Gold and silver continue their strong 2012 advance with relatively sparse mainstream press headlines. Gold is now only $114 per ounce below the all time high of $1,895 reached on September 6, 2011 and silver looks more and more like it is getting ready to challenge the $50 range last seen in mid 2011.

Gold and silver continue their strong 2012 advance with relatively sparse mainstream press headlines. Gold is now only $114 per ounce below the all time high of $1,895 reached on September 6, 2011 and silver looks more and more like it is getting ready to challenge the $50 range last seen in mid 2011.

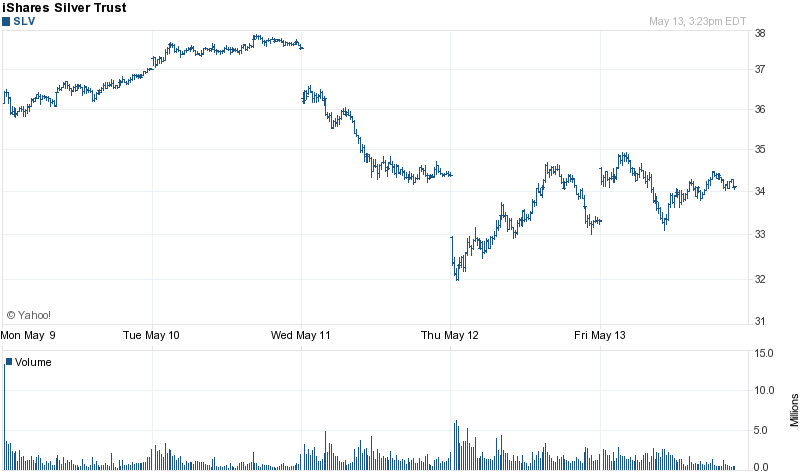

Based on the closing London Fix Price, gold has advanced from $1,598.00 at the beginning of the year to today’s closing price of $1,781.00, for a gain of 11.5% or $183 per ounce. Silver’s advance has been even more dramatic. Since the start of the year, silver has risen 23.7% to $35.60 per ounce, a gain of $6.82 per ounce.

Here are some recent links to excellent gold and silver related stories and blog posts:

One-Half Ounce Proof Gold Eagle Sold Out, Some Silver Products Suspended

The one-half ounce 2011 Proof Gold Eagles have sold out at the U.S. Mint. The one ounce Proof Gold Eagle had previously sold out last October. In addition, some silver numismatic product sales have been suspended pending pricing updates due to the rapid rise in silver prices.

The Financial System Is Sick – Are Precious Metals The Cure?

