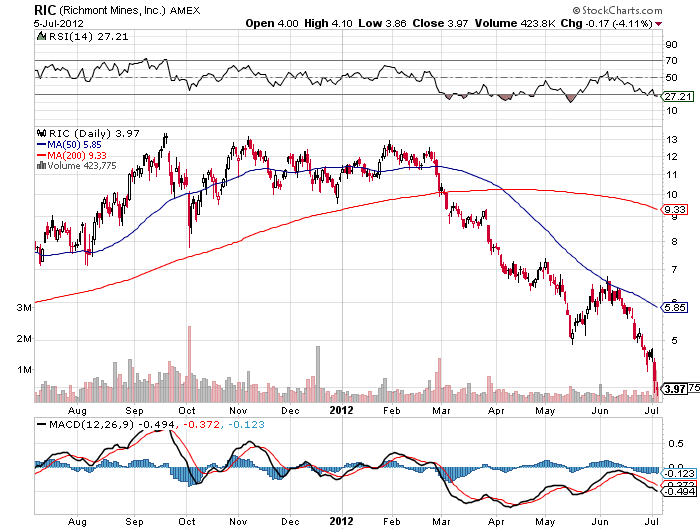

The bear case for gold and silver stocks is well known and investors have reacted by dumping mining stocks indiscriminately. The staggering decline in gold and silver stocks over the past two years now exceeds the decline that occurred during the crash of 2008 when the financial system was at the brink of collapse.

The bear case for gold and silver stocks is well known and investors have reacted by dumping mining stocks indiscriminately. The staggering decline in gold and silver stocks over the past two years now exceeds the decline that occurred during the crash of 2008 when the financial system was at the brink of collapse.

