Gold has had a volatile year. From January’s opening price of $1,598, gold quickly moved up by $183 per ounce by the end of February. An ensuing correction that lasted into July brought the price of gold down by $225 per ounce to $1,556 in mid July, the low of the year. In August gold started to rally, closing yesterday at $1716.25 per ounce, up $118.25 or 7.4% on the year.

Gold has had a volatile year. From January’s opening price of $1,598, gold quickly moved up by $183 per ounce by the end of February. An ensuing correction that lasted into July brought the price of gold down by $225 per ounce to $1,556 in mid July, the low of the year. In August gold started to rally, closing yesterday at $1716.25 per ounce, up $118.25 or 7.4% on the year.

Gold now appears ready to mount an explosive rally that could easily push prices past $2,000 based on sentiment, seasonal factors and rampant money printing by the Federal Reserve.

According to Bloomberg, gold traders are the “most bullish in 10 weeks…the highest level since August 24. Gold rallied strongly from August 24th, adding $124 per ounce by October 4th.

Gold traders are the most bullish in 10 weeks and investors are hoarding a record amount of bullion as central banks pledge to do more to spur economic growth.

Eighteen of 27 analysts surveyed by Bloomberg expect prices to rise next week and five were bearish. A further four were neutral, making the proportion of bulls the highest since Aug. 24. Holdings in gold-backed exchange-traded products gained the past three months, the best run since August 2011, data compiled by Bloomberg show. They reached a record 2,588.4 metric tons yesterday, the data show.

The Bank of Japan (8301) expanded its asset-purchase program on Oct. 30 for the second time in two months, increasing it by 11 trillion yen ($137 billion). The Federal Reserve said last week it plans to continue buying bonds and central banks from Europe to China have pledged more action to boost economies. Gold rose 70 percent as the Fed bought $2.3 trillion of debt in two rounds of quantitative easing from December 2008 through June 2011.

“Central banks are all very concerned about a depression, so they’re keeping monetary policies as loose as possible,” said Mark O’Byrne, the executive director of Dublin-based GoldCore Ltd., a brokerage that sells and stores everything from quarter-ounce British Sovereigns to 400-ounce bars. “People are buying gold as a store of value to protect against currency depreciation.”

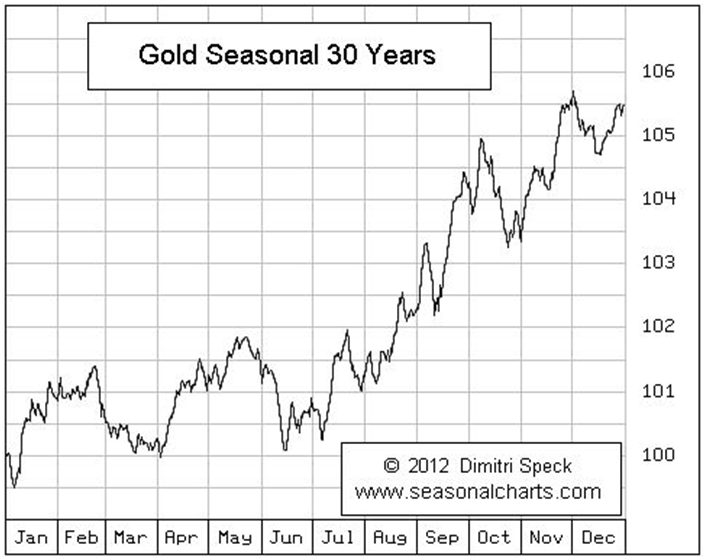

Seasonal Factors

Gold has a pronounced seasonal tendency to rally strongly in the last quarter of the year. The chart below from GoldCore shows the seasonal strength of gold over the past 30 years.

Courtesy goldcore.com

Rampant Money Printing By The Federal Reserve

Central Banks worldwide have gone on a money printing rampage to save governments that are unable to control spending or raise sufficient tax revenues. David Einhorn, President of Greenlight Capital, who has a brilliant investment track record, is rampantly bullish on gold and raises the question of what type of truly desperate measures central banks will take if the world economy enters another recession or suffers an exogenous shock.

“It seems as if nothing will stop the money printing, and Chairman Bernanke in fact assures us that it will continue even after the economic recovery strengthens. Even after the economy starts to recover more quickly, even after the unemployment rate begins to move down more decisively, we’re not going to rush to begin to tighten policy. Apparently, anything less than a $40 billion per month subscription order for MBS is now considered ‘tightening’. He’s letting us know that what once looked like a purchasing spree of unimaginable proportions is now just the monthly budget.”

“If Chairman Bernanke is setting distant and hard-to-achieve benchmarks for when he would reverse course, it is possibly because he understands that it may never come to that. Sooner or later, we will enter another recession. It could come from normal cyclicality, or it could come from an exogenous shock. Either way, when it comes, it is very likely we will enter it prior to the Fed having ‘normalized’ monetary policy, and we’ll have a large fiscal deficit to boot. What tools will the Fed and the Congress have at that point? If the Fed is willing to deploy this new set of desperate measures in these frustrating, but non-desperate times, what will it do then? We don’t know, but a large allocation to gold still seems like a very good idea.”