By Axel Merk

Superior Performance of Gold

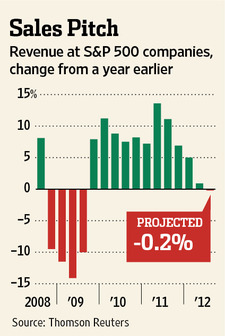

Over recent years, gold has performed remarkably well relative to other asset classes, in terms of both absolute performance and risk-adjusted performance. Over the preceding 10 years, an investment in gold would have significantly outperformed a corresponding investment in the S&P 500 Index or U.S. bonds, not to mention international and emerging market equities. Over the past 10 years, gold outperformed U.S. equities by over three times:

Gold Shines even when Under-performing

Note that even during time periods when gold underperforms other asset classes, as it did during the 20-year time period analyzed above, the addition of a gold component improves the overall risk-adjusted return profile of a risky portfolio. We consider this to be largely driven by the low levels of correlation between the two assets and thus the positive impact it has on the volatility profile of the hypothetical portfolio above. For example, we find that a portfolio comprised 50% gold and 50% the S&P 500 would have exhibited an annualized standard deviation of returns of 12.7% over the 20-year period ended September 30, 2012. This is a significant reduction to the annualized standard deviation of returns exhibited by a portfolio comprised 100% the S&P 500, which was 19.2% over the same time frame.

Read the full article here.

Gold has had a volatile year. From January’s opening price of $1,598, gold quickly moved up by $183 per ounce by the end of February. An ensuing correction that lasted into July brought the price of gold down by $225 per ounce to $1,556 in mid July, the low of the year. In August gold started to rally, closing yesterday at $1716.25 per ounce, up $118.25 or 7.4% on the year.

Gold has had a volatile year. From January’s opening price of $1,598, gold quickly moved up by $183 per ounce by the end of February. An ensuing correction that lasted into July brought the price of gold down by $225 per ounce to $1,556 in mid July, the low of the year. In August gold started to rally, closing yesterday at $1716.25 per ounce, up $118.25 or 7.4% on the year.

Although there are no definitive statistics on how many Americans own gold or silver, the number is certainly small. A Gallup poll earlier this year showed that 28% of respondents thought that gold was the “best investment” but the actual number of people actually owning some form of gold or silver bullion is far less. A Kitco poll indicated that the number of Americans owning precious metals may be as low as 1%.

Although there are no definitive statistics on how many Americans own gold or silver, the number is certainly small. A Gallup poll earlier this year showed that 28% of respondents thought that gold was the “best investment” but the actual number of people actually owning some form of gold or silver bullion is far less. A Kitco poll indicated that the number of Americans owning precious metals may be as low as 1%.

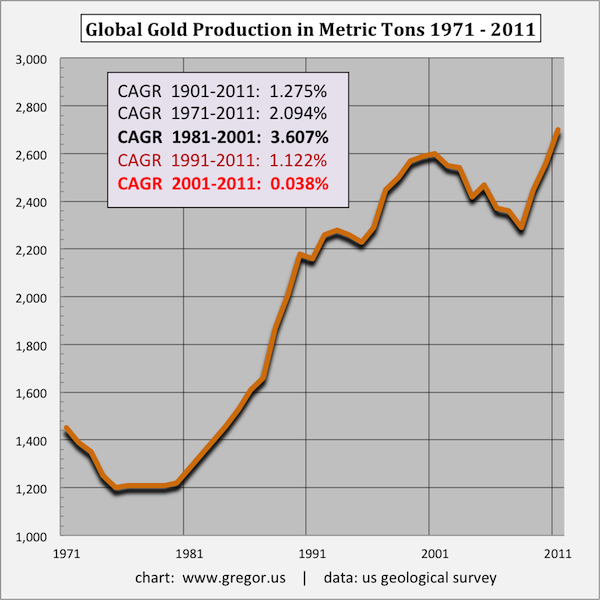

Global gold production could drop sharply as South African miners plan to dismiss thousands of workers for illegally striking. South African precious metal miners have been beset by labor unrest for months as workers protest low wages and dangerous working conditions. The latest disruption came Wednesday as South Africa’s largest gold miner announced plans to

