Many investors in gold mining companies are probably asking “where did I go wrong”? While the price of gold bullion has moved relentlessly higher, many large cap gold stocks have seen little or no price appreciation in recent years.

Many investors in gold mining companies are probably asking “where did I go wrong”? While the price of gold bullion has moved relentlessly higher, many large cap gold stocks have seen little or no price appreciation in recent years.

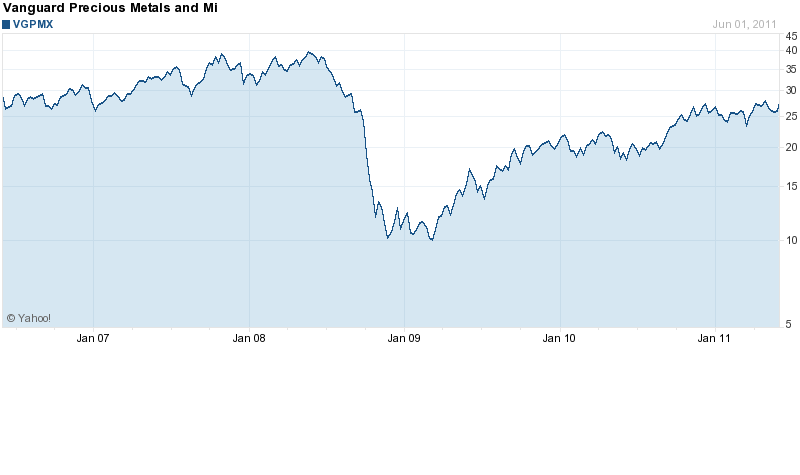

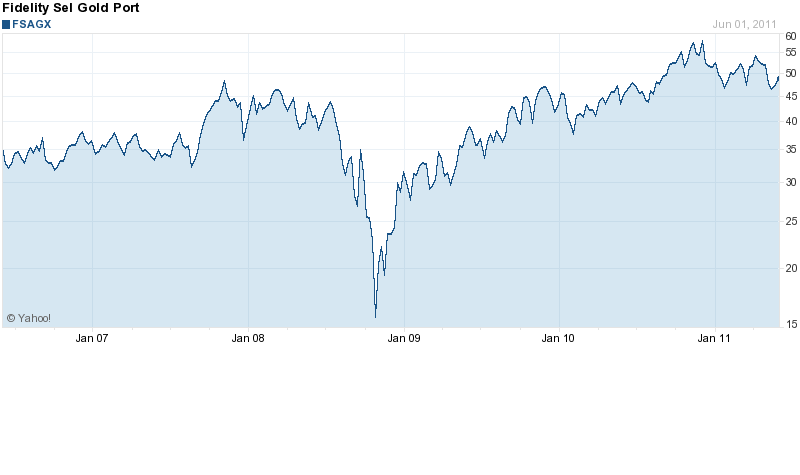

In a previous post, we examined the poor returns of two major gold stock mutual funds compared to the return on owning physical gold. While the price of gold has soared 80% over the past three years, the three year return on the Vanguard Precious Metals Fund (VGPMX) was -.46% and the three year return on the Fidelity Select Gold Portfolio (FSAGX) was only 16.2%.

Why gold stocks have so badly lagged the run up in the price of gold remains subject to conjecture. Some analysts speculate that investors prefer to avoid the risks associated with gold mining stocks and as a result have turned to physical gold and gold ETFs. Since their introduction in 2004, gold ETFs have become very popular with investors, and now hold a total of almost $98 billion in assets. By way of comparison, the market value of three of the largest gold mining companies, Barrick Gold (ABX), Gold Corp (GG) and Newmont Mining (NEM) total $108 billion.

If the gold ETFs did not exist, it is likely that some of the funds that flowed to gold ETFs would have instead flowed into gold mining companies. However, the historical correlation between gold bullion and gold mining stocks has not always been perfectly linked. There have been times when gold stocks outperformed or simply matched the price gains of gold bullion.

The recent under performance of gold stocks relative to gold bullion will probably not continue. Many large cap gold mining companies are positioned to see significant increases in earnings that will eventually propel their stock prices higher. Going forward, it is likely that gold investors will see higher returns on quality gold mining stocks than on holdings of physical gold or gold ETFs.

Two high quality gold mining companies previously featured in the GoldandSilverBlog that should see significant price gains are Newmont Gold (NEM) and Kinross Gold (KGC).

Newmont Gold is one of the world’s largest gold producers. The Company has been increasing profits and production for several years and is forecasting an increase in gold production of 35% over the next six years. Newmont has gold and copper reserves valued at $363 per share and pays a cash dividend of $0.50 per share which will be increased by $0.20 for every $100 increase in the price of gold. Newmont shares closed on Friday at $52.10.

Kinross Gold had very strong first quarter results with revenue up 42% and earnings up 81%. The Company’s cost of production is $543 per ounce and Kinross is forecasting an increase in gold production of 77% by 2015. At the current price of $15.50 per share, an investor is effectively buying gold at around $250 per ounce. Kinross Gold pays a dividend of $.10 per share.

The current pricing disparity between quality gold mining stocks and gold bullion has presented investors with an opportunity to purchase gold shares at deeply discounted prices.

Besides being able to effectively buy gold at a steep discount, gold mining companies pay dividends which are likely to increase substantially. Another significant benefit of owning gold mining companies is the much more favorable tax treatment on gains. Gold bullion and gold ETFs are taxed as collectibles at 28%, while the long term capital gains tax rate on gold stocks is only 15%.