After last week’s major sell off in precious metals, gold and silver prices gained on the week while platinum and palladium registered small declines. As measured by the closing London Fix Price, gold gained $19.25 on the week and silver gained $2.00.

After last week’s major sell off in precious metals, gold and silver prices gained on the week while platinum and palladium registered small declines. As measured by the closing London Fix Price, gold gained $19.25 on the week and silver gained $2.00.

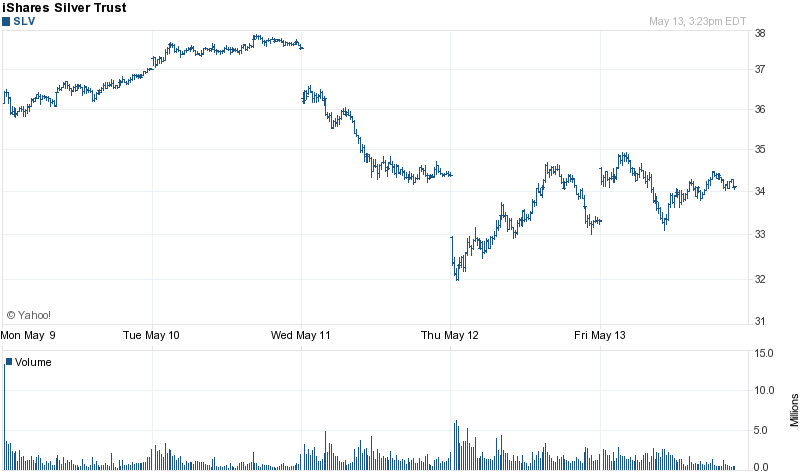

As is typical after a major pullback, silver prices were volatile. Silver’s sharp price increase this year had attracted many day traders and leveraged speculators who were forced to sell as silver prices declined, in large part due to the rapid series of margin increases by the COMEX on silver futures traders.

This week’s volatility in silver prices can be seen using the SLV as a silver proxy. After almost hitting $38 on Tuesday, the SLV plunged to $32 in early Thursday trading before recovering to the $34 level in late Friday trading.

The forced liquidation of silver positions by weaker leveraged hands has provided long term investors with a buying opportunity according to the experts at Dillon Gage Metals, a major precious metals dealer. According to Terry Hanlon, President of Dillon Gage, “This year, silver has had its biggest run in the shortest period of time in recent memory. Profit-taking corrections are to be expected when markets rally. This recent price correction doesn’t change the basic fundamentals, which include good demand for silver to make coins in a number of countries.”

Hanlon also noted that the recent strong dollar rally in early May lead to a broad based commodities sell off which extended to precious metals. The increased margin deposits required by the COMEX which increased from $4,250 a year ago to $16,200 per contract was also an obvious contributor to weakness in silver prices. Hanlon expects silver prices to remain range bound in the short term saying that “I look for investors and money managers to take a brief breather on the sidelines before getting back into the silver market on the buy side.”

No one can say exactly where silver prices will bottom out before heading higher but Dillon Gage sees “support at the $32 an ounce level”. Silver’s 200 day moving average is currently in the $28 range which should provide solid technical support.

| Precious Metals Prices | ||

| PM Fix | Since Last Recap | |

| Gold | $1,505.75 | +19.25 (+1.29%) |

| Silver | $36.20 | +2.00(+5.85%) |

| Platinum | $1,774.00 | -15.00 (-0.84%) |

| Palladium | $718.00 | -3.00 (-0.42%) |

It is interesting that amidst a broad based commodities sell off and a major price pullback in silver, gold’s relative performance has been very strong and indicative of fundamental demand. The recent news that numerous countries are increasing their stockpiles of gold bullion provides further proof that both individual investors and governments are seeking to preserve their wealth by diversifying out of paper currencies.

For investors who prefer to invest in gold mining companies, the K-Ratio, a time tested buy/sell indicator currently has very bullish readings. The K-Ratio is computed by dividing Barron’s Gold Mining Index by the current Handy and Harmon gold price and reflects the relative value of gold stocks compared to gold bullion. A reading below 1.2o tells us that gold stocks are cheap compared to gold bullion. The K-Ratio is currently at .93 indicating that gold stocks are currently a better relative bargain than gold bullion.