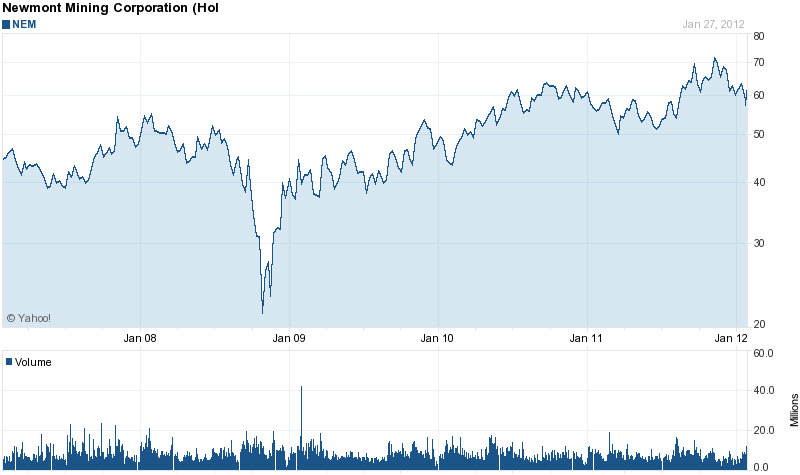

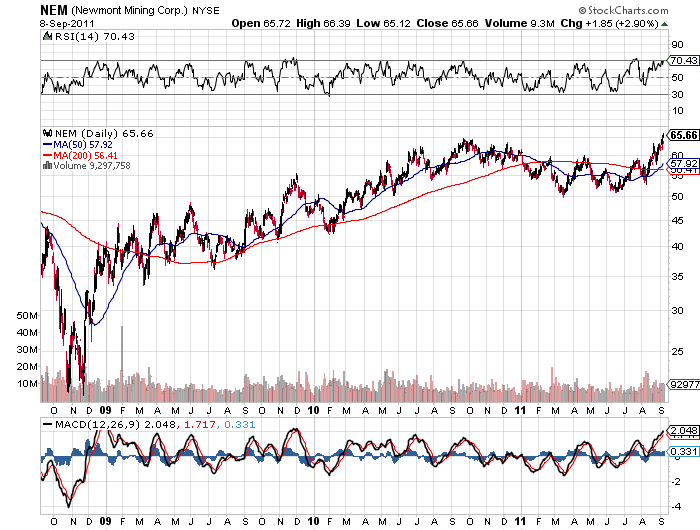

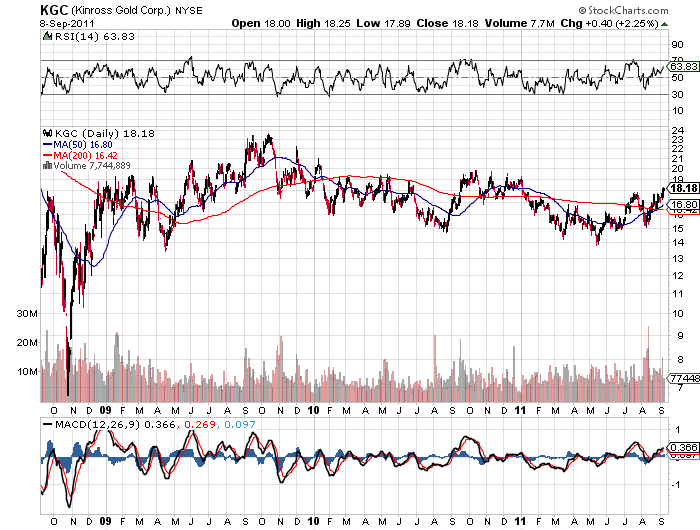

Each day another gold stock blows up. Last week it was NovaGold (NG) and then Newmont Mining (NEM) and before that a long list too painful to mention. Although I strongly prefer holding physical precious metals over mining companies, the gold stocks that I do own have put in less than a sterling performance.

Each day another gold stock blows up. Last week it was NovaGold (NG) and then Newmont Mining (NEM) and before that a long list too painful to mention. Although I strongly prefer holding physical precious metals over mining companies, the gold stocks that I do own have put in less than a sterling performance.

