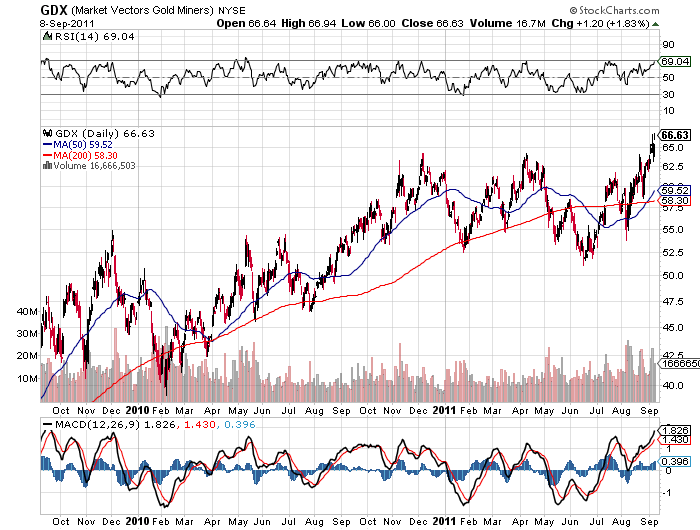

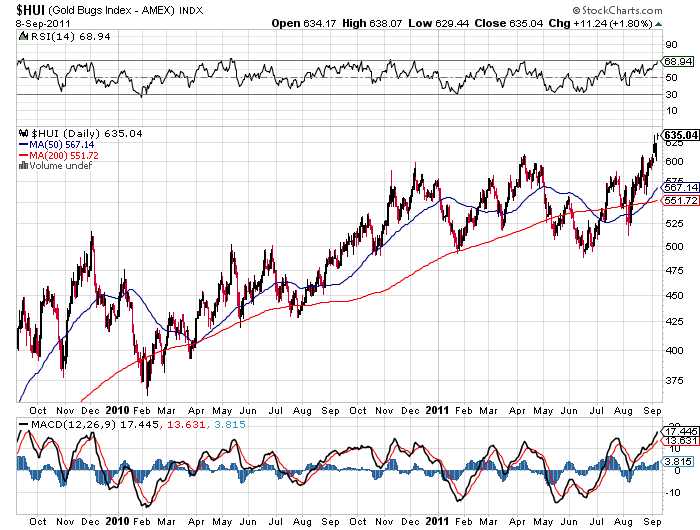

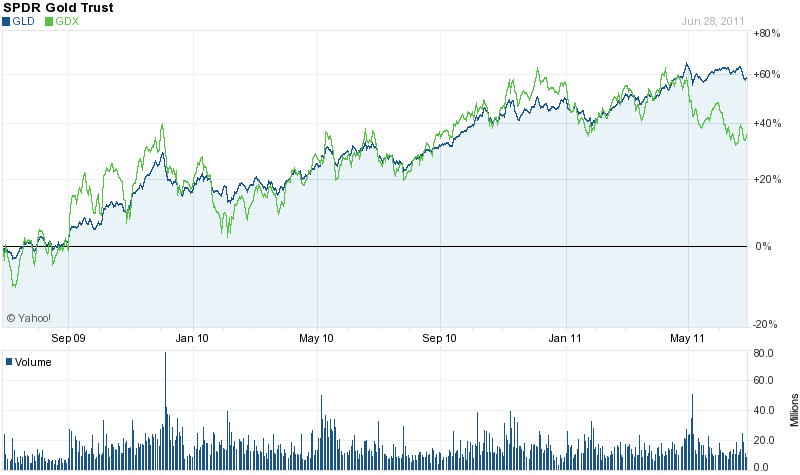

The divergence between the performance of gold bullion and gold stocks seems to be coming to an end. Both the Market Vectors Gold Miners ETF (GDX) and the Gold Bugs Index ($HUI) have broken out to new highs as investors move into undervalued gold mining shares.

