The Perth Mint presents a neat infographic on the world’s top 10 gold producing countries.

The Perth Mint presents a neat infographic on the world’s top 10 gold producing countries.

China, which loves gold more than anything, came in as the number one producer with annual output of 370 metric tons. According to the latest official numbers from the IMF, China holds the world’s fifth largest reserves of gold with holdings of 33.9 million ounces. Unofficially, many analysts say that actual gold reserves held by China are far larger than the “officially” reported numbers.

The second largest gold producer in the world is Australia (home of the Perth Mint) which produced 250 metric tons of gold in 2012.

The United States came in at third place with annual production of 230 metric tons. As a dubious consolation for those who hate to see the U.S. come in third, keep in mind that the United States still reigns supreme in the number one spot for production of paper currency.

The Perth Mint, which has been producing gold coins since 1899 has produced (in my opinion) some of the world’s most artistic gold and silver coins.

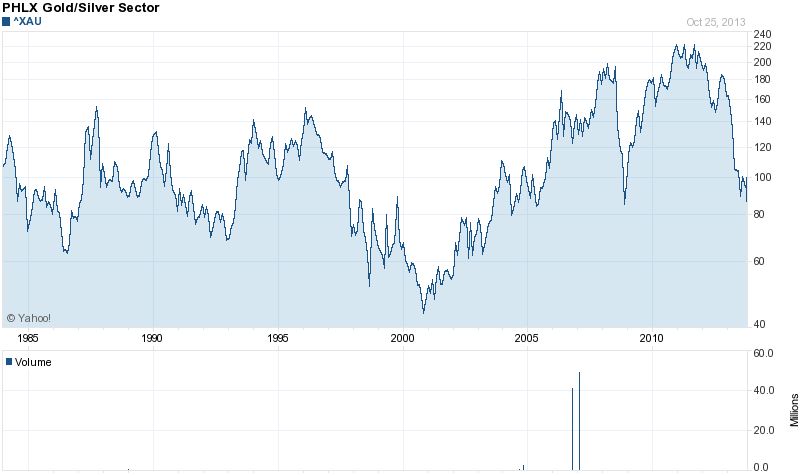

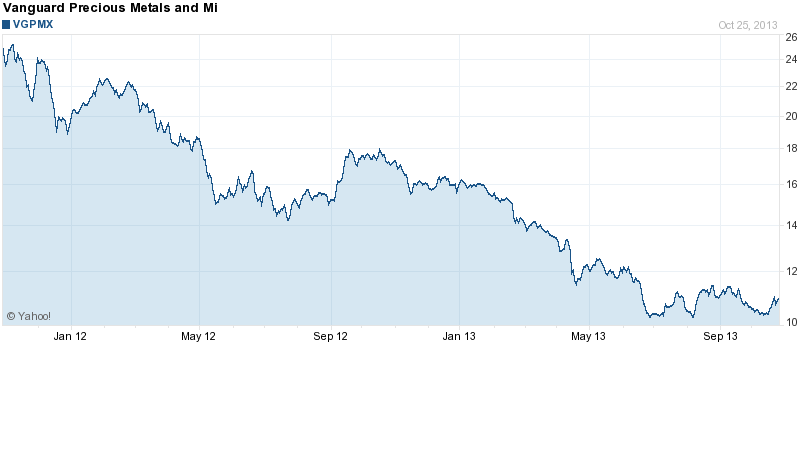

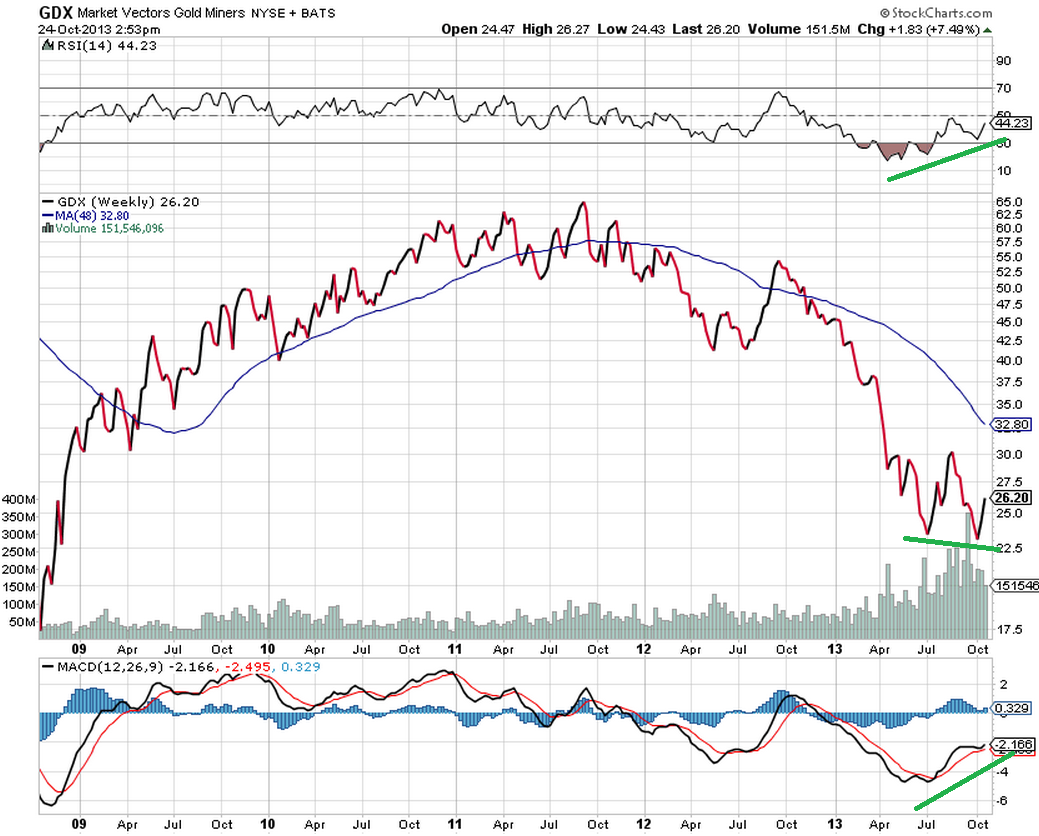

The bear case for gold and silver stocks is well known and investors have reacted by dumping mining stocks indiscriminately. The staggering decline in gold and silver stocks over the past two years now exceeds the decline that occurred during the crash of 2008 when the financial system was at the brink of collapse.

