Kyle Bass recently summed up the thoughts of many gold investors when he said “the largest central banks in the world, they have all moved to unlimited printing ideology. Monetary policy happens to be the only game in town. I am perplexed as to why gold is as low as it is. I don’t have a great answer for you other than you should maintain a position.”

Kyle Bass recently summed up the thoughts of many gold investors when he said “the largest central banks in the world, they have all moved to unlimited printing ideology. Monetary policy happens to be the only game in town. I am perplexed as to why gold is as low as it is. I don’t have a great answer for you other than you should maintain a position.”

Gold investors can easily be forgiven for being perplexed, especially when considering that gold prices are plunging at a time when stocks of physical gold are being rapidly depleted at the COMEX warehouses. Is this just one of life’s unsolvable mysteries or is the gold market being manipulated? Bill Downey at Gold Trends lays out a solid case on how market manipulation caused last week’s gold collapse and why it makes more sense than ever to increase holdings in physical gold and silver.

Charts by Nick Laird of www.sharelynx.com

And how can that happen?

They have to hatch out a plan and carefully orchestrate it in a series of events that takes the gold market by surprise and force the players out of their positions.

Read on for today’s lesson in market manipulation and allow me to relay my speculation about what transpired last week.

A successful ambush usually involves surprise.

One of the main new weapons in the FEDS arsenal is TRANSPARENCY.

After a lifetime of silence the FED all of a sudden has come out of the closet and has decided that the best thing for the market is to be transparent and to that end they now have televised communication meetings with the general public so chairman Bernanke can explain the FED policy and answer any questions that the market has on its mind as well as the usual minutes that get released to the markets that review the policy decisions and discussion of prior meetings.

Why does the Fed need to explain what they are doing now?

Well it isn’t because everything is going just fine. Put it this way. They must figure when you have 50 million people on food stamps and the Dow Jones is going up a few hundred points a week and making all time highs and you have 16 trillion dollars in debt and interest rates are zero, its best to have a communiqué every month before someone asks you to explain what is going on. It’s called staying ahead of the curve if you will. If you tell them what’s going on it makes it look like you know what you’re doing. Otherwise all we have is the statistics and by themselves they tell you something is wrong, something is terribly wrong. So they have become transparent.

During the last communiqué the chairman made it abundantly clear that QE was here to stay until the unemployment rate reached acceptable levels. This communiqué whether by personal appearance or by releasing the FOMC minutes of the prior meeting is something the FED relies on so market participants can remain comfortable and abreast of Fed monetary policy.

Three strikes and you’re out

The FOMC minutes from the last meeting were due for release during last week. But a funny thing happened. They got released EARLIER than expected. It was all a big mistake and the FED let the SEC and the CFTC know right away that the error had occurred. And lo and behold even with all its transparency there happened to be some language we didn’t get updated on until the FOMC minutes were released. The notes say that several members have been discussing cutting back on the stimulus. That was strike one. It got the gold market thinking that stimulus cuts might be coming.

Strike one

Surprise number two

Then a bombshell was released from news sources. It was reported that Cyprus would have to sell 400 million Euro’s of gold as part of the bailout package of raising money for their failed banking system. Gold prices came down to 1550 on the news and the day passed by. Even though Cyprus bankers tell us the next day that they didn’t discuss selling any gold, market jitters seemed to remain and Friday was just around the corner. This was strike two.

Now we need a strike three and you’re out. Gold is a nervous market to begin with as a lot of people have already lost a lot of money in the last six months.

With Gold at 1550, all that is needed for the market to drop is to get one more push where all the stops are (just below the 2 year low of 1525).

The selling began in the Friday sessions overseas. By time we got to the New York COMEX gold open, the price was down to 1542. Now all the players are there and the volume and liquidity is there to create the final blow to the market.

And then the attack began. Wave after wave of selling until gold got to 1525. Then they break down the price below the two year low and all the stops that have been accumulating there start getting tripped up and the selling accelerates as it begins to feed on itself. The physical market for gold sees this as a gift and gets ready to make their move and buy up the gold.

Now comes the part that is pure genius or a total coincidental thing that just so happens to be a gift to those who are short the market and those who would be responsible to deliver gold should the inventory deplete.

ALL OF A SUDDEN THE LONDON PHYSICAL PLATFORM THAT BUYS AND SELLS PHYSICAL GOLD GETS LOCKED UP. THE SYSTEM FREEZES.

Every gold and silver investor owes a debt of gratitude to the

Every gold and silver investor owes a debt of gratitude to the Both the Federal Reserve and the Bank of Japan have gone all in with their attempts to revive weak, debt burdened economies with a pledge of unlimited money printing.

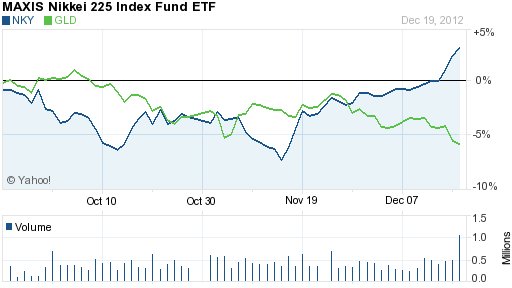

Both the Federal Reserve and the Bank of Japan have gone all in with their attempts to revive weak, debt burdened economies with a pledge of unlimited money printing.