Panicky investors may be dumping their gold, but one investor with a superb long term track record of value investing is loading up on gold bullion.

Panicky investors may be dumping their gold, but one investor with a superb long term track record of value investing is loading up on gold bullion.

In a Fortune interview, Charles de Vaulx, who runs the IVA Worldwide Fund, explains why his $10 billion fund holds over 7% in gold bullion.

At the time of the interview, gold was selling at $1,900 per ounce and de Vaulx was bullish based on a “mistrust of policymakers, be they in the U.S., Europe, Japan, or even China.” The inability of politicians to arrive at agreements in the face of a looming debt crisis gives gold an inherent value that paper currencies do not possess. As to why he would still be buying gold after a sevenfold rise since 2001, de Vaulx said that “the paradox with gold is that even though the price has gone up so much, it is still under-owned.” (See Americans Remain Underinvested In Gold.) The IVA Fund has invested only in gold bullion which is viewed as being “safer and cheaper” than gold mining stocks.

Regarding the U.S. dollar, de Vaulx thinks that over the long term, the U.S. will be forced to solve its massive debt problems through currency debasement and inflation. Initially, the bursting of a credit bubble causes deflationary problems but ultimately the policies of the Federal Reserve will produce inflation. Fed policies will accordingly result in poor returns for bond investors who have sought shelter in U.S. treasury securities.

The circumstances under which de Vaulx would reduce his gold positions would be if policy makers are able to institute policies that would encourage sound currencies or if the values of equities become “truly cheap.”

According to Fortune, de Vaulx launched his fund only three years ago. Based on a long term track record of superior investment returns, de Vaulx was able to quickly attract $10 billion in assets. Due to the recent panic sell off in the gold market, de Vaulx’s fund has taken a hit, but my bet is that de Vaulx is taking advantage of the situation by scooping up more gold at bargain prices.

Through the end of April, the United States Mint has now sold 466,000 ounces of gold and 16,375,000 ounces of silver through its bullion coin programs. In both cases the figures are far ahead of the numbers from the comparable year ago period, despite the higher market price per ounce for the bullion.

Through the end of April, the United States Mint has now sold 466,000 ounces of gold and 16,375,000 ounces of silver through its bullion coin programs. In both cases the figures are far ahead of the numbers from the comparable year ago period, despite the higher market price per ounce for the bullion. Depending on which gold stock investor you talk to, gold stocks have either been under performing or outperforming gold bullion.

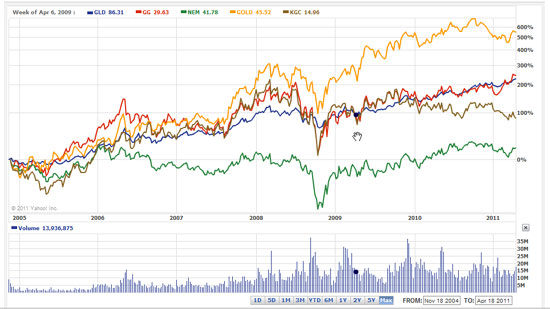

Depending on which gold stock investor you talk to, gold stocks have either been under performing or outperforming gold bullion.

Rep. Ron Paul, during a Subcommittee hearing on problems at the US Mint, linked the shortage of gold and silver coins to the “huge debasement” of the United States currency.

Rep. Ron Paul, during a Subcommittee hearing on problems at the US Mint, linked the shortage of gold and silver coins to the “huge debasement” of the United States currency. The weekly sales levels for the United States Mint’s gold and silver bullion coins were little changed from the levels of the previous period. Across the available options for gold, sales reached 23,000 ounces. Meanwhile total sales of 697,500 ounces of silver bullion were recorded.

The weekly sales levels for the United States Mint’s gold and silver bullion coins were little changed from the levels of the previous period. Across the available options for gold, sales reached 23,000 ounces. Meanwhile total sales of 697,500 ounces of silver bullion were recorded. Gold trusts have probably been a decisive factor in promoting the ownership of gold and expanding the market to investors who would otherwise not participate in the market. Prior to the establishment of the gold trusts, investors had two primary options for investing in gold, both of which had drawbacks. Gold investors could purchase the shares of gold mining companies or physically purchase gold coins or bars.

Gold trusts have probably been a decisive factor in promoting the ownership of gold and expanding the market to investors who would otherwise not participate in the market. Prior to the establishment of the gold trusts, investors had two primary options for investing in gold, both of which had drawbacks. Gold investors could purchase the shares of gold mining companies or physically purchase gold coins or bars. The pace of United States Mint gold and silver bullion coin sales picked up in the prior week. The US Mint currently has available one ounce American Silver Eagles in allocated quantities and unrestricted quantities of American Gold Eagles.

The pace of United States Mint gold and silver bullion coin sales picked up in the prior week. The US Mint currently has available one ounce American Silver Eagles in allocated quantities and unrestricted quantities of American Gold Eagles. The US Mint utilizes a network of authorized purchasers (AP’s) to distribute bullion products to the public. This small group of private sector businesses are allowed to purchase bullion coins from the Mint in bulk quantities, and in turn resell them to the public. The price charged to the APs is based on the market price of the metal plus a mark up.

The US Mint utilizes a network of authorized purchasers (AP’s) to distribute bullion products to the public. This small group of private sector businesses are allowed to purchase bullion coins from the Mint in bulk quantities, and in turn resell them to the public. The price charged to the APs is based on the market price of the metal plus a mark up.