Global gold production could drop sharply as South African miners plan to dismiss thousands of workers for illegally striking. South African precious metal miners have been beset by labor unrest for months as workers protest low wages and dangerous working conditions. The latest disruption came Wednesday as South Africa’s largest gold miner announced plans to dismiss about 12,000 workers.

Global gold production could drop sharply as South African miners plan to dismiss thousands of workers for illegally striking. South African precious metal miners have been beset by labor unrest for months as workers protest low wages and dangerous working conditions. The latest disruption came Wednesday as South Africa’s largest gold miner announced plans to dismiss about 12,000 workers.

South Africa’s biggest gold miner by output, AngloGold Ashanti Ltd., said Wednesday it will begin a process to dismiss about 12,000 workers, following in the footsteps of other mining companies desperate to end crippling strikes.

If AngloGold follows through on its threat, it means more than 35,000 mining workers at several companies have been dismissed for illegally striking in recent weeks. The mass firings have prompted criticism from unions and the government, but so far have not provoked a repeat of the violence that sparked national labor unrest in South Africa in August.

Several major South African gold and platinum producers are struggling to end weeks of wildcat strikes that have halted thousands of ounces of gold and platinum production and caused billions of rand in lost revenue.

Gold production problems in South Africa run deeper than merely resolving a labor/management dispute over low wages. The cost and effort to mine gold has grown exponentially as the easy to reach grades of gold ore have been depleted. Miners have had to dig much deeper to reach low grades of ore with a corresponding increase in extraction costs. South Africa, once the leading country in gold production has dropped to fifth place.

In 2006, South Africa produced 272,128 kilograms of gold, but by 2011 output had plunged by 30% to only 190,000 kilograms. With workers no longer willing to work for what amount to slave labor wages, along with declining ore reserves, gold output from South African mines will continue to decline dramatically. SBG Securities analyst David Davis says “Almost all of the gold mines on strike are mature. These mines were going to have to be restructured and downsized anyhow in the next 12 to 36 months.”

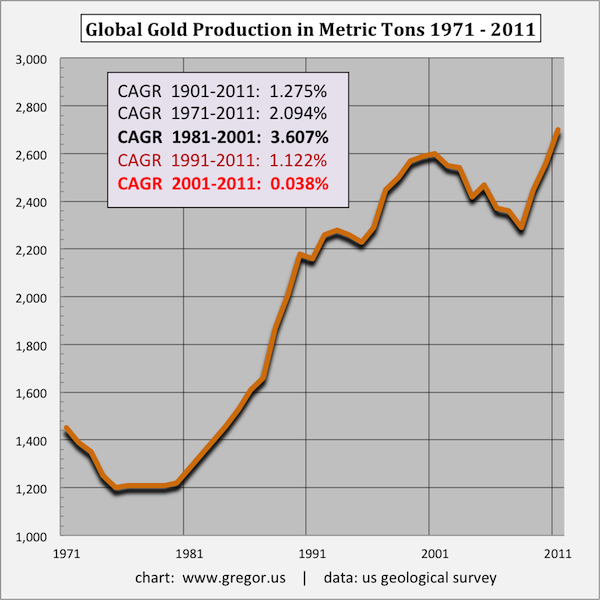

Further reductions in future global gold supply will continue based on the constantly increasing costs of mining lower grade ores and the lack of major new gold discoveries. According to the US Geological Survey, gold production decreased in every year from 2001 to 2008, a remarkable statistic in light of the huge increase in gold prices during that period of time. Gold sold for only around $300 per ounce in 2001 compared to today’s price of over $1,700 per ounce.

Over the past three years from 2009 to 2011, gold production increased as miners went all out to take advantage of surging gold prices. According to the World Gold Council, mine production rose from 2,611 tonnes in 2009 to 2,822 tonnes in 2011. The previous production peak for yearly gold production occurred in 2001 at 2,600 tonnes. As the current situation in South Africa shows, much of the recent increase in gold production came as mining companies desperately worked old mines to depletion while paying workers as little as possible. Those days are now over and South African gold production will continue to plummet.

Ironically, gold production soared from 1981 to 2000 as gold declined in price from $750 per ounce in 1981 to under $300 by the turn of the century. Gold miners were forced to produce as much gold as possible to stay in business as revenues constantly declined due to the drop in the price of gold.

Absent major new discoveries of large gold deposits, gold mining production could decline substantially in future years. Declining supplies, along with massive currency printing by central banks worldwide, will create the perfect storm for a continuation of the decade long bull market in gold. Note to Ben Bernanke – no, you can’t print gold.

Speak Your Mind