Despite the recent set back in gold prices due to panic selling by investors, gold has still racked up an impressive 15.7% gain with a price increase of $218 per ounce since the first of the year. So how does a hedge fund manager with one of the best track records in the industry wind up losing over 10% on his gold portfolio?

Despite the recent set back in gold prices due to panic selling by investors, gold has still racked up an impressive 15.7% gain with a price increase of $218 per ounce since the first of the year. So how does a hedge fund manager with one of the best track records in the industry wind up losing over 10% on his gold portfolio?

The man who can answer this question is John Paulson, famous for his billion dollar gains betting against subprime mortgages before they collapsed in price. Making matters even worse, the set back in Paulson’s Gold Fund, although painful, pales in comparison to losses run up by the Paulson Advantage Fund, as reported by Bloomberg.

John Paulson, the billionaire money manager mired in the worst slump of his career, lost 10.5 percent in his Gold Fund this year even as the metal heads for its 11th straight annual gain, according to people familiar with the fund’s performance.

The fund, which invests in mining stocks and other gold- related securities, remains the best performer in Paulson’s $28 billion fund family this year. His Paulson Advantage Fund, which seeks to profit from corporate events such as takeovers and bankruptcies, has fallen about 35 percent. The performance numbers for the two funds are from Dec. 28, 2010, through Dec. 20, 2011, and may not reflect returns for all shareholders, said the people, who asked not to be identified because the information is private.

Paulson & Co., based in New York, has lost money this year on investments including Citigroup Inc., Bank of America Corp. and Sino-Forest Corp., the Chinese forestry company accused by short-seller Carson Block of overstating timberland holdings. Paulson, 56, cut the so-called net exposure in his main hedge funds to 30 percent last month and reduced bullish bets across all his funds.

Paulson’s frustrations with the losses on his gold portfolio mirrors that of other investors who have bet on gold stocks and lost despite the fact that gold bullion scored another impressive advance this year.

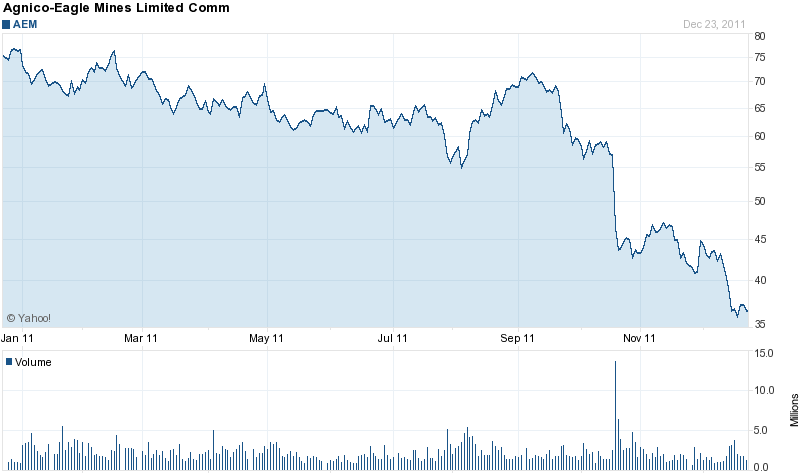

Paulson’s had large positions in Anglo Gold Ashanti (AU), Gold Fields Ltd (GFI), Nova Gold Resources (NG), Agnico-Eagle Mines (AEM), Iamgold Corp (IAG) and Barrick Gold Corp (ABX), all of which declined. Agnico-Eagle Mines was the worst performer with a stunning decline of over 50% on the year.

It will be interesting to see if Paulson dramatically reduces his positions in gold mining shares over the coming quarters. Given the fact that the fundamentals for owning gold are stronger than ever and gold mining shares are deeply oversold, it would not be surprising to see Paulson actually increase his gold stock holdings.