Global gold production could drop sharply as South African miners plan to dismiss thousands of workers for illegally striking. South African precious metal miners have been beset by labor unrest for months as workers protest low wages and dangerous working conditions. The latest disruption came Wednesday as South Africa’s largest gold miner announced plans to

By Axel Merk & Yuan Fang

By Axel Merk & Yuan Fang

According to

According to

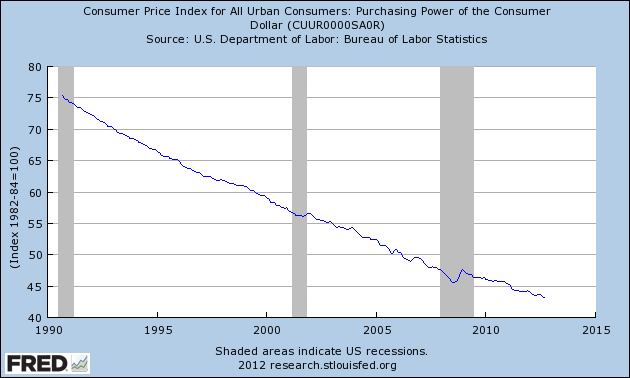

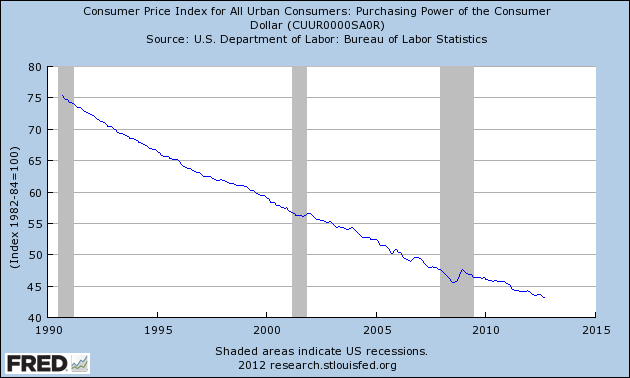

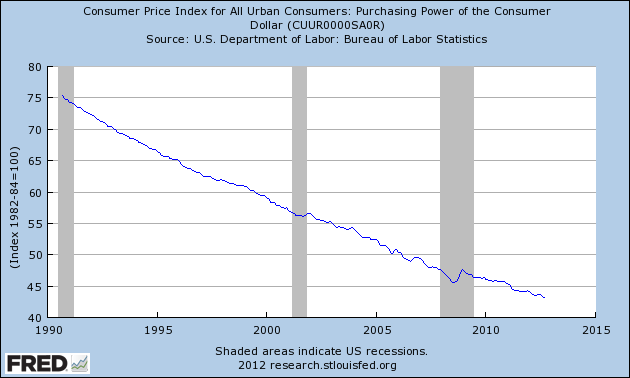

In an effort to expand credit and spur job creation, the Federal Reserve has massively expanded its balance sheet with the most aggressive monetary policies in the history of the Federal Reserve. Since the start of the financial crisis, the Fed instituted two rounds of quantitative easing under which over $2.75 trillion of debt securities were purchased by, in effect, printing money.

In an effort to expand credit and spur job creation, the Federal Reserve has massively expanded its balance sheet with the most aggressive monetary policies in the history of the Federal Reserve. Since the start of the financial crisis, the Fed instituted two rounds of quantitative easing under which over $2.75 trillion of debt securities were purchased by, in effect, printing money.

The third quarter 2012 Investment Statistics Commentary released today by the World Gold Council summarizes the performance of gold in various currencies and explores reasons why demand for gold should continue to increase.

The third quarter 2012 Investment Statistics Commentary released today by the World Gold Council summarizes the performance of gold in various currencies and explores reasons why demand for gold should continue to increase.