Gold news from around the web-

Gold news from around the web-

Gold Confiscation?

Are those predicting the confiscation of gold by the U.S. government simply seeking headlines or seriously misguided? Jim Sinclair has the answer.

I am sick of all this confiscation talk of gold and even gold companies. It emanates from gold people who do not know or understand the history of gold. We condemn MSM for inaccurate, false and misleading news. I condemn gold writers who practice sensationalism, who offer their opinions as if they were facts and simply make things up out of thin air as if they were insiders privy to things that no one else is. Right now leaders of this community are printing stuff as misleading as MOPE or MSM ever have.

Eric De Groot put what I have been trying to teach you perfectly today. In the 1930s gold was to the monetary system what QE is today, a means of increasing the supply of money for Fed and Treasury discretionary use. The US Secretary of the Treasury and President Roosevelt set the gold price higher at their daily breakfast together arbitrarily. Higher because to create money then the system required a higher value of gold to have more money outstanding. This is why Roosevelt ordered the confiscation of gold in order to unfold his type of monetary stimulation, his QE. This is what confiscationophiles simply do not know.

Your fears and the outrageous untrue statement by the Scottish hedge fund manager are based on totally wrong reasoning and misunderstanding. Gold was not confiscated because it was going up in price. Gold’s order of confiscation came as a tool of monetary stimulation in order to create monetary creation in order to attempt to increase employment.

So, Exactly Where is Germany’s Gold?

The Germans, tough with monetary policy, turn out to be wimps when it comes to safeguarding their own massive 3,396 ton gold stockpile. Turns out that the Germans, who allegedly hold most of their gold in French, British and U.S. vaults, never even bothered to conduct a physical audit of their holdings – talk about trusting your neighbors! After severe criticism and a national “Bring Back Our Gold” campaign, the Bundesbank is finally promising to conduct audits and bring their gold back home. MarketWatch wonders if the expatriation of German gold may be the beginning of a move to a gold backed currency.

Gold and Silver Technical Charts

Some really amazing gold and silver charts suggest that we may be in the initial stages of a massive gold and silver rally.

Gold and Silver – The Ideal Holiday Gift

A stunning selection of new gold and silver coins from The Perth Mint provides the answer to “what should I get her for Christmas?” Included in the November product releases are some unique rectangular colored silver coins.

Gold Through the Centuries

One of the largest Roman gold coin hoards every found was discovered in Great Britain. The coins are approximately 1600 years old. Any guesses on what $10,000 of U.S. currency buried today would be worth in the year 3612??

Although there are no definitive statistics on how many Americans own gold or silver, the number is certainly small. A Gallup poll earlier this year showed that 28% of respondents thought that gold was the “best investment” but the actual number of people actually owning some form of gold or silver bullion is far less. A Kitco poll indicated that the number of Americans owning precious metals may be as low as 1%.

Although there are no definitive statistics on how many Americans own gold or silver, the number is certainly small. A Gallup poll earlier this year showed that 28% of respondents thought that gold was the “best investment” but the actual number of people actually owning some form of gold or silver bullion is far less. A Kitco poll indicated that the number of Americans owning precious metals may be as low as 1%.

By Axel Merk & Yuan Fang

By Axel Merk & Yuan Fang

According to

According to

The New York Times reports on the “domestic terrorism” case of Bernard von NotHaus who awaits sentencing for minting private money known as the Liberty Dollar. At the age of 68, Von NotHaus is facing the equivalent of a terminal jail sentence since he faces 20 years in prison.

