Investor demand for gold during 2011 hit an all time high, fueled by soaring demand in China and India. Total gold demand by China and India during 2011 amounted to a staggering 61% of all gold mine production last year.

Investor demand for gold during 2011 hit an all time high, fueled by soaring demand in China and India. Total gold demand by China and India during 2011 amounted to a staggering 61% of all gold mine production last year.

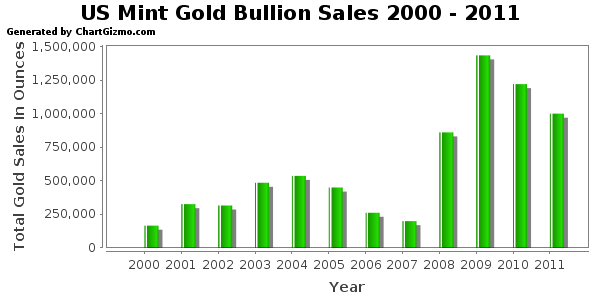

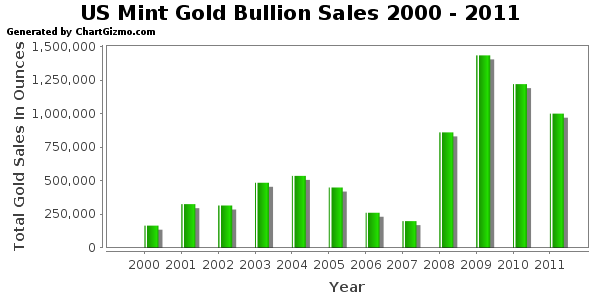

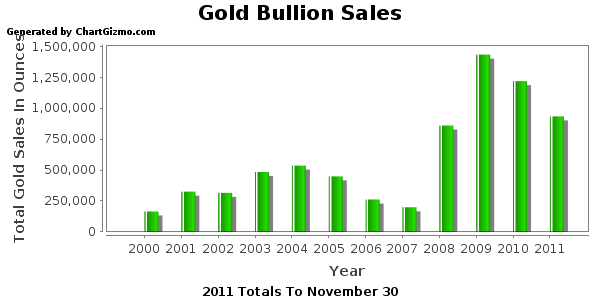

The 2011 Gold Demand Trends report issued by the World Gold Council show a huge increase in gold demand and a small increase in global gold mine production. This continues a trend that has been in place since 2001. Despite an almost 600% increase in the price of gold since 2001, global gold mine production has increased by only 7.7%.

