John Paulson, hedge fund titan, seemed invincible in the opening days of 2011. Based on a huge bearish position in mortgage bonds, Paulson’s hedge funds earned an astonishing $15 billion during 2007.

John Paulson, hedge fund titan, seemed invincible in the opening days of 2011. Based on a huge bearish position in mortgage bonds, Paulson’s hedge funds earned an astonishing $15 billion during 2007.

Paulson’s winning streak continued for three years and by the end of 2010, Paulson’s success had attracted huge amounts of new investor money. By the end of 2010, the amount of money under management in Paulson’s funds had swelled to over $32 billion. During 2010 Paulson personally made $5 billion and had become an investment legend.

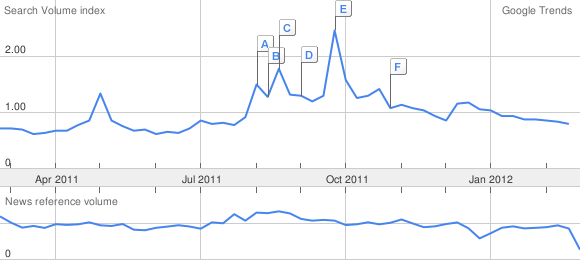

No one, least of all John Paulson, could have imagined the disaster that was ready to unfold during 2011. Paulson’s two largest funds got crushed during 2011 with the Paulson Advantage fund down 36% and the Paulson Advantage Plus fund down a staggering 52%. Bad bets involving financial stocks and a large investment in Sino-Forest, a Chinese timber company, proved disastrous during 2011.

Although Paulson is well known for his long term bullish bets on gold this did not save him during 2011. Despite a 10% increase in the price of gold during 2011, Paulson’s positions in gold stocks contributed to his losses as gold shares dramatically underperformed gold bullion.

In a wide ranging interview with Bloomberg Businessweek, Paulson explained why 2011 turned out to be the year of pain for both himself and fund investors.

The firm had made four major mistakes, according to Paulson, “overweighting long event equity,” underestimating Europe’s debt crisis, overestimating the U.S. economy, and some plain-old terrible stock picking. “Our performance in 2011 was clearly unacceptable,” he wrote. “However, we believe 2011 will be an aberration in our long-term performance.”

Despite the huge losses of 2011, Bloomberg notes that Paulson still registered gains of $22.6 billion for investors over the lifetime of his funds, the third best in the hedge fund industry.

Paulson told Bloomberg that he considers 2011 an “aberration” and expects his long term strategies, including his large bet on the gold market to rack up large gains going forward. During an interview in October 2010 at the University Club in New York, Paulson predicted that the price of gold would hit $4,000 per ounce.

Paulson explained his view on gold during the Bloomberg Businessweek interview as follows:

“We view gold as a currency, not a commodity,” Paulson says. “Its importance as a currency will continue to increase as the major central banks around the world continue to print money.” He adds that as the market keeps shuddering, demand for gold will stay high, and soon enough all of his depressed gold holdings should shoot up. He also thinks that anyone in Greece, Italy, and France should pull all their money out of the banking system and purchase gold bars before the Continent collapses.

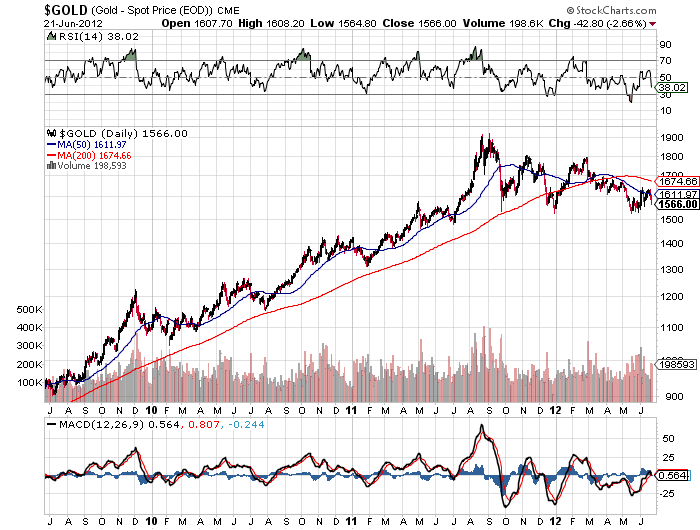

Although Paulson remains committed to gold long term, he did substantially reduce his holdings in the SPDR Gold Shares ETF (GLD) during 2011. At March 31, 2011, Paulson’s funds held 31.5 million shares of GLD valued at $4.4 billion but by the end of 2011, the position had declined to 17.3 million shares valued at $2.85 billion. In Paulson’s latest Form 13-F filing with the SEC at March 31, 2012, Paulson’s position in the GLD remained unchanged from 2011 year end holdings.