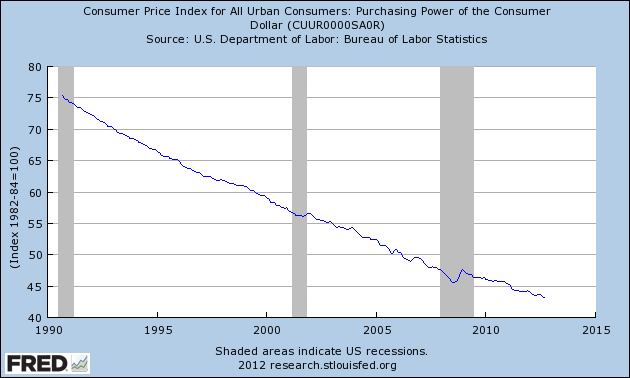

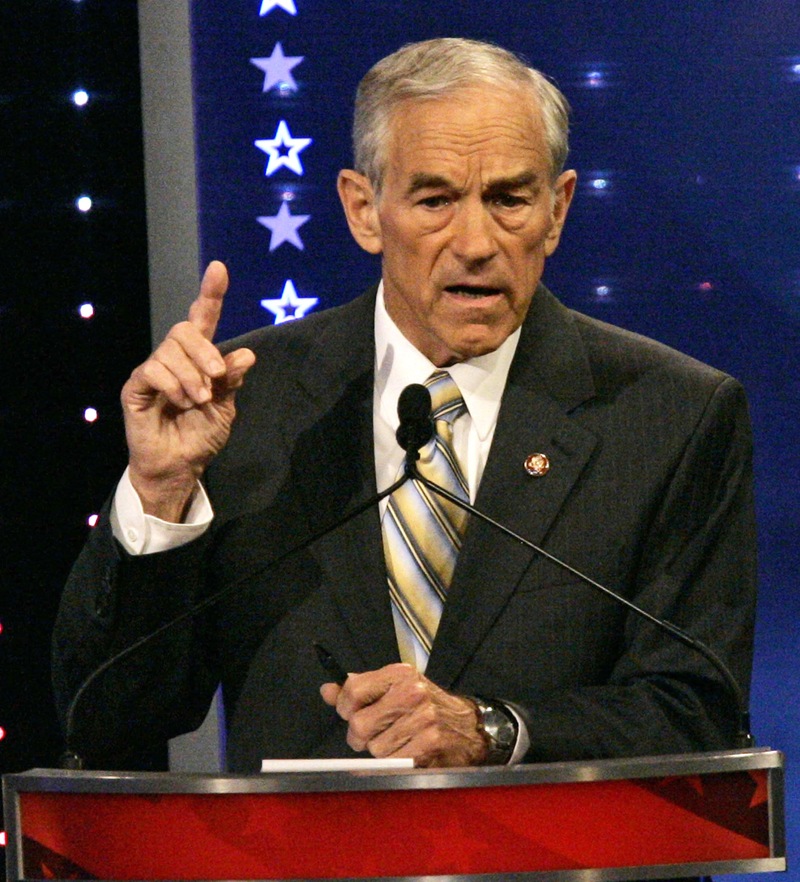

The New York Times reports on the “domestic terrorism” case of Bernard von NotHaus who awaits sentencing for minting private money known as the Liberty Dollar. At the age of 68, Von NotHaus is facing the equivalent of a terminal jail sentence since he faces 20 years in prison. While Wall Street cheers the Federal Reserve’s decision to engage in perpetual quantitative easing, Congressman Ron Paul says the Fed is devastating the U.S. economy through its blatant manipulation of interest rates. According to Ron Paul, manipulating interest rates to the zero bound level has caused a massive misallocation of capital, destroyed the purchasing power of the U.S. dollar and will eventually lead to another financial crisis.

While Wall Street cheers the Federal Reserve’s decision to engage in perpetual quantitative easing, Congressman Ron Paul says the Fed is devastating the U.S. economy through its blatant manipulation of interest rates. According to Ron Paul, manipulating interest rates to the zero bound level has caused a massive misallocation of capital, destroyed the purchasing power of the U.S. dollar and will eventually lead to another financial crisis. According to the latest report from the U.S. Mint, demand for both gold and silver bullion coins during September surged to the highest levels since January.

According to the latest report from the U.S. Mint, demand for both gold and silver bullion coins during September surged to the highest levels since January. By

By  By

By