Precious metals advanced across the board today, with palladium the stellar performer with a 2.86% gain. Gold gained $9.70 to $1685.30, silver tacked on $0.48 to $33.53, platinum rose $18 to $1633.00 and palladium jumped $19.00 to $689.00.

Precious metals advanced across the board today, with palladium the stellar performer with a 2.86% gain. Gold gained $9.70 to $1685.30, silver tacked on $0.48 to $33.53, platinum rose $18 to $1633.00 and palladium jumped $19.00 to $689.00.

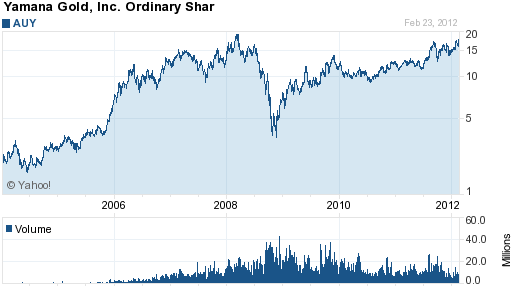

Although precious metals recently hit a selling storm (see The Flash Crash in Gold), precious metals remain up strongly on the year and gold is up $257.20 per ounce or 18% over the past year. The following chart show the gains for the year on the precious metals group. All prices per the London PM Fix closing price.

| GOLD | SILVER | PLATINUM | PALLADIUM | |

| JAN 3RD | $1,590.00 | $28.78 | $1,406.00 | $664.00 |

| MARCH 7TH | $1,677.50 | $33.17 | $1,627.00 | $678.00 |

| $ GAIN | $87.50 | $4.39 | $221.00 | $14.00 |

| % GAIN | 5.50% | 15.25% | 15.72% | 2.11% |

Here’s a brief round up of some of the latest thoughtful coverage on gold and silver related news.

Free Von Nothaus from the tyranny of unjust government actions – Judging Silver or Something Else?

As I look at the circumstances, I do not see that von Nothaus or his Liberty Dollar products victimized anyone. In contrast, those who chose to keep Federal Reserve Notes and coinage of the U.S. Mint have been victimized by loss of purchasing power. If anything, and I say this with all due respect, it seems to me that it would be more sensible and appropriate to prosecute those who have victimized American citizens through the depreciation of the “money” issued by the U.S. government.

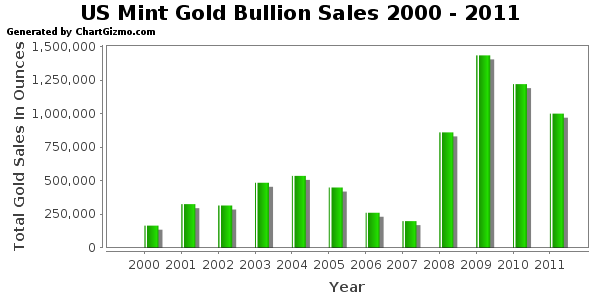

US Mint Drops Price of Gold Products

With all of the pricing data now available, the US Mint’s gold numismatic products are set for a two tier decrease. This will reduce prices by the equivalent of $100 per ounce of gold content.

Owning gold is a “privilege, not a right”. Why The US Confiscated Gold in 1933 and Can It Happen Again?

We previously stated that gold ownership was made illegal on 1st May 1933. What we did not tell you was that U.S. citizens, under Order 6102, were allowed to own up to $100 in gold coin [+5 ounces].

Congress could easily revoke the privilege again. In fact, at no time during this century has the U.S. government recognized the right of private gold ownership.

The privilege, not right, to own gold was restored to U.S. citizens on the 15th August 1974 (not 1971, when Nixon floated the USD against gold and stopped foreign central banks from converting USD to gold). It is pertinent to the thinking behind this series, to understand the importance to government of gold and that the right to confiscate may not be restricted to individuals or institutions but could embrace a nation or two.

It’s believed that some 60% of Germany’s gold is stored outside of Germany and much of it in the Federal Reserve Bank of New York. If this is the case one has to ask, in the light of the massive currency swaps engineered by the Fed and the E.C.B. to raise the two tranches of cheap money for European banks, “Was gold swapped too, or was it pledged as collateral?”

