When gold was hitting new highs during 2011 the mainstream media was full of articles with “experts” predicting further price gains but the exact opposite happened.

When gold was hitting new highs during 2011 the mainstream media was full of articles with “experts” predicting further price gains but the exact opposite happened.

As speculators, short term traders, and price manipulators took the price of gold down by over $600 an ounce the experts switched their tune and the chorus of gold bears grew steadily. By the end of 2013 when declining prices had shaken out all the weak hands in the gold market and all the experts were bearish, prices had nowhere to go but up.

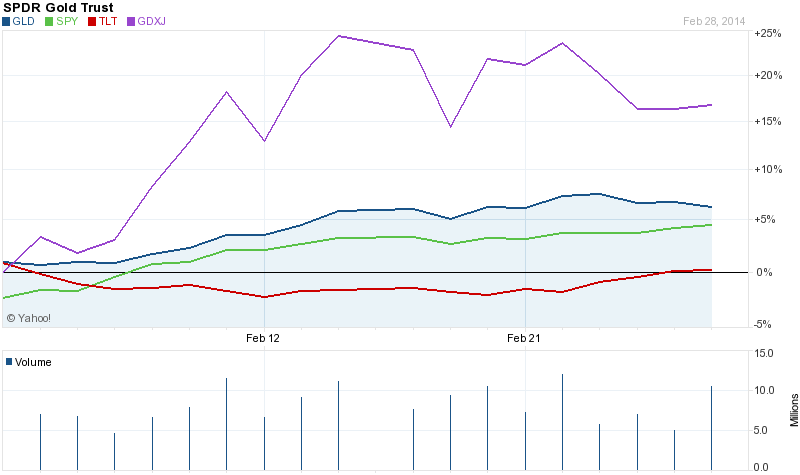

With the start of the new year gold ignored the bears and has been on a tear in 2014. Two months into the new year with gold bullion and gold stocks far outpacing the gains in stocks and bonds, the “experts” still insist that it’s time to bail out of gold before prices collapse.

The Top Two Gold Forecasters selected by Bloomberg remain steadfast in their views that gold is undergoing a dead cat bounce that will soon run out of steam.

“I just see this as a corrective move,” said Robin Bhar, the head of metals research at Societe Generale SA in London and the most-accurate forecaster tracked by Bloomberg in the past two years. “We would still want to be bearish gold,” said Bhar, who expects a fourth-quarter average of $1,050.

“Haven demand plays well when gold is cheap, but it’s no longer cheap,” said Justin Smirk, a senior economist in Sydney at Westpac Banking Corp. and the second most-accurate forecaster tracked by Bloomberg in the past two years. “I’m a little surprised by the volatility in the market, but it really doesn’t change my overall view,” said Smirk, who expects a slide through the year to a fourth-quarter average of $1,020.

Barron’s took note this week of The Gold Rally’s Fatal Flaws forecasting that a tighter Fed policy, low inflation along with an easing of investment demand from China and India will send gold prices lower.

Another concern is that gold prices are already up so much that investors in China and India are suffering sticker shock. The two nations together account for roughly half of the world’s gold demand, buying gold gifts to celebrate weddings, birthdays, and religious festivals. These regular purchases help create a floor for the market and were instrumental in stemming the violent sell-offs that gold suffered last year.

BUT WHILE SOME Indian and Chinese buyers felt they were getting gold on sale in December, when prices dipped below $1,200 an ounce, this is no longer the case. “For gold, physical demand keeps slipping as the price moves up,” says Walter de Wet, head of commodity strategy at Standard Bank.

Even more bearish was commentary by respected analyst Mark Hulbert who notes that the sentiment among short term gold market timers has soared to the bullish side in the past month, typically a contrary bearish omen.

Even more wildly bearish is Claude Erb, a professor at Duke University interviewed by Hulbert who is forecasting a major crash in the price of gold.

Erb, along with Duke University finance professor Campbell Harvey, was the co-author of a January 2013 study published by the National Bureau of Economic Research — which I featured in a February 2013 column for Barron’s on the price of gold. The study suggested that gold remained significantly overvalued, even though its bear market at that point was already 16 months old. By the end of the year gold had shed nearly $500 an ounce.

Unfortunately for the gold bulls, Erb’s and Harvey’s study suggests gold is still overvalued. One valuation indicator they point to is equivalent to a stock’s price/earnings ratio: It is the ratio of gold’s price to the Consumer Price Index. According to their calculations, and given the historical average level for this gold/CPI ratio and where the CPI index currently stands, gold’s “fair value” today is around $820 an ounce — about $500 lower than where it now trades.

The reasons articulated above for being bearish on gold and silver have already been well advertised and discounted by the markets which is probably why gold and silver have been soaring this year. It wouldn’t be surprising if the “experts” are wrong and gold and silver turn out to be the best place to keep your money this year.

April was a brutal month for precious metal investors. Gold ended the month down almost 8% and silver prices tumbled almost 13%. The sell off continued in May with gold down another $60 per ounce to $1,412 and silver down $1.55 to $22.87 per ounce at mid month.

April was a brutal month for precious metal investors. Gold ended the month down almost 8% and silver prices tumbled almost 13%. The sell off continued in May with gold down another $60 per ounce to $1,412 and silver down $1.55 to $22.87 per ounce at mid month.