Every now and then I find myself playing around with Google Trends. For anyone who hasn’t tried it before, it’s a Google product in the early stages of development that allows you to see historic search volume trends for given search terms. When I recently ran some gold related searches, I came up with some interesting results.

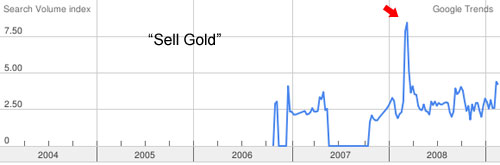

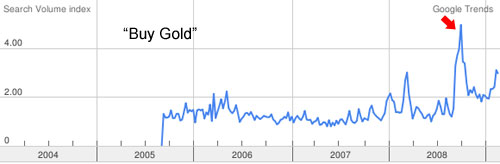

Here are the results for the search volumes for “Sell Gold” and “Buy Gold” followed by a chart of gold scaled to align. I added the red arrows to emphasize the extremes.

The large spike in search volume for “Sell Gold” appeared just as gold was hitting its peak. Similarly, there was a spike of search volume for the term “Buy Gold” just as gold reached an intermediate low. The broad, aggregated intent of internet searchers as determined by Google Trends called the exact high and low for gold. Maybe Google Labs has created a perfect communicator for the “wisdom of internet searches.”

What does the internet crowd say about gold’s run to $1,000 and subsequent fall back to the $900 level? The response seems mixed. There were small increases in both the “Buy and “Sell” searches that don’t seem to suggest strong conviction in either direction. I have a feeling that the Google Trends indicator might work well for extremes or broad trends, but not so well for other situations.

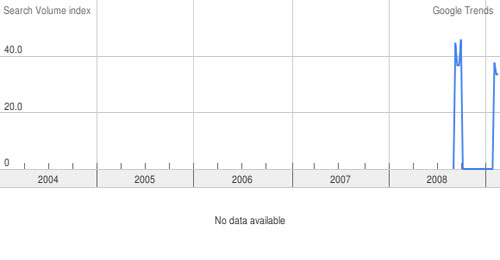

To finish, here’s one final Google Trends search that is worth noting. Below are the results for “Gold Investment.” If a search term does not have sufficient search volume, data is not displayed. “Gold Investment” finally received enough searches to show up around September 2008 and once again in February 2008. Is investing in gold starting to go mainstream?

Fascinating stuff. Maybe we should create some software that alerts us of spikes in internet searches. Because the results for “buy gold” and “sell gold” were dead on.

… this is a worthy endeavour … many westerners are talking about gold for the first time … it is even getting some play in review pieces on the economy in television coverage …

tc