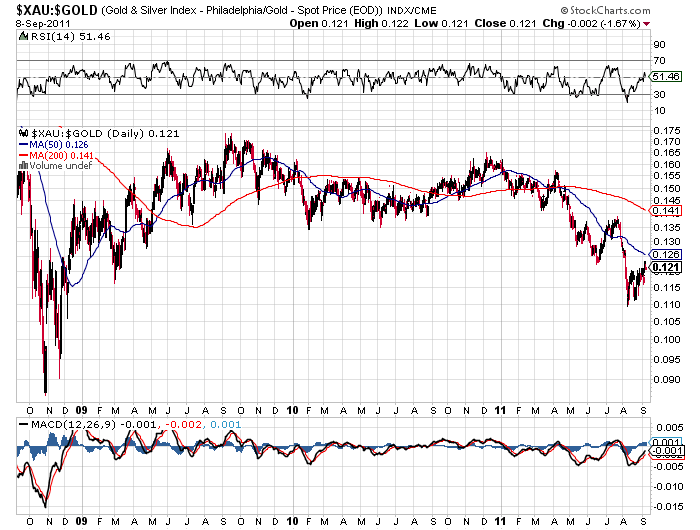

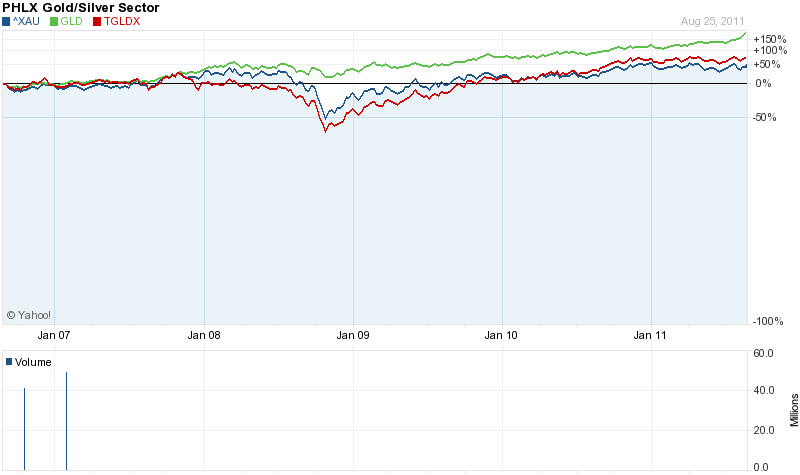

During the initial stages of the gold bull market,gold stocks significantly outperformed gold bullion. From October of 2000 to June of 2008 gold stocks, as measured by the PHLX Gold/Silver Index (XAU), rose 345% compared to a gain of 252% for gold bullion.

Since 2008 gold stocks have significantly underperformed bullion as gold prices increased by over $1,000 per ounce. As a result, many gold stocks are selling at bargain prices based on increased earnings and the value of proven gold reserves.

Investors have a wide variety of options for investing in gold mining shares including ETFs and gold stock mutual funds. One of the best performing gold funds is the Tocqueville Gold Fund (TGLDX) run by John Hathaway. TGLDX has achieved an average annual return of 26% over the past 10 years. An investment of $10,000 in the Tocqueville Gold Fund made in June 2001 was worth $102,929 as of June 2011.

For investors who prefer to invest in individual gold mining shares, here’s a short list of three gold mining stocks that could easily double in price.