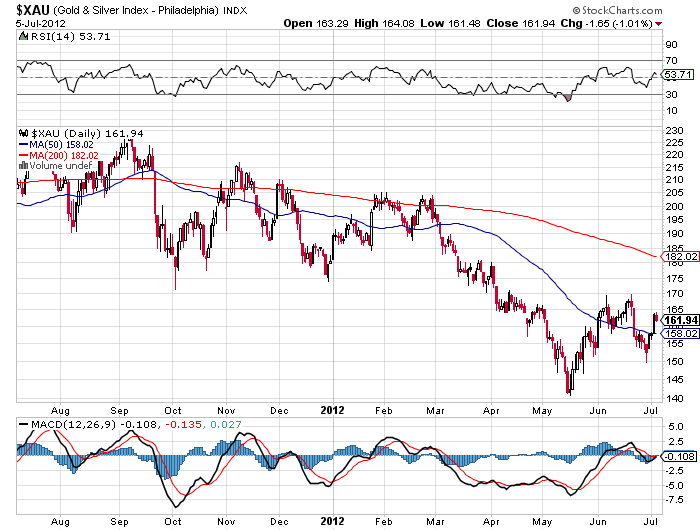

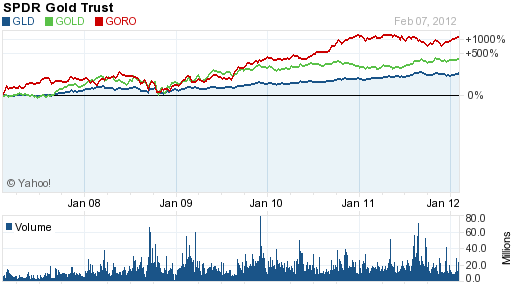

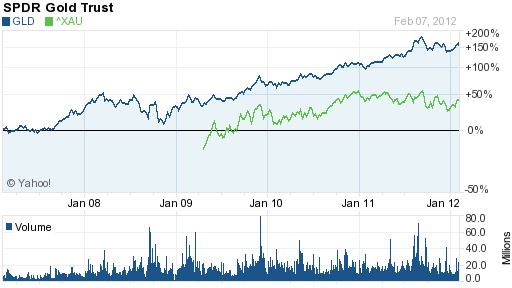

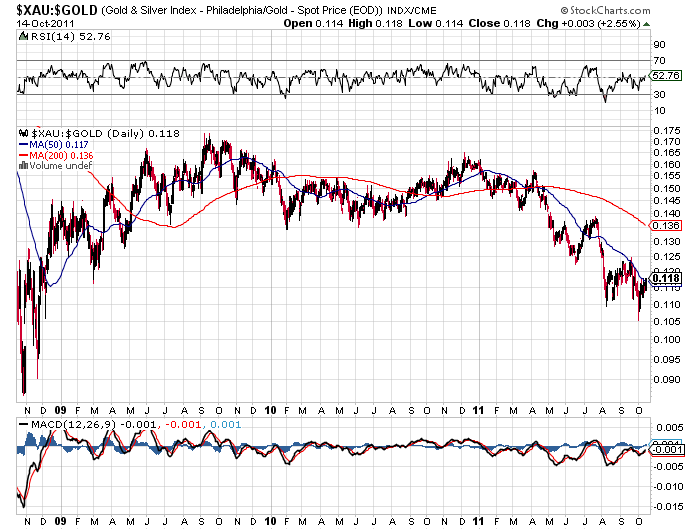

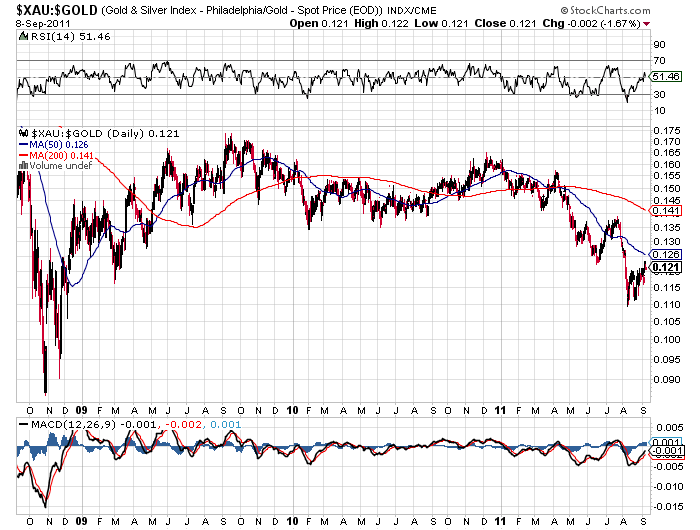

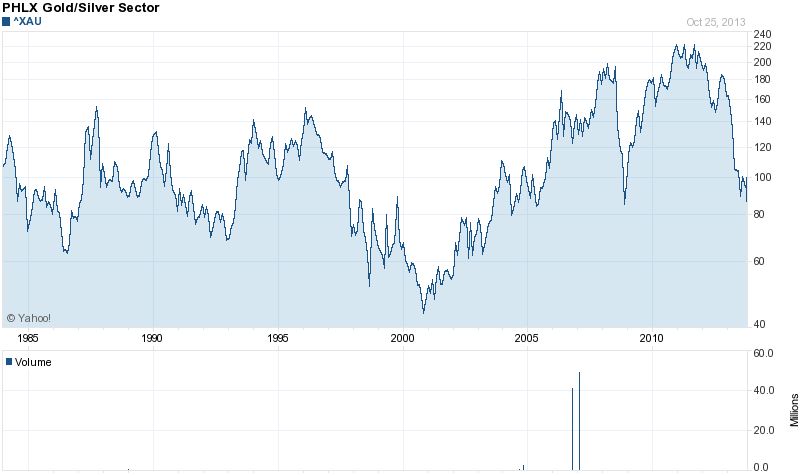

The Philadelphia Gold and Silver Index (XAU) is an index comprised of sixteen major precious metal mining companies. During the crash of 2008 the XAU declined by 58.5%. From the peak of 226.58 in December 2010 to the low of 90.15 in June 2013, the XAU has collapsed by 60.2%.