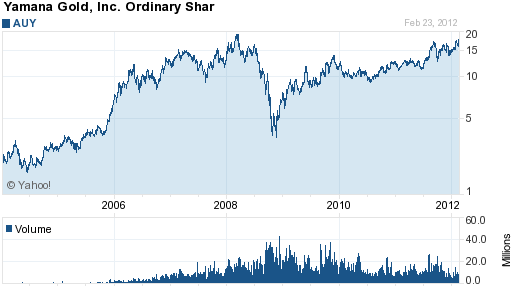

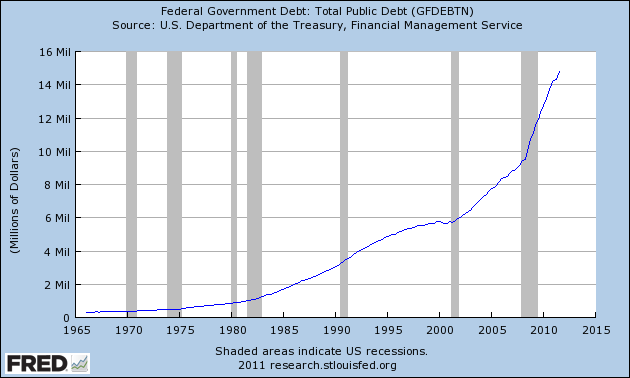

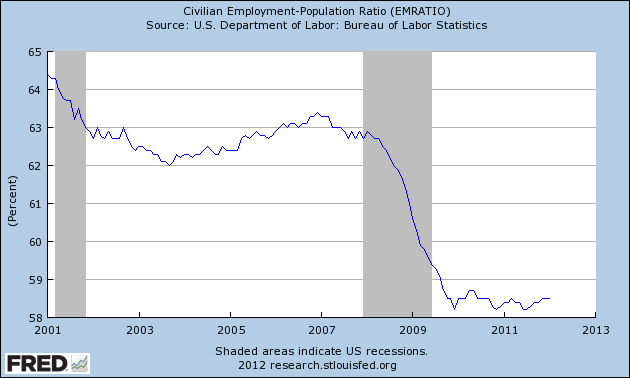

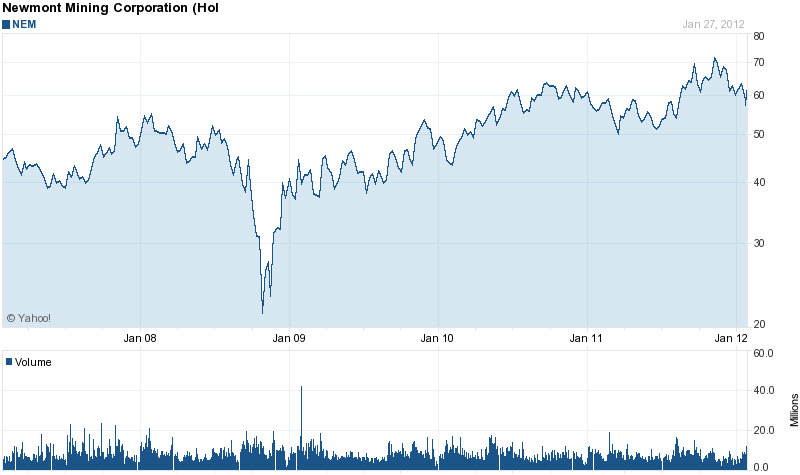

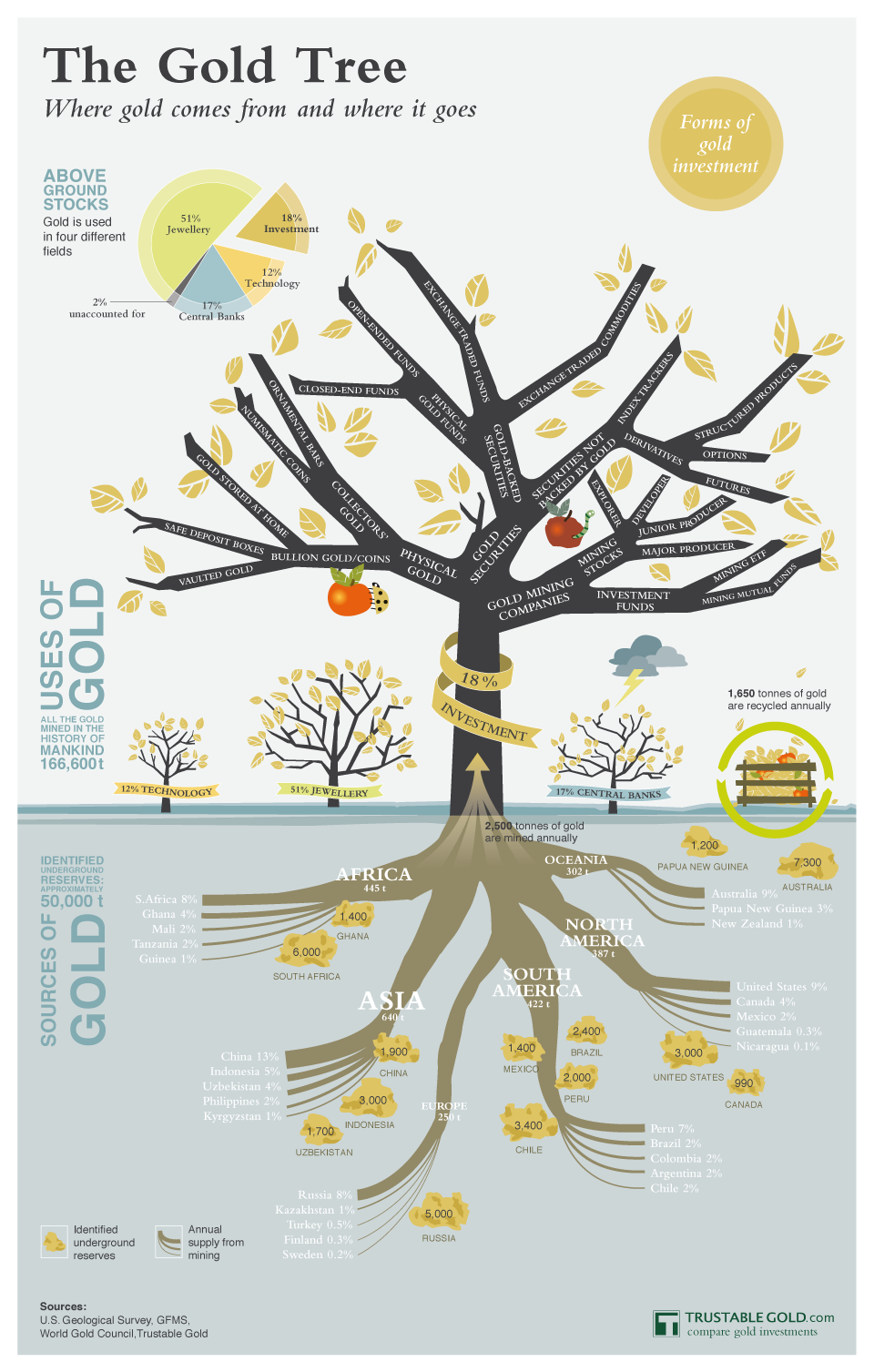

Over thousands of years, gold and silver are the only currencies that have not failed and have protected wealth. With rampant worldwide money printing, the wealth of nations is being stolen through endless money printing. Expect the severely undervalued gold stocks to rally strongly.

Gold Market of the 1970s Was A Dress Rehearsal

Jim Sinclair sees QE to infinity and persuasively argues that the only tool left in the toolbox is money printing which is required to prevent a global implosion from towering levels of debt.

Gold Should Be $2,100 – $2,200 Right Now

Great interview with Jim Puplava who discusses central bank money printing, financial repression, economic issues and why gold is undervalued by at least 22%.

Why The U.S. Government Confiscated Gold in 1933 – Can It Happen Again?

The U.S. government is already seizing the wealth of millions of Americans through financial repression. Through executive order U.S. citizens were forbidden to own gold from 1933 through 1974. Julian Phillips examines the reasons why this occurred and wonders if it could happen again?

Silver Price Rises Twice As Fast As Gold As The Eurozone Floods With Money

Silver has been on a tear this year, up 24% compared to an increase of 12% for gold. How should investors react to position themselves if gold soars over $2,000 and silver spikes to over $50?

Ex-Fed Governor Warsh Again Confirms Gold Price Suppression

GATA highlights the role of governments in financial repression and suppression of gold prices. Ex Fed Governor Kevin Warsh notes the growing call in Europe and the U.S. to devalue debts through money printing and higher inflation. Warsh says that “Such an inflation tax would transfer wealth from those who have lent money, in good faith, to the borrowers. Inflation is a blunt and inappropriate instrument for assigning winners and losers from profligate fiscal policy or excessive borrowing by private individuals and firms.”

Terrific article on the enduring characteristics of gold, why gold is money and how much gold should an investor own? Be prepared to get your checkbook out after reading this article. Whatever amount of gold you currently own, it’s not enough!