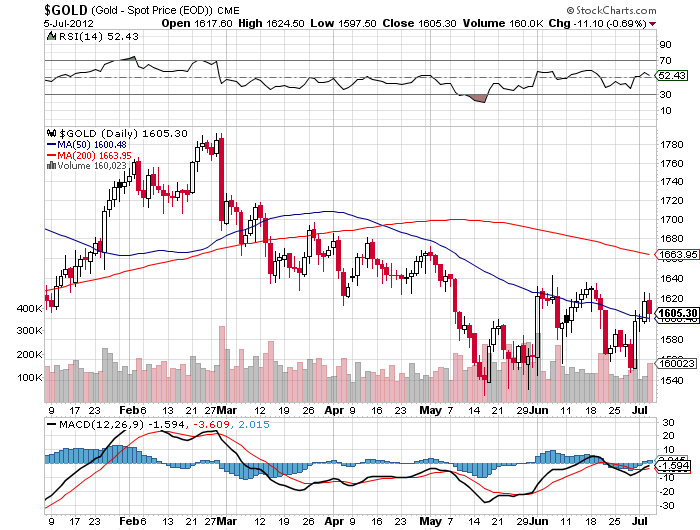

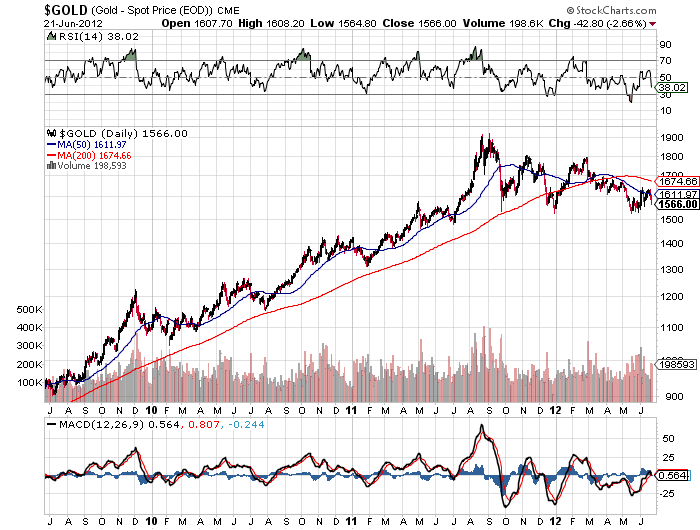

The price of gold is almost exactly unchanged on the year. The first trading day of the year saw gold close at $1598 per ounce. After reaching a high of $1781 on February 28th, gold has drifted lower and at today’s closing price of $1604 gold is up a fraction of a percent on the year.

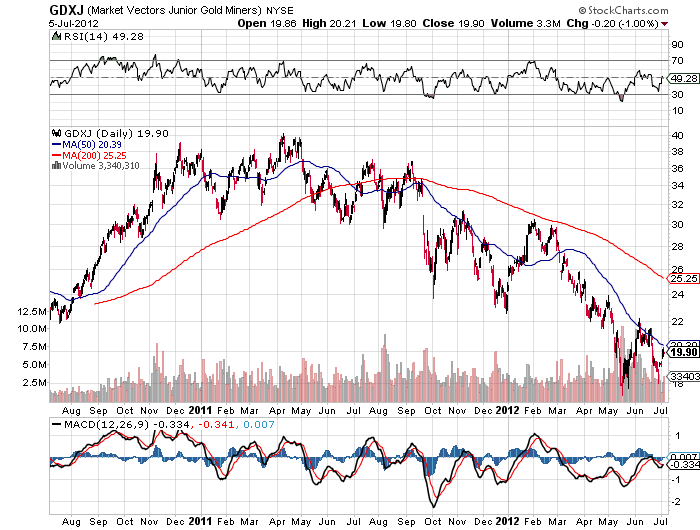

The story has been quite different for stockholders in gold mining companies. Gold stocks have gone through a brutal sell off during 2012 despite the neutral price action of gold bullion. Stock prices of the junior gold miners have been particularly brutalized as shown by the Market Vectors Junior Gold Mine ETF (GDXJ) which is down over 50% from its high late last year.