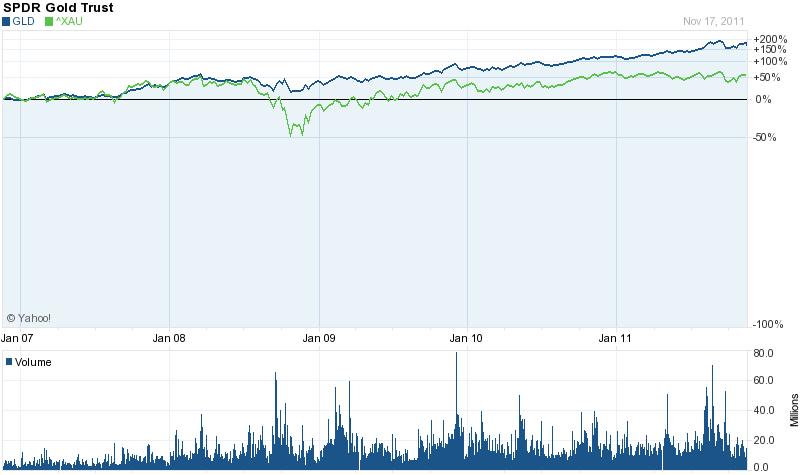

Courtesy Yahoo Finance

Has the sell off of the past two years been so extreme as to constitute a selling climax which usually signals a major reversal from the lows? According to John J. Murphy, an acknowledged technical analyst, a selling climax is “usually a dramatic turnaround at the bottom of a down move where all the discouraged longs have finally been forced out of the market on heavy volume. The subsequent absence of selling pressure creates a vacuum over the market, which prices quickly rally to fill.”

It is too early to tell if prices have reached a capitulation bottom but investors who haven’t sold out positions in the precious metal miners after a 60% decline are probably thinking more about buying than selling. Another factor that impedes future selling is the fact that investors are now getting paid to wait for a turnaround in the mining industry.

Historically, precious metal miners have never paid out large dividends but this metric has changed. The stock price declines in senior gold and silver producers have been so severe that the dividend yields on some gold mutual funds now approaches 4%.

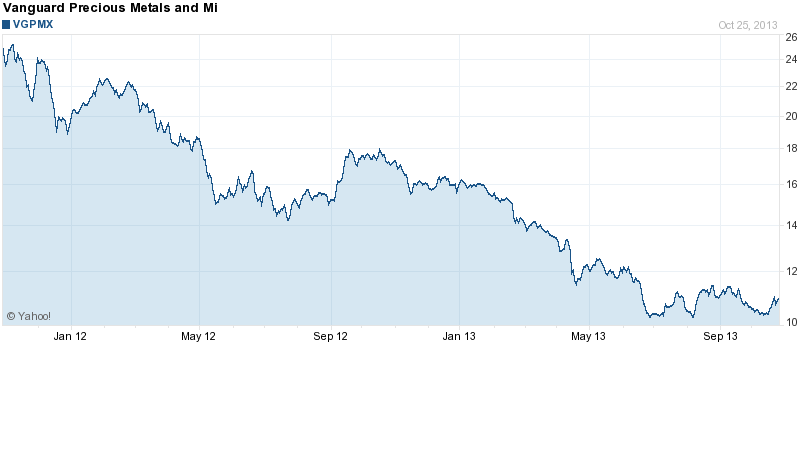

The $2.4 billion Vanguard Precious Metals and Mining fund (VGPMX) currently yields 3.76% and holds a well diversified portfolio of seasoned mining companies. The Vanguard fund holds investments in both domestic and foreign companies involved in activities related to gold, silver, platinum, diamonds, and rare minerals.

