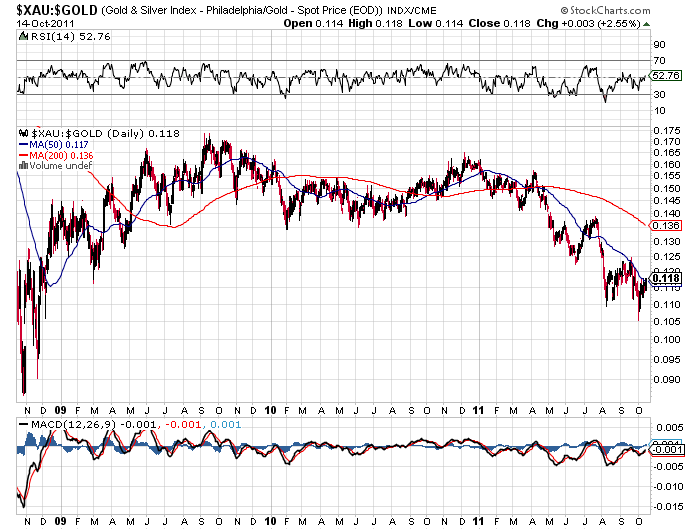

Investors in gold mining stocks have had a tough five years. Since 2008, the price of most gold stocks have remained frozen in time even as gold bullion has doubled in price. Is the disparity in price performance between gold stocks and gold bullion a bullish set up or another false dawn for gold stock investors?

The PHLX Gold and Silver Index (XAU), which is comprised of 16 major gold and silver producers, is no higher than it was during the last quarter of 2007. The large cap gold stocks represented by the Market Vectors Gold Miners ETF (GDX) have shared the same fate with no gain for the past five years.

Beginning in 2011, the divergence between the price of gold bullion and gold stocks has widened even further. Comparing the SPDR Gold Trust (GLD) to the PHLX Gold and Silver Index, we see that gold has dramatically outperformed gold stocks by a factor of five since early 2007.

At this point, gold stocks are incredibly oversold and, in addition, represent sound fundamental value based on the price of gold bullion. Given the notorious volatility of gold stocks, a move by gold above its high of last year could be the spark that ignites a huge rally in the gold stocks.

John Hathaway of the Tocqueville Gold Fund (TGLDX), who has produced fabulous investment returns over the past decade, had this to say in his latest Investment Update.

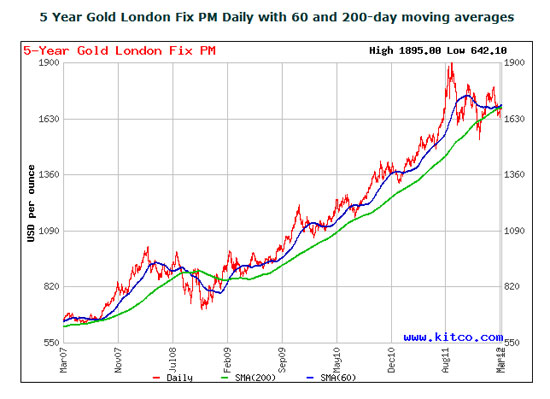

Gold and gold stocks appear to be bottoming in the wake of a four month correction which began in mid -August when the metal peaked at $1900/oz. Bearish sentiment is at extremes not seen in many years. This and a number of other indicators, such as stocks that have been hit by negative sentiment, the downtrend in gold prices since August, and tax loss selling, support our view that a rally lies ahead. This very bullish market set-up, in our opinion, mirrors the extraordinary investment opportunity of the despondent year end in 2007. Even though gold prices have been declining for several months, they finished the year with substantial gains. This suggests that the value represented by gold mining equities held in our portfolio could be extraordinary.

Disarray in Europe is, in our opinion, a slow motion version of the global market meltdown in 2007. It appears to us that the U.S. Fed is once again acting as the lender of last resort to European central banks in their efforts to save the euro. As in 2007, U.S. sovereign credit will be substituted for failing credits, in this case, peripheral European states. The fig leaf to justify such action on the Fed’s part is sado-fiscalism, or extreme austerity packages administered by technocrats. Tough restraints on profligate public spending, which has become a way of life in all Western democracies, will not go down easily. These measures are deflationary and will be ultimately met by howls of protests from mobs demanding renewed money printing and deficit spending. In our opinion, the fundamentals for gold are stronger than ever because the outlook for paper currencies is dire. The difficult correction of the last four months has shaken out all but the strongest holders, a perfect set-up for advances to new all-time highs in 2012.

Over the past ten years the Tocqueville Gold Fund has had an average annual return of 24%, far exceeding the 3% return by the S&P500. The top ten holdings and percent of total assets of the Tocqueville Fund are listed below.