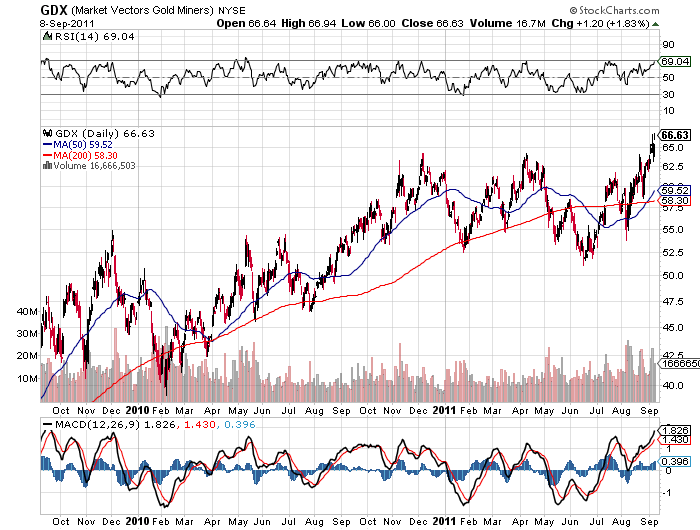

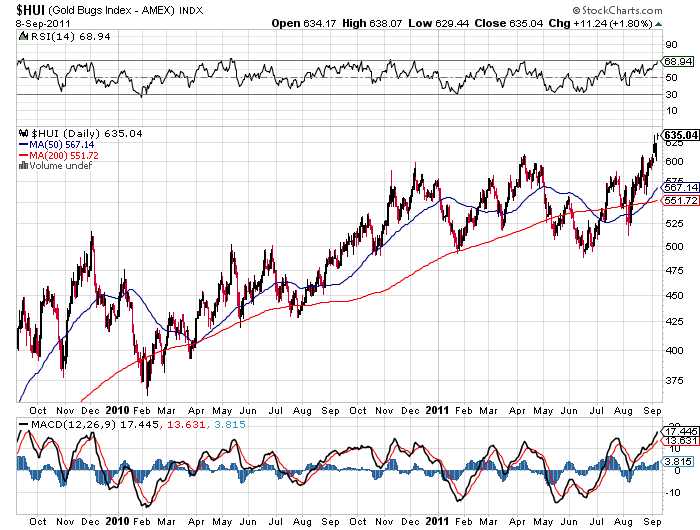

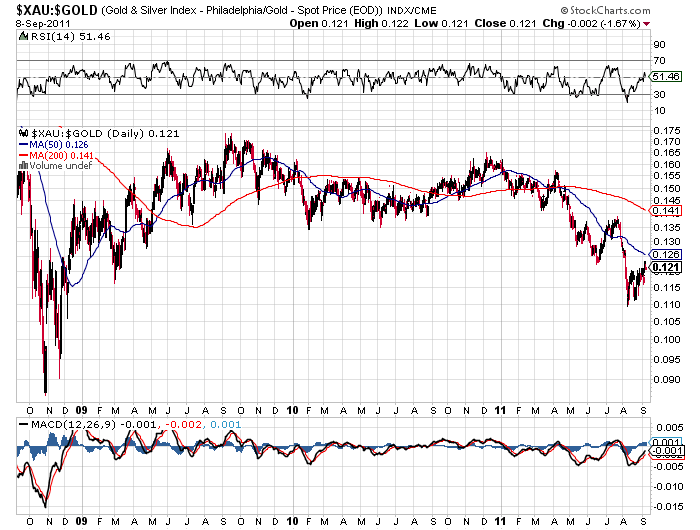

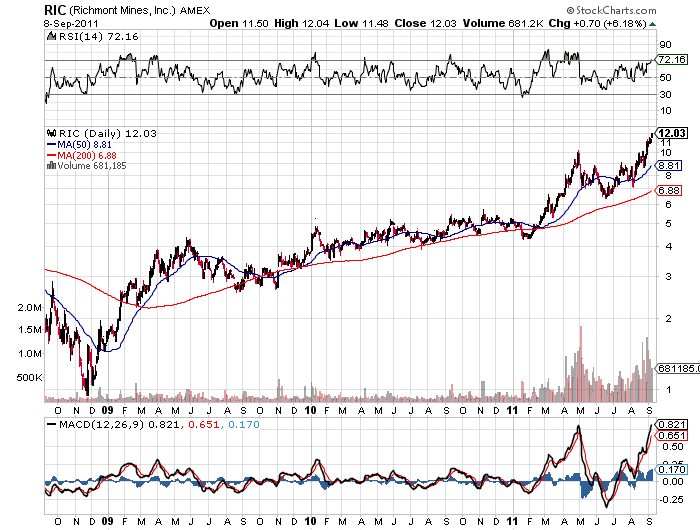

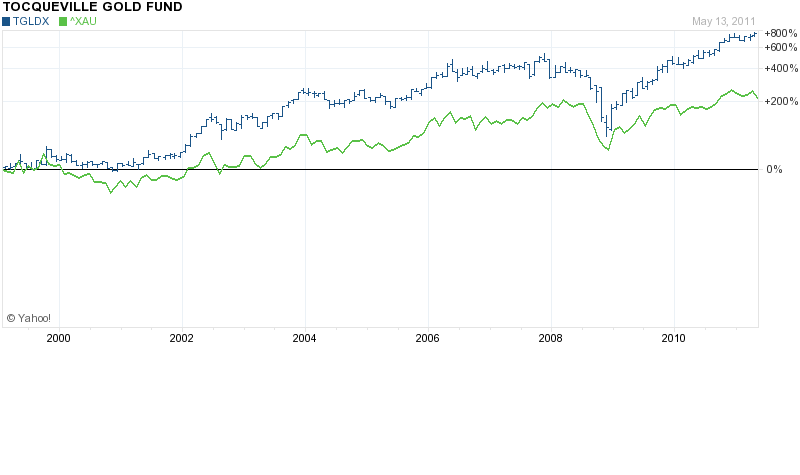

I won’t bother going through the reasons why gold stocks could recover or mention the fact that many of them are trading at a fraction of what they were worth when gold was a thousand dollars lower. Stocks are ultimately valued on earnings and for a variety of reasons, many of the mining companies have not been able to translate higher gold prices into higher dividends or earnings.

To put this all into perspective, I was pondering on two innate character traits I possess that can be confirmed by anyone who knows me.

First and foremost, I procrastinate on everything in life, but actually have a very profound theory to validate the benefits of a trait that many would view as indolence. Despite the occasional guilt for not doing something today instead of next week, I have conclusively proved to myself that a large percentage of those “today to do list” items somehow resolve themselves without my intervention. Perhaps just a rationalization but it seems to work.