The public pressure to repatriate national gold reserves has heightened considerably in the last year. Should Germany want its gold back home, we ask, “Can it get it back or has it already been used in these ways?

Germany to Review Bundesbank Gold Reserves in Frankfurt, Paris, London and Federal Reserve Bank of New York

German lawmakers are to review Bundesbank controls of and management of Germany’s gold reserves. Parliament’s Budget Committee will assess how the central bank manages its inventory of Germany’s gold bullion bars that are believed to be stored in Frankfurt, Paris, London and the Federal Reserve Bank of New York, according to German newspaper Bild.

There is increasing nervousness amongst the German public, German politicians and indeed the Bundesbank itself regarding the gigantic risk on the balance sheet of Germany’s central bank and this is leading some in Germany to voice concerns about the location and exact amount of Germany’s gold reserves.

The eurozone’s central bank system is massively imbalanced after the ECB’s balance sheet surged to a record 3.02 trillion euros ($3.96 trillion) last week, 31% bigger than the German economy, after a second tranche of three-year loans.

The concern is that were the eurozone to collapse, Bundesbank’s losses could be half a trillion euros – more than one-and-a-half times the size of the Germany’s annual budget.

In that scenario, Germany’s national patrimony of gold bullion reserves would be needed to support the currency – whether that be a new euro or a return to the Deutsche mark.

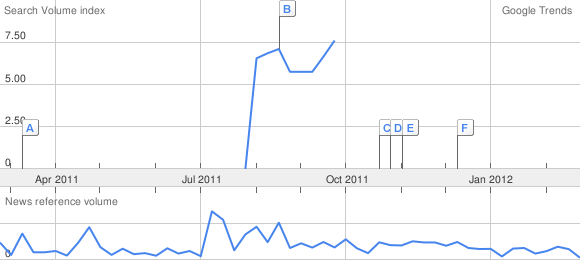

Instead, this selloff was sparked not by a development, but a non-development. In his address to Congress, Fed Chairman Ben Bernanke offered no clue as to when the Federal Reserve would unleash its next round of quantitative easing.

The markets took this as a sign that the monetary madness is coming to an end, which would bode poorly for precious metals. Metals are increasingly seen as substitutes for continuously debased fiat money, and tend to do well when new liquidity injections are announced.

Bernanke’s failure to telegraph more printing means nothing. Investors are craving a return to normalcy, which means more prudent monetary policy. As a result, many are grasping at straws. But I believe these hopes are premature, and that gold will be buoyed by easy money for quite some time.