The bear case for gold and silver stocks is well known and investors have reacted by dumping mining stocks indiscriminately. The staggering decline in gold and silver stocks over the past two years now exceeds the decline that occurred during the crash of 2008 when the financial system was at the brink of collapse.

By: GE Christenson

By: GE Christenson

Demand for American Eagle gold and silver bullion coins remained sluggish in September according to the latest figures from the U.S. Mint.

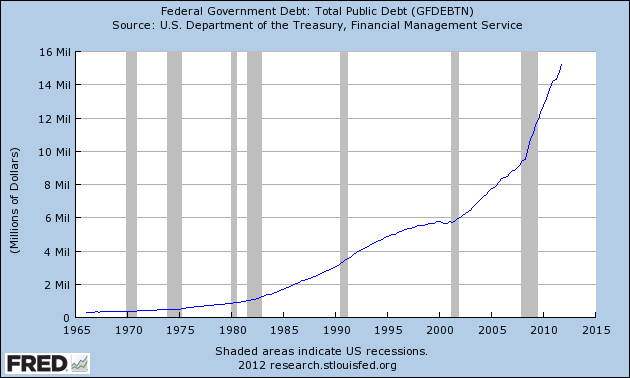

Demand for American Eagle gold and silver bullion coins remained sluggish in September according to the latest figures from the U.S. Mint. Bridgewater’s Ray Dalio, one of the world’s most successful hedge fund investors, has put out a neat video explaining how the economic system works and how the suffocating burden of unmanageable debts can be reduced without propelling the world into uncontrollable inflation or a deflationary depression.

Bridgewater’s Ray Dalio, one of the world’s most successful hedge fund investors, has put out a neat video explaining how the economic system works and how the suffocating burden of unmanageable debts can be reduced without propelling the world into uncontrollable inflation or a deflationary depression. By: GE Christenson

By: GE Christenson

The months long guessing game on whether or not the Fed would start tapering its $85 billion per month of treasuries and mortgage securities came to a conclusion today as the Fed promised to keep the printing presses going full blast.

The months long guessing game on whether or not the Fed would start tapering its $85 billion per month of treasuries and mortgage securities came to a conclusion today as the Fed promised to keep the printing presses going full blast.

By:

By:  By: GE Christenson

By: GE Christenson