GDXJ - Courtesy stockcharts.com

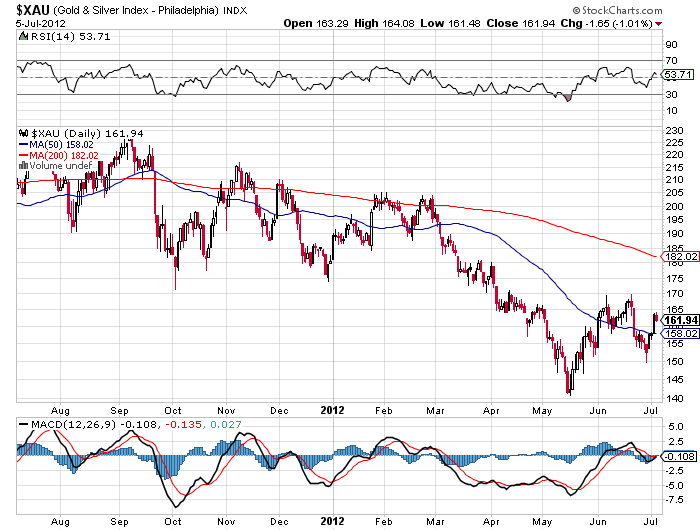

The shares of the largest gold miners have also seen major losses during 2012. The PHLX Gold and Silver Index (^XAU), comprised of 16 major gold and silver producers, has decline by 21% from its peak reached in early February.

XAU - courtesy stockcharts.com

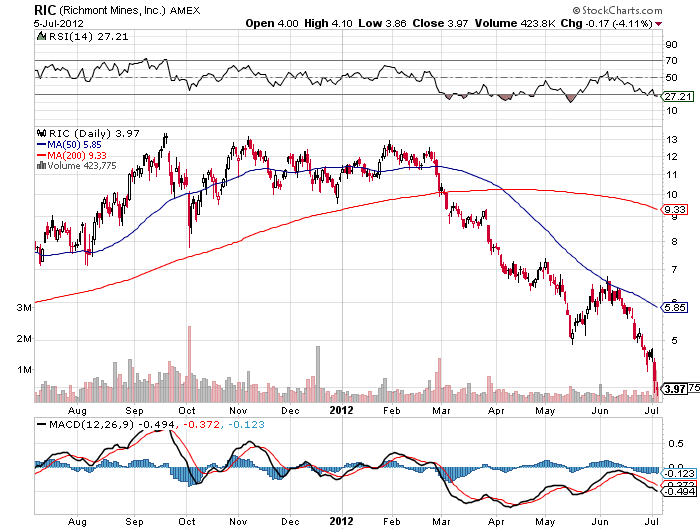

The latest casualty in the junior gold mining sector was Richmond Mines (RIC) which recently lowered its estimate of reserves and production and took a major write down on assets. Richmond, a highly regarded gold mining company with excellent reserves and earnings prospects, was only one of the latest blowups in the junior gold mining sector. Richmond Mines has collapsed 70% from its $13 per share price in late January, closing today at $3.97.

Courtesy stockcharts.com

Is the decline in gold mining shares a harbinger for the future trend in gold bullion or is the latest sell off a major buying opportunity?

Here are some thoughts from two of the brightest minds in the industry who both have superb long term track records.

Legendary gold investor John Hathaway of the Tocqueville Gold Fund (TGLDX) remains bullish as discussed in his latest Gold Strategy Investment Letter.

Why would anyone own them other than for the possibility of a higher gold price? While we do not wish to minimize such issues as capital spending cost pressures, resource nationalism, or competition from GLD and similar instruments, we believe those concerns will fall by the wayside with the resumption of the bull market in the metal. If gold were to trade at $2,000/oz. later this year, and should the ratio of gold mining shares (XAU basis) return to the mid -point of its range since the launch of GLD in 2004, or roughly 15% versus the current level roughly 10%, mining stocks could double on a 25% increase in the gold price.