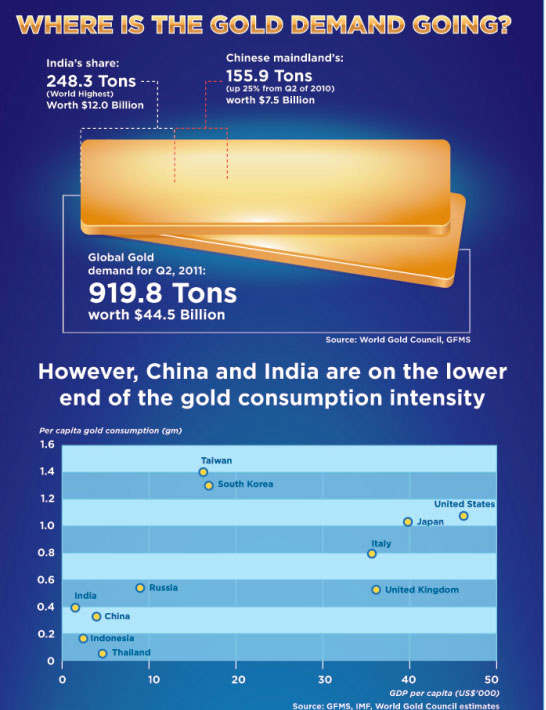

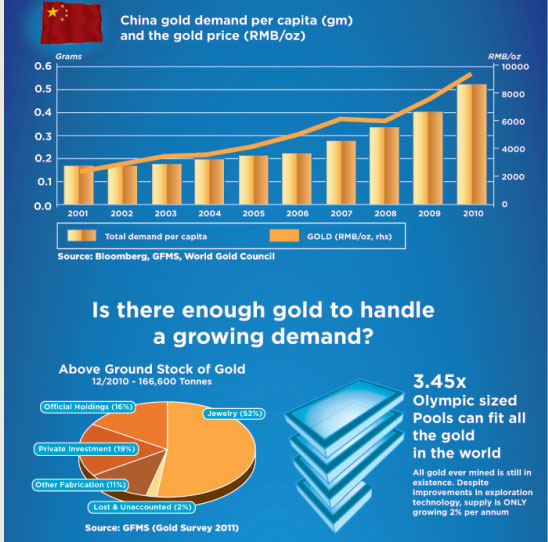

In addition, gold will likely be favored by the greatest financial struggle of the coming decade: China’s plans to replace the United States as the dominant economic power.

Buy Japanese Bonds At 0.05% And Get A Gold Coin

Japan began selling special government bonds Monday aimed at raising funds for reconstruction from the March 2011 earthquake and tsunami, saying it will present buyers with commemorative gold coins imprinted with an image of the “miracle pine” that survived the killer tsunami when the bonds mature in three years.

The coins — worth ¥10,000 each, and silver coins worth ¥1,000 — are engraved with the design of the 30-meter-high pine in Rikuzentakata, Iwate Prefecture, that was the only one of about 70,000 pines on a stretch of coast to survive the massive tsunami.

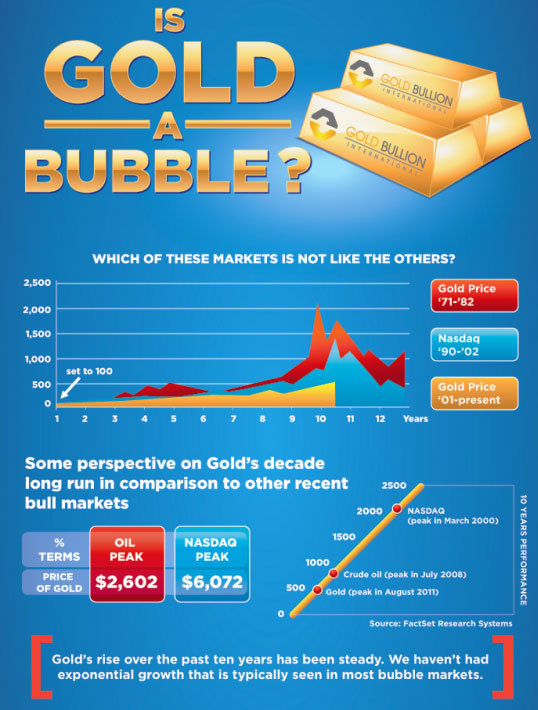

Peter Schiff on why Buffett is wrong about gold – Buffett’s Bursting Bubble

The gold doomsayers have found their champion in the media’s favorite financial advisor and one of the world’s richest men. Warren Buffett, the man dubbed the “Oracle of Omaha,” has repeatedly and publicly denied that gold is an investment, and called gold buyers “speculators” and people “who fear almost all other assets.” In fact, Buffett claims that gold’s rise has the same characteristics as the housing and dot-com bubbles, and it is only a matter of time before it reverses course. He doesn’t mean that the price will decline because of austerity measures and a free-market interest rate, mind you. He just asserts that because he’s deemed it a bubble, it will inevitably burst.

Gold prices will only go down when governments change course and make significant cuts. Until then, gold is not in a bubble. It’s the only way to protect your wealth; and in the current economic condition, it’s poised to go much higher. I think it’s high time Buffett takes to heart his father’s wise words: “For if human liberty is to survive in America, we must win the battle to restore honest money.”

The Volatile Ride To Higher Gold

Back in 1980, Phase Three only lasted for 21 days, but increased 66% in that time span. Considering the ten year time span of Phase One, and my projection for Phase Two, I feel that Phase Three (which starts in 2015) will last for six months and drive gold up to over $6,000 per ounce. If the world’s financial leaders decide to return to a Gold Standard, or if gold bullion confiscation becomes the government’s reaction to severe inflation, my projections would escalate. Possible other government reactions that can affect my projections negatively are: limiting gold ownership, restrictions on transporting or trading, and any Gold windfall profits tax.