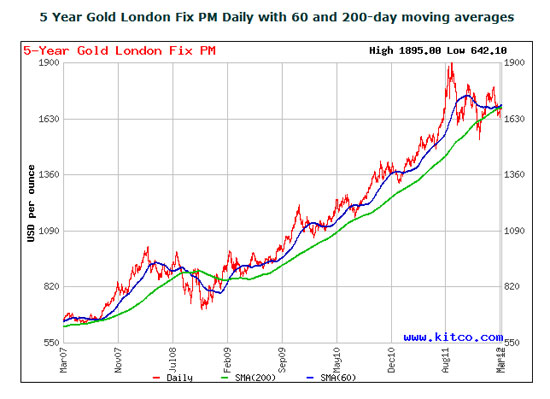

In hindsight, Paulson should have gone “all in” on gold during 2011 as he did with his bearish mortgage bets in 2007. Gold closed at $1388.50 on the first day of trading in 2011 and closed the year at $1,531. Had Paulson been 100% in gold bullion or the GLD during 2011 his portfolios would have increased in value by about 10.3%.

2011 Gold - courtesy kitco.com

Although Federal Reserve Chairman Ben Bernanke refuses to acknowledge that gold is money, another major regulatory agency views the value of gold money as a risk free asset for calculation of Tier 1 regulatory capital by banks. Meanwhile, as Ben Bernanke dismisses the value of gold, other central banks around the world continue to increase gold reserves. As the world financial system spirals closer to a complete breakdown, it is the holders of paper currencies that are squarely placed at the highest point of the risk spectrum.

Although Federal Reserve Chairman Ben Bernanke refuses to acknowledge that gold is money, another major regulatory agency views the value of gold money as a risk free asset for calculation of Tier 1 regulatory capital by banks. Meanwhile, as Ben Bernanke dismisses the value of gold, other central banks around the world continue to increase gold reserves. As the world financial system spirals closer to a complete breakdown, it is the holders of paper currencies that are squarely placed at the highest point of the risk spectrum.

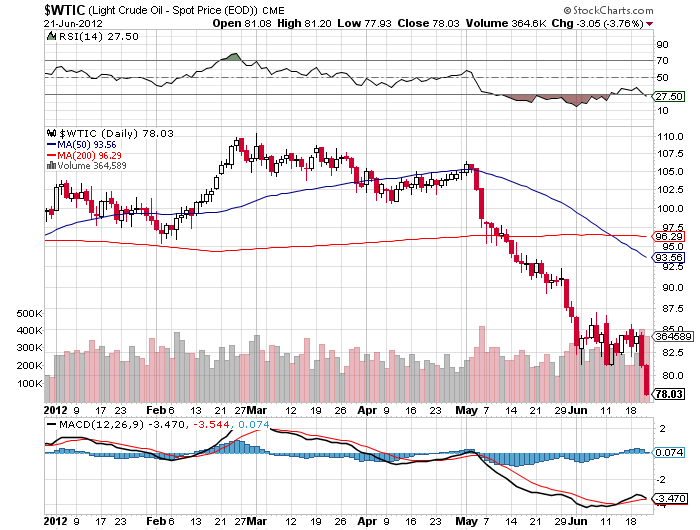

The combination of increasingly ominous economic reports along with the Fed’s failure to announce bold new monetary initiatives resulted in a brutal reassessment of risk by investors. Stock, commodity and precious metal markets all plunged with the Dow down 250 points, gold down by $41.60 per ounce to $1,566 and silver off by 4.4% to $26.98. Crude oil in New York trading was off 4%, dropping below $80 a barrel for the first time in eight months.

The combination of increasingly ominous economic reports along with the Fed’s failure to announce bold new monetary initiatives resulted in a brutal reassessment of risk by investors. Stock, commodity and precious metal markets all plunged with the Dow down 250 points, gold down by $41.60 per ounce to $1,566 and silver off by 4.4% to $26.98. Crude oil in New York trading was off 4%, dropping below $80 a barrel for the first time in eight months.

It is no secret that the price of gold has been declining since reaching almost $2,000 per ounce last year. After rallying in the early part of the year, gold prices have now fallen to $1,556, representing a decline of $42 per ounce or 2.6% below the closing price on the first trading day of 2012.

It is no secret that the price of gold has been declining since reaching almost $2,000 per ounce last year. After rallying in the early part of the year, gold prices have now fallen to $1,556, representing a decline of $42 per ounce or 2.6% below the closing price on the first trading day of 2012.