The policy challenges facing the Volcker Fed and the Reagan administration that ultimately capped the previous bull market in gold seem mild by comparison to those of today. We believe that gold remains under owned and misunderstood notwithstanding a thirteen year bull market. It is considered a fringe strategy to most, a little bit exotic and slightly risqué to the mainstream investor. While policy makers attempt to buy time by inventing solutions that are incomprehensible to most, the dream of mainstream investors for robust growth amidst stable economic conditions remains alive. Faith in half-baked policy improvisations that are nothing more than repackaging bad debt in the envelope of sovereign credit, along with hope that ever increasing quantities of sovereign debt will generate growth is, in our opinion, delusional.

Peter Grandich gives an excellent in-depth analysis on both gold stocks and gold bullion in a recent post on the Grandich Letter website. The full post is a must read – here are some of his latest thoughts.

Despite general metals prices much, much higher than a decade or two ago, the mining and exploration industry is far more challenged now than ever before. This is especially true as you move further down the food chain in the junior resource sector.

I’m certain there are other reasons, but I believe the above is a good part of why we’re where we are today. The question now is does this mean the mining and exploration stocks are no longer worthy?

The “mother” of all bull markets continues thanks to four key reasons:

- Once dominant sellers that capped any advances, Central Banks are now net buyers.

- Gold producers, who once “cut their noses to spite their faces” by selling forward large quantities of future production and helped capped the price by doing so, now operate under the belief hedging is a “four-letter” word among investors.

- Gold Exchange Traded Funds (ETFs) greatly changed the balance between supply and demand. Investors who never or rarely sought exposure to gold beforehand (because of difficulties associated with physical bullion buying) and/or who ended using mining shares for exposure only to see them not come close to correlating movements in the gold price themselves, embraced ETFs in a big and powerful way in order to have exposure to gold. Whether or not those ETFs are really direct ways to physical ownership doesn’t concern them, but their large-scale appetite for them combined with the changes among Central Banks and gold producers greatly altered the supply versus demand in favor of demand.

- Gold is money. There’s no Central Bank printing it like it’s going out of style. There’s no government(s) borrowed up to their eyeballs in it. Where you find real growing wealth in the world you find those people acquiring it are using gold as a storer of their wealth.

According to the latest report from the U.S. Mint, sales of gold bullion coins increased by over 13% during June, while total sales of the silver bullion coins were essentially unchanged from May.

According to the latest report from the U.S. Mint, sales of gold bullion coins increased by over 13% during June, while total sales of the silver bullion coins were essentially unchanged from May.

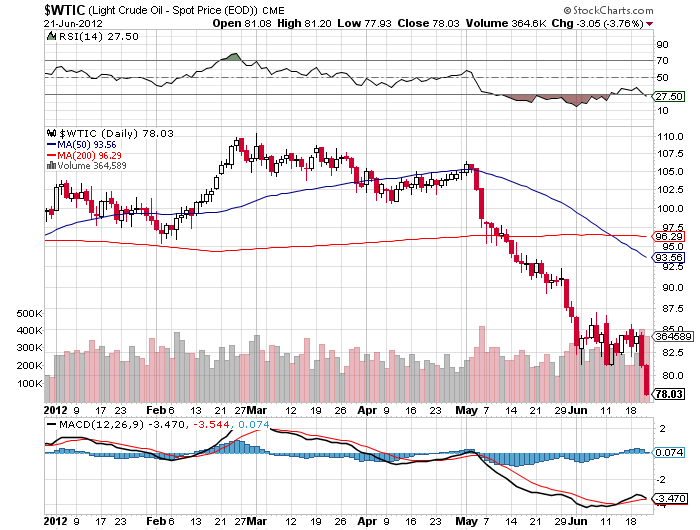

The combination of increasingly ominous economic reports along with the Fed’s failure to announce bold new monetary initiatives resulted in a brutal reassessment of risk by investors. Stock, commodity and precious metal markets all plunged with the Dow down 250 points, gold down by $41.60 per ounce to $1,566 and silver off by 4.4% to $26.98. Crude oil in New York trading was off 4%, dropping below $80 a barrel for the first time in eight months.

