The Standard & Poors 500 stock index is still below the level it reached more than 10 years ago in early 2000. Interest rates on traditional bank savings have barely exceeded zero percent since the Fed instituted its zero interest rate policies in 2008. Meanwhile, incomes are stagnant and the cost of items we use everyday have been inexorably increasing.

The Standard & Poors 500 stock index is still below the level it reached more than 10 years ago in early 2000. Interest rates on traditional bank savings have barely exceeded zero percent since the Fed instituted its zero interest rate policies in 2008. Meanwhile, incomes are stagnant and the cost of items we use everyday have been inexorably increasing.

Investors who expected to achieve financial independence by investing in actively managed stock mutual funds have seen their dreams turn to nightmares. The brutal truth is that the vast majority of mutual fund managers do not beat the market over the long run. Investors who did not diversity out of traditional investments have seen the value of their savings diminished by inflation and stagnant stock prices.

By contrast, one legendary gold investor who has consistently made great calls in the precious metals markets has achieved average annual returns over the past ten years of over 29%. Money doubles in about 2.5 years at 29%. Investors who had the patience and conviction to ride out inevitable corrections have seen fabulous returns.

The man who achieved this stunningly successful investment record is Harvard educated John Hathaway, who has been with the Tocqueville Gold Fund (TGLDX) since its inception in 1998. Hathaway’s success has been based on his ability to chose smaller mining companies that have the potential for explosive growth and then patiently wait for results. The average gold mutual fund has an annual holdings turnover of 104% compared to 9% at TGLDX. While other fund managers frenetically trade mining stocks, Hathaway’s deep knowledge of the companies he invests in has resulted in superior investment returns. Also benefiting shareholders is the fact that the TGLDX does not charge front end or deferred sales loads which reduce investor returns.

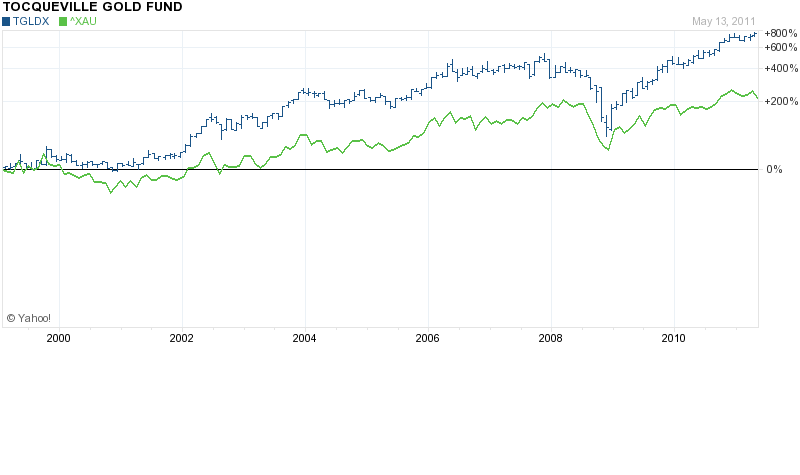

The TGLDX has soundly beaten the investment performance of both gold bullion and the widely followed PHLX Gold/Silver Sector (XAU) which holds a broad basket of gold and silver stocks. Since 2000, the TGLDX has returned approximately 810% compared to 500% for gold bullion and 325% for the XAU.

TGLDX VS XAU - COURTESY YAHOO FINANCE

When John Hathaway speaks, serious gold and silver investors pay attention. In the Tocqueville Gold First Quarter 2011 Observations, Mr. Hathaway explained why he remains positioned for further gains in the precious metals and related equities.

Mr. Hathaway noted that his current position on gold is based on interrelated macro economic issues which make the “current landscape especially tricky”. Hathaway noted that “the Fed seems predisposed to maintain extremely lax monetary conditions” and that “a credible fiscal plan seems like a long shot”. Conditions in the Middle East could worsen considerably, energy prices are likely to remain at levels that seemed “unthinkable” a year ago and if there is political resistance to the Fed reducing its balance sheet, “the conditions are ripe for an inflationary spiral”.

The dollar appears to be deeply oversold and a near term rally could slow gold’s uptrend, according to Hathaway.

Mr. Hathaway feels that by mid year, the outlook will be more clear but in the meantime, “we remain positioned for further advances in precious metals”.

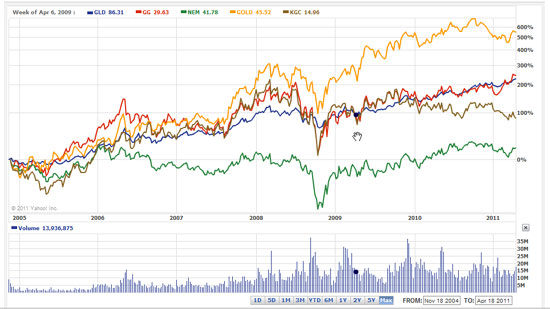

The top 8 stock holdings of TGLDX at March 31, 2011 were Goldcorp (GG), Newmont Mining (NEM), IAMGold (IAG), Ivanhoe (IVN), Silver Wheaton (SLW), Gold Resource Corp (GORO), Osisko Mining (OSK) and Randgold Resources (GOLD).

Depending on which gold stock investor you talk to, gold stocks have either been under performing or outperforming gold bullion.

Depending on which gold stock investor you talk to, gold stocks have either been under performing or outperforming gold bullion.