My second dominate character trait, and this one actually relates to plunging gold stocks, is my innate belief that somehow there is a blessing lurking next to each catastrophe. What often times seems like Armageddon may be a benefit. So how exactly do plunging gold mining stocks wind up benefiting long term gold investors? The answer is actually in the details of each poor earnings report delivered regularly by gold miners. When you drill into the core reasons for poor earnings, the answers all correlate to lower gold production due to overestimates of ore reserves, mining difficulties and the higher cost of mining lower grade ore reserves.

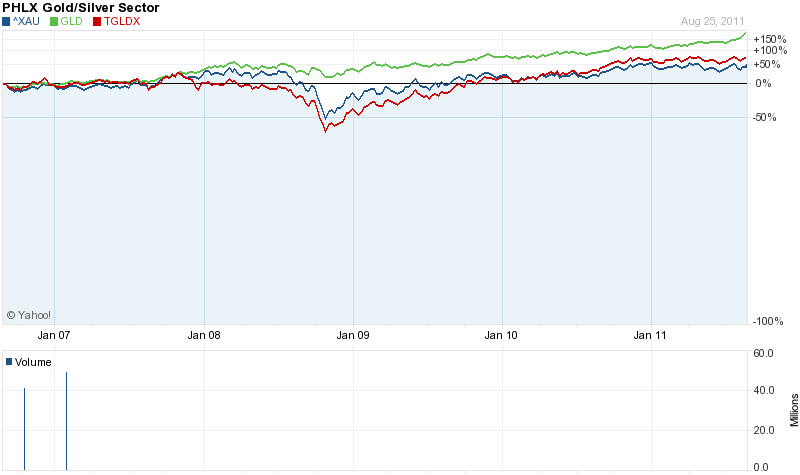

The fundamental fact is that the quantity of high grade ore reserves has declined dramatically making it much more costly and difficult to produce gold. In a recent article the Wall Street Journal estimated that at current production rates, all known gold reserves would be depleted within ten years. It wouldn’t take much of a bump in demand to eventually propel gold to multiples of today’s price.

Here’s a neat info graphic from visual.ly. Note that net gold supply has been static for the past decade and large scale high grade gold deposits are rarer than ever.