What I Know for Certain – By: GE Christenson

- Death and taxes!

- Fear and greed are powerful motivators.

- Individuals, businesses, and governments do what they think is beneficial for them.

- Businesses and governments protect their products and territory and resist competition and enemies.

- Concentrated wealth creates power and corruption. The greater the concentration of wealth, the larger and more pervasive the power and corruption.

- Gold and silver have been money for over 3,000 years.

- Unbacked paper money systems have always failed.

What I Think is True

- The basic product of a central bank is the unbacked paper currency it prints in ever-increasing quantities.

- Central banks will fight all competitors to their currencies. The oldest competitor to unbacked paper currencies is gold, ancient money.

- Politicians want to spend money and increase their power.

- Bankers want to create money, lend it to governments, and thereby secure a permanent and increasing revenue stream.

What I Think the Consequences Are

- Bankers use their wealth to “influence” politicians. Politicians respond with favorable legislation. It has worked for centuries.

- Central banks want an expanding money supply and ever-increasing debt. The consequence is that consumer prices inevitably increase.

- A currency collapse is like a bank run – everyone scrambles to remove his/her wealth from the currency (or the bank) due to a loss of confidence. In fractional reserve banking systems, bank runs are inevitable. Even though they may last for many decades, unbacked paper currencies inevitably devalue and eventually collapse.

- Bank runs and currency collapses are feared by bankers and politicians; they do what they can to support confidence in their products and to squash their competitors.

In the United States

- Debt and government spending seem likely to increase until a crash-reset occurs.

- The crash-reset will involve a dollar collapse.

- Gold and silver will eventually reach much higher prices due to the loss of value and confidence in the dollar, the banking system, and the sustainability of the current financial system.

- “Paper gold” will be seen for what it is – a promise that might not be paid.

- Physical gold will be seen for what it is – real wealth.

- The USA and Europe are sending their real wealth – gold – to China, India, Russia, and the Middle East. China, India, and Russia are buying aggressively and know that exchanging paper dollars and euros for gold will strengthen their economies and governments tomorrow.

- It is openly speculated that much of the sovereign government and central bank gold supposedly owned by the USA and Europe is either gone, leased, or otherwise committed.

Read: The Crash Before the Climb

Accept what you cannot change and act based on facts, not our current financial and economic fictions. Protect your financial well-being with physical gold and silver safely stored in a secure location.

GE Christenson

aka Deviant Investor

The exploding demand for physical gold and silver has become a worldwide phenomenon. Shortly after the price plunge of early April buyers rushed in to take advantage of bargain prices. Dealers and mints worldwide have reported off the charts demand for physical gold and silver.

The exploding demand for physical gold and silver has become a worldwide phenomenon. Shortly after the price plunge of early April buyers rushed in to take advantage of bargain prices. Dealers and mints worldwide have reported off the charts demand for physical gold and silver. Don’t precious metal investors read newspapers? Despite proclamations from the mainstream press that the bull market in gold and silver is over, a buying frenzy in precious metals is occurring worldwide. The gold rush mentality to buy gold and silver at bargain prices has resulted in stock out conditions for many retail sellers of precious metals, including

Don’t precious metal investors read newspapers? Despite proclamations from the mainstream press that the bull market in gold and silver is over, a buying frenzy in precious metals is occurring worldwide. The gold rush mentality to buy gold and silver at bargain prices has resulted in stock out conditions for many retail sellers of precious metals, including  We have probably all heard enough already from the mainstream nitwits who are forecasting the end of the gold bull market and further price declines. Funny thing though, most precious metal investors don’t need advice from self proclaimed experts on how to invest their money. The explicitly stated goal of central banks to increase the rate of inflation through currency debasement is blatantly obvious. Investors are acting accordingly by taking advantage of the recent decline in precious metal prices.

We have probably all heard enough already from the mainstream nitwits who are forecasting the end of the gold bull market and further price declines. Funny thing though, most precious metal investors don’t need advice from self proclaimed experts on how to invest their money. The explicitly stated goal of central banks to increase the rate of inflation through currency debasement is blatantly obvious. Investors are acting accordingly by taking advantage of the recent decline in precious metal prices.

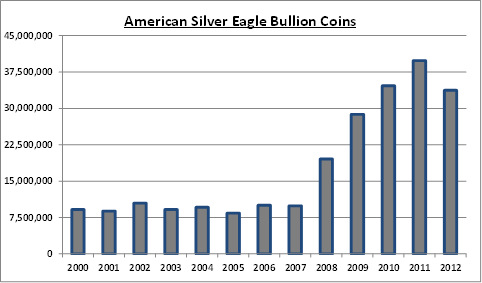

Sales of both the American Eagle gold and silver bullion coins soared in February compared to the previous year.

Sales of both the American Eagle gold and silver bullion coins soared in February compared to the previous year.

Sales of the American Eagle gold bullion coin soared during the first month of the year. According to the US Mint, gold bullion coin sales totaled 150,000 ounces, up 97.4% from December 2012 when 76,000 ounces were sold. Sales for the month were up 18.1% from comparable sales of 127,000 ounces a year ago during January 2012.

Sales of the American Eagle gold bullion coin soared during the first month of the year. According to the US Mint, gold bullion coin sales totaled 150,000 ounces, up 97.4% from December 2012 when 76,000 ounces were sold. Sales for the month were up 18.1% from comparable sales of 127,000 ounces a year ago during January 2012. With two days remaining in the month of January, U.S. Mint sales of the American Silver Eagle bullion coins have already established an all time record high. The latest numbers from the Mint show total sales of 7,420,000 silver bullion coins as January 29, 2013. Total sales during January 2012 amounted to 6,107,000 coins. During January 2011 (the previous monthly record high for silver bullion coin sales) the Mint sold 6,422,000 coins.

With two days remaining in the month of January, U.S. Mint sales of the American Silver Eagle bullion coins have already established an all time record high. The latest numbers from the Mint show total sales of 7,420,000 silver bullion coins as January 29, 2013. Total sales during January 2012 amounted to 6,107,000 coins. During January 2011 (the previous monthly record high for silver bullion coin sales) the Mint sold 6,422,000 coins. According to the latest U.S. Mint report, sales of the American Eagle Gold bullion coins for December 2012 totaled 76,000 ounces, up 16% from December 2011 when 65,500 ounces were sold. Sales for the month were down 44.3% from November sales which totaled 136,500 ounces.

According to the latest U.S. Mint report, sales of the American Eagle Gold bullion coins for December 2012 totaled 76,000 ounces, up 16% from December 2011 when 65,500 ounces were sold. Sales for the month were down 44.3% from November sales which totaled 136,500 ounces. As gold demand in Asia soars, vault companies are racing to keep up with storage demand. In July, Gold and Silver Blog reported on a

As gold demand in Asia soars, vault companies are racing to keep up with storage demand. In July, Gold and Silver Blog reported on a