The combination of increasingly ominous economic reports along with the Fed’s failure to announce bold new monetary initiatives resulted in a brutal reassessment of risk by investors. Stock, commodity and precious metal markets all plunged with the Dow down 250 points, gold down by $41.60 per ounce to $1,566 and silver off by 4.4% to $26.98. Crude oil in New York trading was off 4%, dropping below $80 a barrel for the first time in eight months.

According to the latest report from the U.S. Mint, sales of both gold and silver bullion coins rebounded strongly during May.

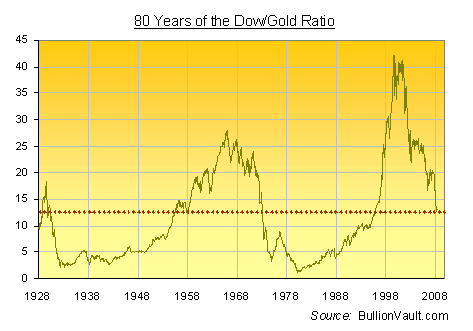

According to the latest report from the U.S. Mint, sales of both gold and silver bullion coins rebounded strongly during May. Long term gold and silver investors who have gradually accumulated physical precious metals over the years have seen the value of their holdings increase substantially when measured against the value of the paper dollar. Astute investors realize that a large part of the “gains” on their precious metals have merely preserved purchasing power compared to paper money which has been consistently debased by the monetary and fiscal policies of the government and federal reserve.

Long term gold and silver investors who have gradually accumulated physical precious metals over the years have seen the value of their holdings increase substantially when measured against the value of the paper dollar. Astute investors realize that a large part of the “gains” on their precious metals have merely preserved purchasing power compared to paper money which has been consistently debased by the monetary and fiscal policies of the government and federal reserve.

It is no secret that the price of gold has been declining since reaching almost $2,000 per ounce last year. After rallying in the early part of the year, gold prices have now fallen to $1,556, representing a decline of $42 per ounce or 2.6% below the closing price on the first trading day of 2012.

It is no secret that the price of gold has been declining since reaching almost $2,000 per ounce last year. After rallying in the early part of the year, gold prices have now fallen to $1,556, representing a decline of $42 per ounce or 2.6% below the closing price on the first trading day of 2012.

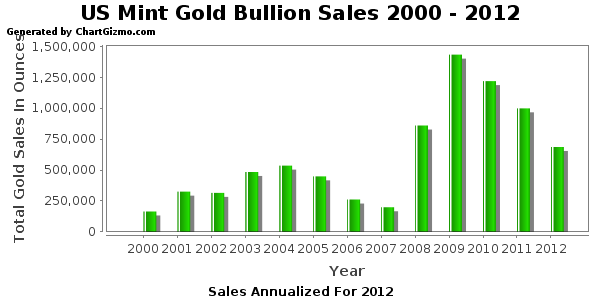

The latest sales figures from the U.S. Mint show a continuing trend of lower gold bullion coin sales. Sales of American Gold Eagle bullion coins hit an all time high in 2009 when the Mint sold 1,435,000 ounces. During 2010, sales declined to 1.2 million ounces and in 2011 only 1 million ounces of gold bullion coins were sold.

The latest sales figures from the U.S. Mint show a continuing trend of lower gold bullion coin sales. Sales of American Gold Eagle bullion coins hit an all time high in 2009 when the Mint sold 1,435,000 ounces. During 2010, sales declined to 1.2 million ounces and in 2011 only 1 million ounces of gold bullion coins were sold.