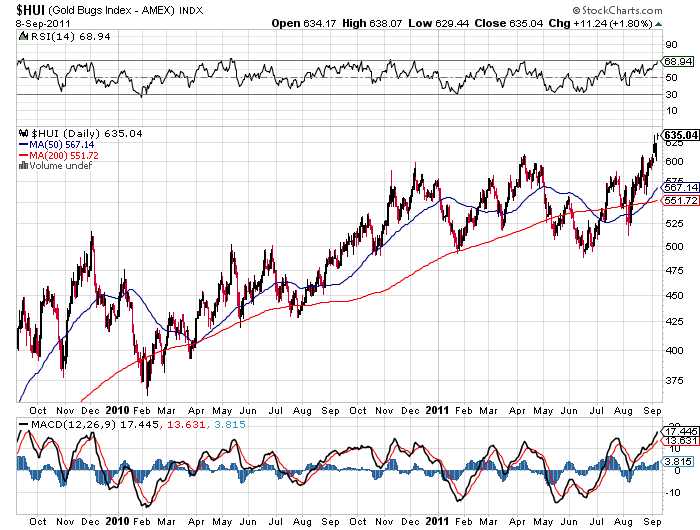

The chart on VGPMX looks like a reason for precious metal investors to commit suicide but if a selling climax has occurred, the losses of the past two years may be quickly recouped. In addition, the chart of the Vanguard fund has made a triple bottom over the past six months.

