Historically, gold stocks have outperformed gold bullion. Mining companies typically benefit from leveraged earning gains as gold prices rise and production costs remain stable. Higher gross profits on each ounce of gold produced flow right to the bottom line, boasting profits and stock prices.

Historically, gold stocks have outperformed gold bullion. Mining companies typically benefit from leveraged earning gains as gold prices rise and production costs remain stable. Higher gross profits on each ounce of gold produced flow right to the bottom line, boasting profits and stock prices.

During the initial phase of the gold bull market, investors reaped greater profits by owning a basket of gold mining stocks as opposed to holding gold bullion.

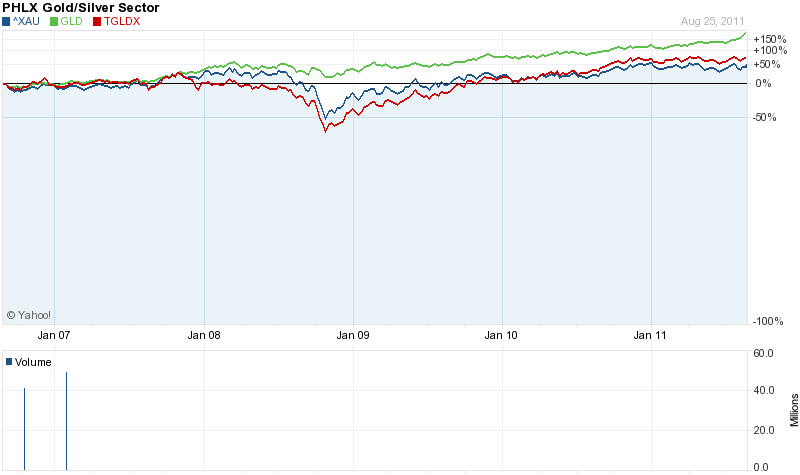

Using the PHLX Gold/Silver Index (XAU) as a proxy for mining stocks, the XAU significantly out performed gold bullion during the initial stages of the gold bull market from 2000 through 2008. From 43.87 in October 2000, the XAU advanced to 195.25 in June 2008 for a gain of 345%. During that same period of time, gold rose from $264 in October 2000 to $930 in June of 2008 for a gain of 252%.

Since 2008, however, the price correlation of gold mining stocks to gold bullion has reversed. Despite a doubling in the price of gold since 2008, the XAU is only marginally higher at 210.93 for a very paltry gain of 8%. An investor who was super bullish on gold since 2008 would have gained virtually nothing in mining stocks while the price of gold soared.

Investors in broadly diversified precious metal mutual funds had equally poor results. As of June 2011, both the Vanguard and Fidelity gold mutual funds have drastically under performing gold bullion since 2008. The Vanguard Precious Metals Fund (VGPMX) actually delivered a horrendous three year return of minus 0.46% as the price of gold soared 80%. The only investors in gold mining stocks since 2008 who made profits were those astute enough to pick the handful of mining stocks that out performed gold bullion.

Even the Tocqueville Gold Fund (TGLDX), run by legendary gold investor John Hathaway, has been unable to outperform gold bullion since 2008.

Some of the reasons for the disconnect between gold mining companies and gold bullion since 2008 include the following.

- Investors learned the downside risks of leverage during 2008 when gold stocks got absolutely crushed while the price of gold bullion had a relatively modest decline. As measured by the XAU, gold stocks declined by a devastating 65.7% during 2008 while gold bullion declined by only 29% from a peak of $1,011 to a low of $713.

- A growing preference for holding physical gold and silver.

- The realization by investors that it takes an in-depth technical knowledge of the mining industry as well as the ability to analyze financial statements to be able to pick the gold mining stock that will outperform gold bullion.

- Gold mining companies can go bankrupt while gold bullion is eternal and will always retain a value and constitute a store of wealth. Long time gold investors may remember stocks like Echo Bay Mines, Royal Oak Mines and many others which became worthless.

- The introduction of gold ETFs such as the SPDR gold shares (GLD) created competition for gold mining stocks. Before gold ETFs were established, investors who wanted exposure to the gold market without having to hold physical bullion would have had to invest in gold mining shares. The GLD recently became the largest ETF by value with holdings of over $70 billion in gold bullion.

Investor preference for gold bullion and gold ETFs over mining stocks has created a vast pricing disparity between gold bullion and gold stocks. High quality major gold producers with vast proven reserves of gold are now on the bargain table. Gold stocks are selling at almost all time lows compared to gold bullion. Two bargain gold mining stocks previously featured in goldandsilverblog.com are Newmont Mining (NEM) and Kinross Gold (KGC). Investors in Kinross Gold, for example, are effectively buying gold at around $300 per ounce.

Markets can price stocks far below fundamental values, sometimes for an extended period of time, but ultimately the underlying value will be reasserted. Gold mining stocks at this time represent immense value and are being steeply discounted.

What will be the trigger for an explosive move up in quality gold mining stocks? Consider Glencore’s recent bids for nickel, coal and copper miners as reported in ft.com.

Glencore on Wednesday launched a A$268m (US$280m) bid to acquire full control of Minara Resources, an Australia-based nickel miner in which it already has a 73 per cent stake. Last month it offered $475m (£295m) to acquire one of Peru’s largest copper prospects, the Mina Justa project.

Industry executives said that Glencore’s latest target was Optimum, South Africa’s fourth largest coal exporter. The trading house is close to launching a bid for the Johannesburg-listed miner with the support of several South African partners, executives said.

Gold mining stocks have become irresistible take over targets. The first takeover bid for a gold mining company will trigger a buying stampede which could rapidly result in a doubling of gold stock prices from currently depressed levels.