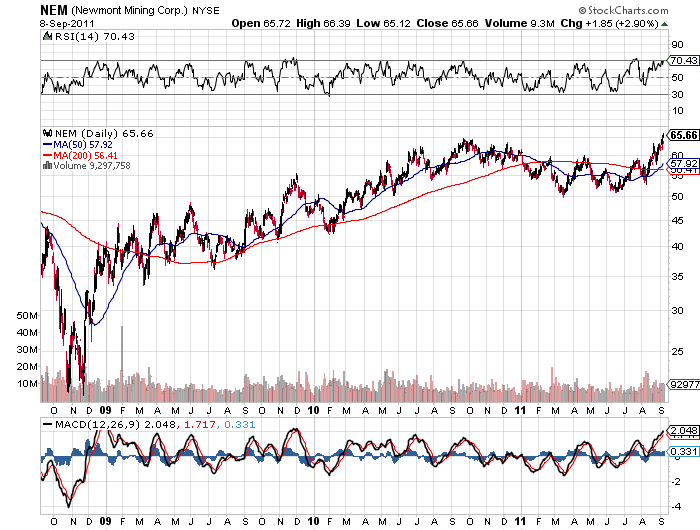

Newmont Mining (NEM) is a large cap gold mining company with proven and probable gold reserves of 93.5 million ounces. NEM has a strong balance sheet, is forecasting an increase in gold production of 35% over the next six years and pays a cash dividend of 50 cents per share (see A Large Cap Gold Stock That Could Double in Price). NEM hit a new all time high today.

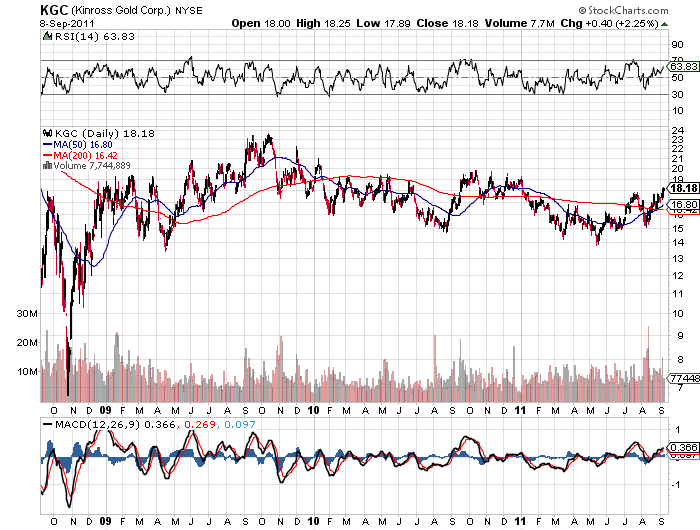

Kinross Gold (KGC) is selling at a large discount to the value of its gold reserves. One value investor is forecasting a price target of $27 per share (see How Patient Investors Can Buy Gold At $250 Per Ounce). KGC closed Thursday at $18.18, up $0.40.

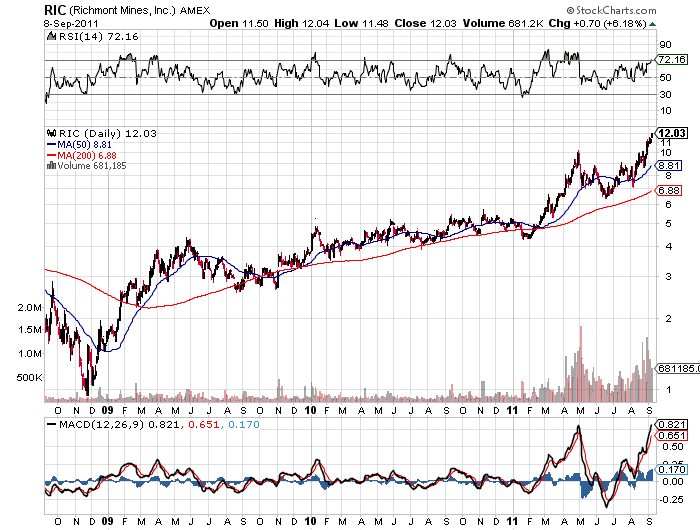

Richmont Mines (RIC) is a junior gold producer. Earnings for the second quarter of 2011 increased from $0.01 per share to $0.16 per share compared to the prior year. RIC hit a new high of $12.03 at yesterday’s close.