The stunning and unprecedented April gold crash has staggered investors with huge losses. Over the course of the first two weeks of April gold has declined by $203.50 or almost 13%. Since the beginning of the year, gold has crashed $313.75 or 18.5%.

The stunning and unprecedented April gold crash has staggered investors with huge losses. Over the course of the first two weeks of April gold has declined by $203.50 or almost 13%. Since the beginning of the year, gold has crashed $313.75 or 18.5%.

So who was the biggest loser in the gold market? That distinction belongs to the U.S. Treasury which allegedly holds 261.5 million troy ounces of gold. The April decline wiped out $53.2 billion and the value of U.S. gold holdings have declined by $134.7 billion from the early September 2011 peak closing price of $1,895.

Central bank holdings of gold have declined by over half a trillion dollars since the 2011 high.

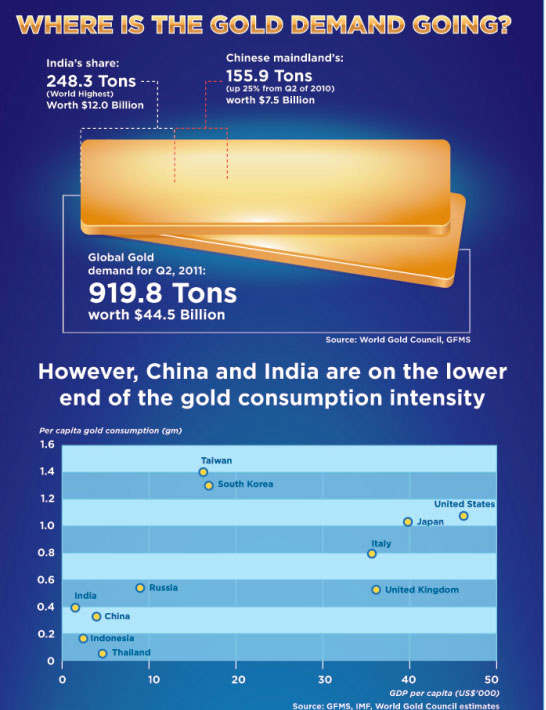

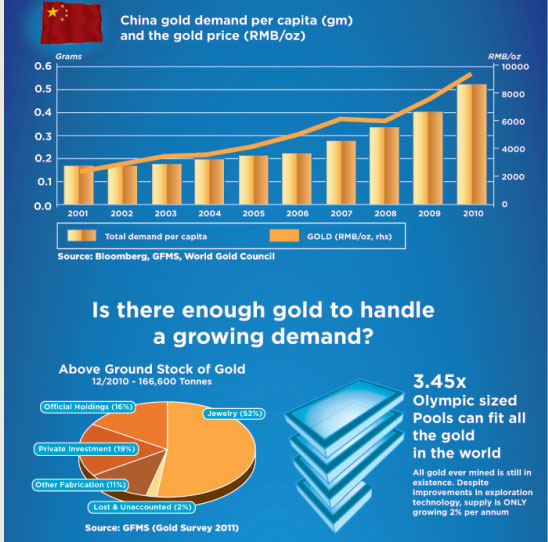

Central banks are among the biggest losers because they own 31,694.8 metric tons, or 19 percent of all the gold mined, according to the World Gold Council in London. After rallying for 12 straight years, the metal has tumbled 28 percent from its September 2011 record of $1,923.70 an ounce.

Investors are dumping gold funds at the fastest pace in two years in favor of equities, compounding a slump that has wiped $560 billion from the value of central bank reserves.

The losses to private gold investors, who own about 80% of above ground gold, exceeds the gross domestic product of most countries. Privately owned gold totals about 4.4 billion ounces and the price decline since late 2011 translates into a loss of wealth of $2.27 trillion.

courtesy: kitco.com

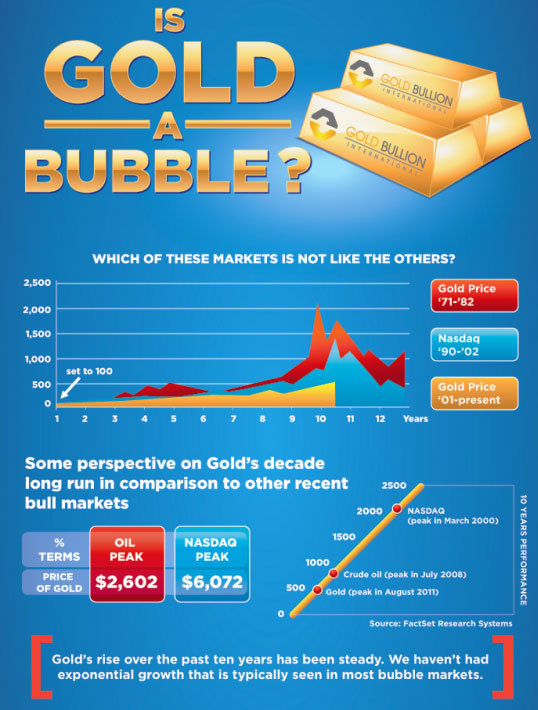

So where does gold go from here? Sophisticated investors know better than to sell after a market crash. Even after the recent flash crash, gold has appreciated 410% since 2001 compared to only an 18% increase in the S&P 500. It would not be surprising to see a repeat of this performance over the next decade.