ratio of 18% and is committed to increasing the dividend in line with the increase in the price of gold. Newmont’s total proven and probably gold reserves of 93.5 million ounces are valued at only $285 per share.

In this week’s Barron’s Roundtable, analyst Fred Hickey talks about Newmont Mining and why he is bullish on gold.

Hickey: Newmont Mining [NEM], which I recommended last year, outperformed. [The stock rose 5.5% through Dec. 30.] The driver is gross margin expansion. Gold prices are up by a factor of six through this bull market, yet costs have roughly doubled. The company has had tremendous cash flow, leading to dividend increases. Newmont has tied its dividend policy to the gold price. If the price rises, you are guaranteed more dividends. The money won’t be wasted on bad acquisitions. In 2008 Newmont earned under $2 a share. It could earn $4.82 for 2011, and $5.96 in 2012. There’s no reason these stocks should be so cheap.

As Felix has said, owning physical gold is important. In addition, you can own gold through exchange-traded funds, such as the GLD [ SPDR Gold Shares]. They are audited. The U.S. government’s gold holdings haven’t been independently audited in decades. The GLD charges fees of 0.40% of assets. The IAU, or iShares Gold Trust, charges only 0.25% of assets. It trades for about a hundredth of the price of gold, so it is selling for $15.76 a share. It has been around since 2005 and has $9 billion in assets and 171 tons of gold. It stores its gold in vaults around the world. Last year I recommended stocks. This year I like the GDX, or Market Vectors Gold Miners ETF. It gives you diversification with 31 names, including a few silver stocks. Barrick Gold [ABX], Newmont and Goldcorp [GG] account for 41% of assets. At some point gold stocks will outperform bullion.

Newmont is currently selling at a steep discount to the underlying value of its gold reserves. As the price of gold continues to rise, the stock will eventually reflect the fundamentals and could easily double from current levels.