According to the latest report from the U.S. Mint, demand for both gold and silver bullion coins during September surged to the highest levels since January.

According to the latest report from the U.S. Mint, demand for both gold and silver bullion coins during September surged to the highest levels since January.

Total sales of the American Eagle Gold bullion coins during September soared 75.6% to 68,500 ounces from 39,000 ounces in August. Monthly sales of gold bullion coins have fluctuated widely during 2012 with a high of 127,000 ounces in January and a low of 20,000 ounces in April. The average monthly sales of gold bullion coins through September is 53,500.

Total sales of the American Eagle Gold bullion coins through September total 481,500 ounces. Unless sales surge dramatically during the last three months of the year, 2012 will be the fourth year of declining sales of the gold bullion coin. As detailed below, the all time record for sales of the gold bullion coins was during 2009 when sales exceeded 1.4 million ounces.

| Gold Bullion U.S. Mint Sales By Year | ||

| Year | Total Sales Oz. | |

| 2000 | 164,500 | |

| 2001 | 325,000 | |

| 2002 | 315,000 | |

| 2003 | 484,500 | |

| 2004 | 536,000 | |

| 2005 | 449,000 | |

| 2006 | 261,000 | |

| 2007 | 198,500 | |

| 2008 | 860,500 | |

| 2009 | 1,435,000 | |

| 2010 | 1,220,500 | |

| 2011 | 1,000,000 | |

| Sept-12 | 481,500 | |

| Total | 7,731,000 | |

U.S. Mint sales of the American Eagle Silver bullion coins during September totaled 3,255,000 ounces, up 13.4% from August sales of 2,870,000 ounces.

Investor demand for the American Eagle Silver bullion coins has been relatively consistent throughout the year. After a very strong January during which over 6.1 million coins were sold, demand remained strong with monthly sales well in excess of 2 million ounces except for February when sales slumped to 1,490,000 ounces. If monthly sales of the American Eagle silver coins continue at the September sales pace, total sales for 2012 will be close to the record year of 2011 when almost 40 million ounces were sold.

Total annual sales by the U.S. Mint of the silver bullion coins since 2000 are shown below. Sales for 2012 are through September.

| American Silver Eagle Bullion Coins | ||

| YEAR | OUNCES SOLD | |

| 2000 | 9,133,000 | |

| 2001 | 8,827,500 | |

| 2002 | 10,475,500 | |

| 2003 | 9,153,500 | |

| 2004 | 9,617,000 | |

| 2005 | 8,405,000 | |

| 2006 | 10,021,000 | |

| 2007 | 9,887,000 | |

| 2008 | 19,583,500 | |

| 2009 | 28,766,500 | |

| 2010 | 34,662,500 | |

| 2011 | 39,868,500 | |

| Sept-12 | 25,795,000 | |

| TOTAL | 224,195,500 | |

The American Eagle gold and silver bullion coins produced by the U.S. Mint can only be purchased by Authorized Purchasers who in turn resell the coins to other dealers and the general public. Numismatic versions (uncirculated or proof) of the American Eagle series coins can be purchased by the public directly from the U.S. Mint.

Nothing seems to obsess the U.S. government more than gold. Could this be due to the fact that gold represents an alternative currency to the failing U.S. dollar, despite the assertions of Fed Chairman Bernanke that “

Nothing seems to obsess the U.S. government more than gold. Could this be due to the fact that gold represents an alternative currency to the failing U.S. dollar, despite the assertions of Fed Chairman Bernanke that “

India may increase the import tax on gold for the third time this year in an attempt to shore up the weak rupee. Purchases of gold and silver account for a huge 12.5% of all Indian imports and are contributing to a record current-account deficit according to

India may increase the import tax on gold for the third time this year in an attempt to shore up the weak rupee. Purchases of gold and silver account for a huge 12.5% of all Indian imports and are contributing to a record current-account deficit according to

The latest sales figures from the U.S. Mint for August show a significant increase in sales of both gold and silver bullion coins.

The latest sales figures from the U.S. Mint for August show a significant increase in sales of both gold and silver bullion coins.

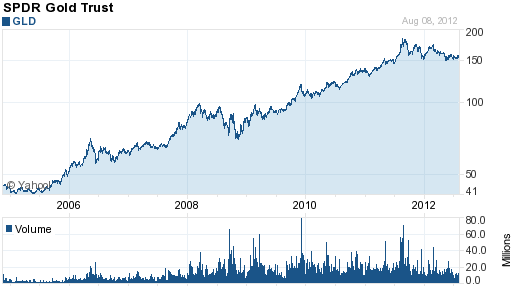

Yahoo Finance ran a story today entitled “Gold, Silver & Copper Are All Heading Lower.” Nothing worth discussing about the specifics of the article – the real story here is that this a classic contrary headline seen at market bottoms, not tops.

Yahoo Finance ran a story today entitled “Gold, Silver & Copper Are All Heading Lower.” Nothing worth discussing about the specifics of the article – the real story here is that this a classic contrary headline seen at market bottoms, not tops. By

By

General Outlook for Gold and the Miners

General Outlook for Gold and the Miners

Each day another gold stock blows up. Last week it was NovaGold (NG) and then Newmont Mining (NEM) and before that a long list too painful to mention. Although I strongly prefer holding physical precious metals over mining companies, the gold stocks that I do own have put in less than a sterling performance.

Each day another gold stock blows up. Last week it was NovaGold (NG) and then Newmont Mining (NEM) and before that a long list too painful to mention. Although I strongly prefer holding physical precious metals over mining companies, the gold stocks that I do own have put in less than a sterling performance.

The latest sales figures from the U.S. Mint show that sales of both gold and silver bullion coins declined dramatically during July. While sales of silver bullion coins have remained at historically high levels, sales of the gold bullion coins have been in a steep decline since 2009.

The latest sales figures from the U.S. Mint show that sales of both gold and silver bullion coins declined dramatically during July. While sales of silver bullion coins have remained at historically high levels, sales of the gold bullion coins have been in a steep decline since 2009.