Although there are no definitive statistics on how many Americans own gold or silver, the number is certainly small. A Gallup poll earlier this year showed that 28% of respondents thought that gold was the “best investment” but the actual number of people actually owning some form of gold or silver bullion is far less. A Kitco poll indicated that the number of Americans owning precious metals may be as low as 1%.

Although there are no definitive statistics on how many Americans own gold or silver, the number is certainly small. A Gallup poll earlier this year showed that 28% of respondents thought that gold was the “best investment” but the actual number of people actually owning some form of gold or silver bullion is far less. A Kitco poll indicated that the number of Americans owning precious metals may be as low as 1%.

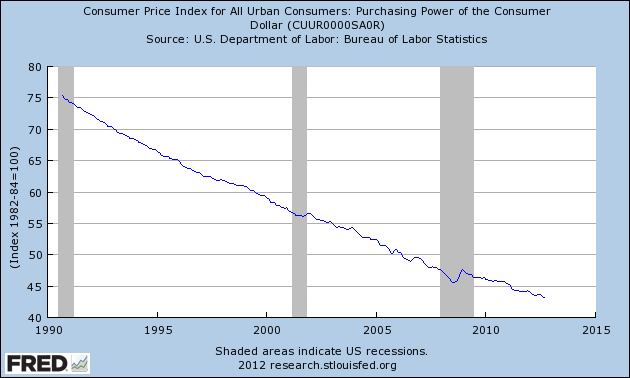

Despite the steady erosion in the purchasing power of the U.S. dollar, Americans retain their faith in paper money, apparently oblivious to the destruction of their wealth. Monetary debasement is an insidious process that few Americans fully understand as explained by economist John Maynard Keynes in 1921.

“By a continuing process of inflation, Governments can confiscate, secretly and unobserved, an important part of the wealth of their citizens. By this method they not only confiscate, but they confiscate arbitrarily; and, while the process impoverishes many, it actually enriches some …. Those to whom the system brings windfalls …. become “profiteers” who are the object of the hatred … the process of wealth-getting degenerates into a gamble and a lottery .. Lenin was certainly right. There is no subtler, no surer means of overturning the existing basis of society than to debauch the currency. The process engages all the hidden forces of economic law on the side of destruction, and does it in a manner which not one man in a million is able to diagnose.”

Most Americans don’t bother trying to understand economic theories but it is not hard to understand the following charts.

When the average American finally realizes what is happening to the value of the dollar, the rush to gold and silver will result in a massive upward surge in precious metal prices. That day has not yet arrived and until it does, buy gold and silver with impunity, especially on corrections.