Courtesy: Yahoo Finance

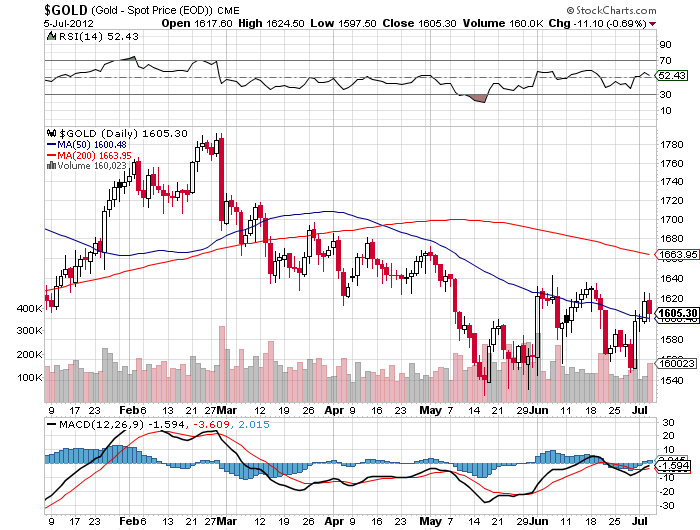

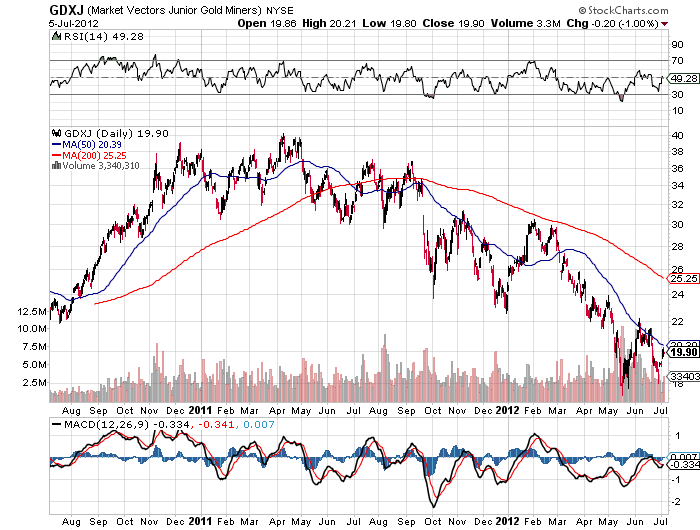

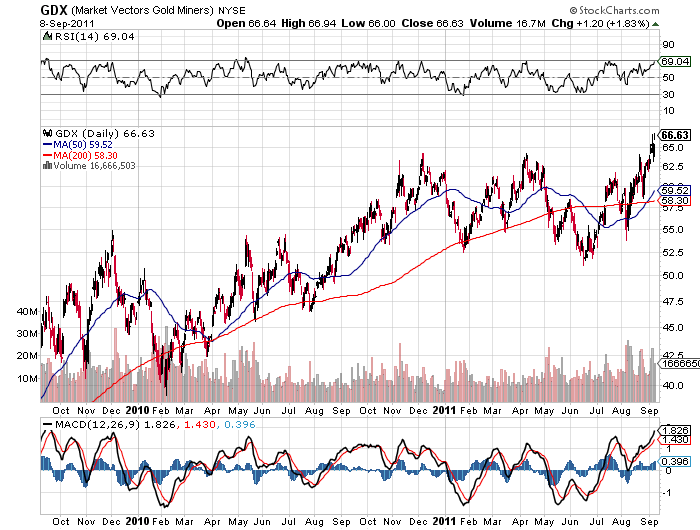

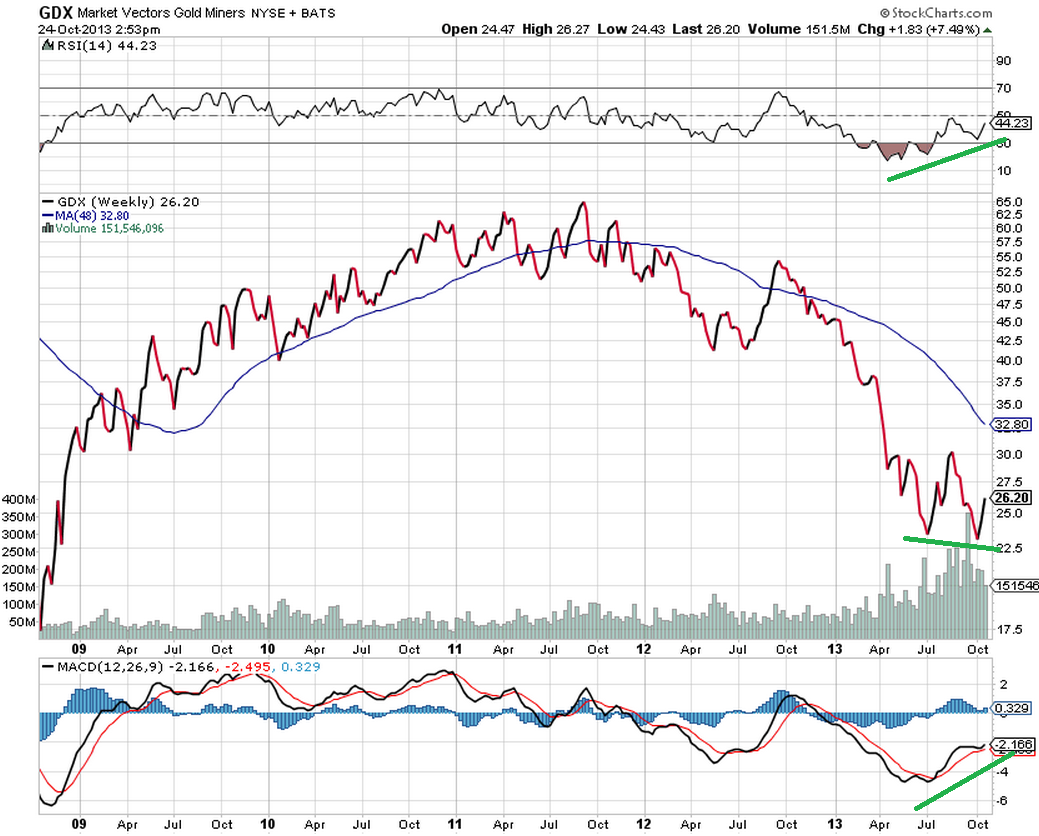

Another classic sign of a bottom in precious metal stocks was discussed by Mebane Faber who has drawn an analogy to the bottom of stock prices in early 2009 to the current chart of the Market Vectors Gold Miners (GDX). In 2009 the S&P 500 kept hitting new lows even as the RSI and the MACD were making higher lows which is a classic bull signal. A similar situation exists today with the GDX.

Courtesy: mebanefaber.com