In the past week, the United States Mint sold 833,500 ounces of silver bullion and 31,500 ounces of gold bullion. Available products included the American Silver Eagle in one ounce size and the American Gold Eagle in one ounce or three fractional sizes.

In the past week, the United States Mint sold 833,500 ounces of silver bullion and 31,500 ounces of gold bullion. Available products included the American Silver Eagle in one ounce size and the American Gold Eagle in one ounce or three fractional sizes.

For the year to date, the US Mint has now sold 8,152,500 ounces of silver, which is running well ahead of the pace of sales from the previous year. During 2010, the US Mint had sold 5,642,500 ounces through the end of February. Annual sales eventually reached a record 34,662,500 ounces from Silver Eagles, with an additional 875,000 ounces from the America the Beautiful Silver Bullion Coins.

Gold bullion sales for the year to date are now 189,000. Once again, this is running ahead of last year’s pace when the Mint sold 169,000 ounces through the end of February. By year end, sales had reached 1,220,500 ounces worth of Gold Eagles, plus 209,000 ounces from the 24 karat Gold Buffalo coins.

US Mint Bullion Coin Program Sales 2/16/2011 (ounces)

| Prior Week | Month to Date | Year to Date | |

| American Silver Eagle | 833,500 | 1,730,500 | 8,152,500 |

| American Gold Eagle | 31,500 | 55,500 | 189,000 |

| America the Beautiful Silver | 0 | 0 | 0 |

| American Platinum Eagle | 0 | 0 | 0 |

| American Gold Buffalo | 0 | 0 | 0 |

This month the US Mint began sales of the fractional weight 2011-dated American Gold Eagles. Throughout January, only the one ounce size was available bearing this year’s date.

Fractional Gold Eagle sales for the month so far include 100,000 of the one-tenth ounce size coins, 16,000 of the one-quarter ounce coins, and 5,000 of the one-half ounce coins. In recent years, the one ounce size coins have accounted for the bulk of bullion sales.

After the furious pace of sales experienced during January for the United States Mint’s American Silver Eagle and American Gold Eagle bullion coins, the current month is progressing at a more measured pace. For the week ending February 9, 2011, the US Mint recorded sales of 847,000 ounces worth of silver and 18,000 ounces worth of gold.

After the furious pace of sales experienced during January for the United States Mint’s American Silver Eagle and American Gold Eagle bullion coins, the current month is progressing at a more measured pace. For the week ending February 9, 2011, the US Mint recorded sales of 847,000 ounces worth of silver and 18,000 ounces worth of gold. The United States Mint sold less gold bullion during 2010 than the previous year, as measured in ounces. Across their offerings of American Gold Buffalo and American Gold Eagle bullion coins, sales reached 1,429,500 in the current year compared to 1,625,000 in the prior year.

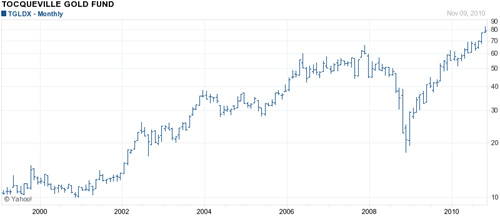

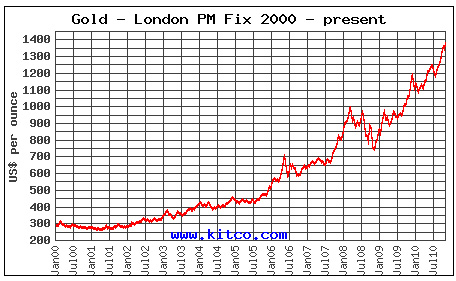

The United States Mint sold less gold bullion during 2010 than the previous year, as measured in ounces. Across their offerings of American Gold Buffalo and American Gold Eagle bullion coins, sales reached 1,429,500 in the current year compared to 1,625,000 in the prior year. Gold investors have two basic choices – buying gold bullion or buying shares in companies that produce or own gold. As we examine the two basic investment vehicles available to gold investors, it becomes apparent that choosing the best investment option can be a complex decision. Some of the questions that a gold investor should consider include the following.

Gold investors have two basic choices – buying gold bullion or buying shares in companies that produce or own gold. As we examine the two basic investment vehicles available to gold investors, it becomes apparent that choosing the best investment option can be a complex decision. Some of the questions that a gold investor should consider include the following.

The US Mint’s published sales figures for the month of August show a stunning decline in the level of gold bullion sales. The monthly sales for their popular American Gold Eagle bullion coins measured just 41,500 ounces. This represents the lowest monthly total since June 2008, before the financial crisis took hold and led to a surge in bullion sales.

The US Mint’s published sales figures for the month of August show a stunning decline in the level of gold bullion sales. The monthly sales for their popular American Gold Eagle bullion coins measured just 41,500 ounces. This represents the lowest monthly total since June 2008, before the financial crisis took hold and led to a surge in bullion sales.