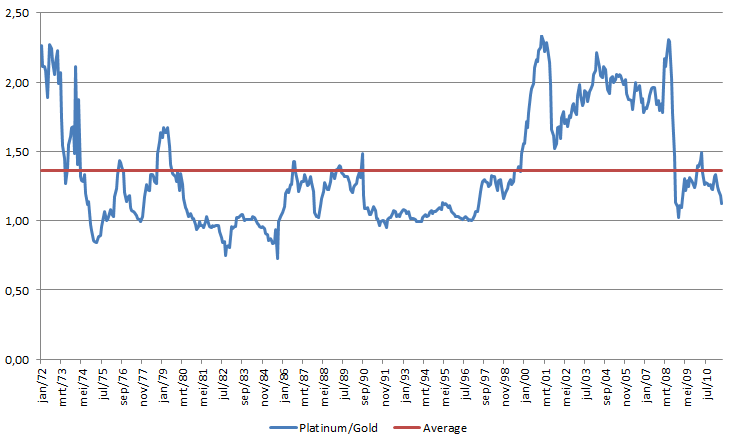

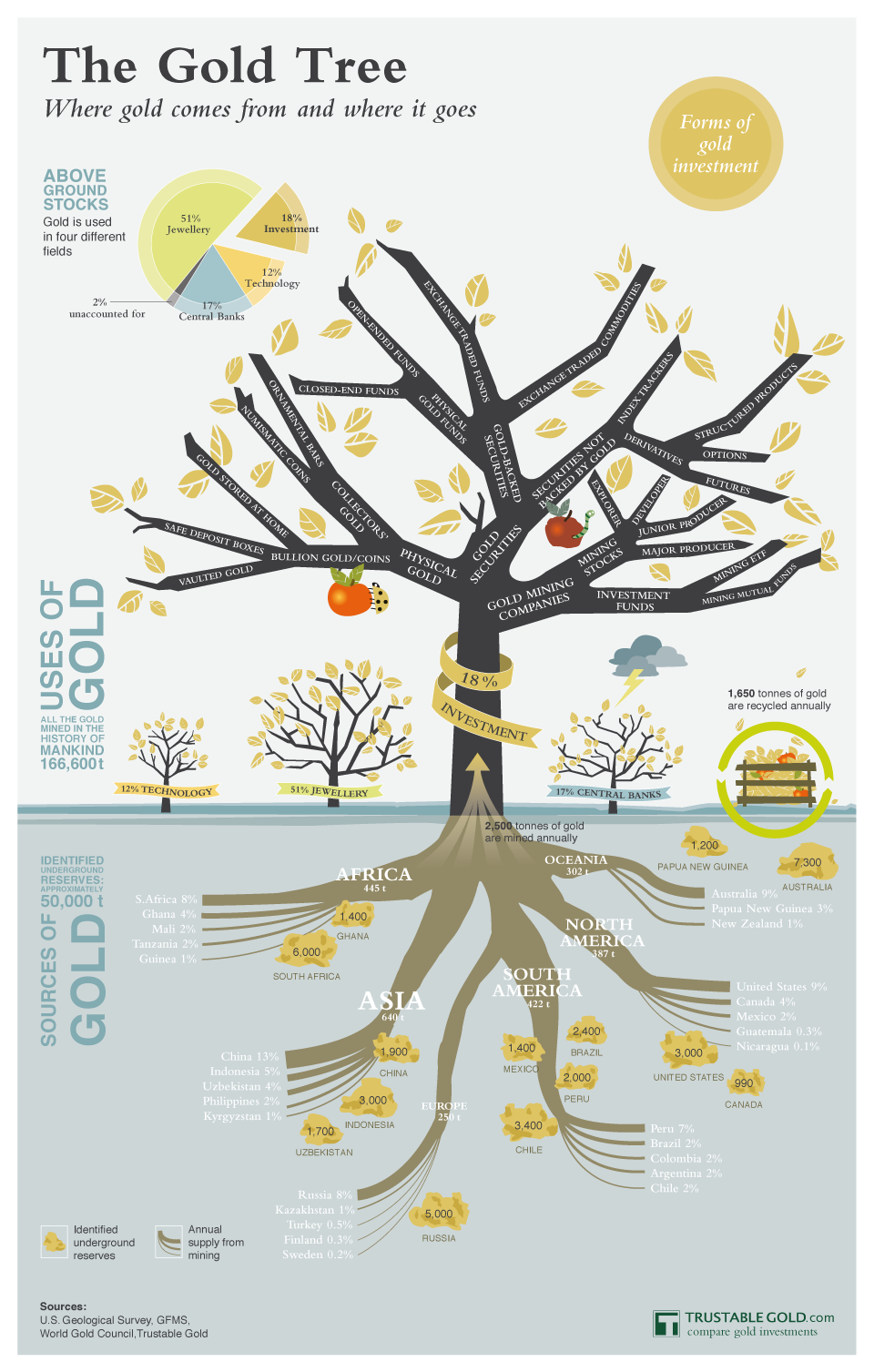

Typically, a large increase in price will bring forth additional supplies as producers rush to take advantage of higher prices. This has not happened with gold due to the depletion of existing gold reserves and the inability of miners to discover and develop new gold deposits. The continuing increase in gold demand and the lack of new supply will eventually result in gold prices higher than most people can imagine today.

Highlights of the Gold Demand Trends report are summarized below.

- For the first time ever, on a dollar basis, gold demand hit all time record highs at $205.5 billion, representing 4,067.1 tonnes of gold.

- Investor demand for gold hit all time record of 1,640.7 tonnes, up 5% from the previous year.

- Demand for gold by China soared 20% last year to 769.8 tonnes and demand by India, despite currency weakness, was 933.4 tonnes. It is expected that China will become the largest gold market in the world during 2012 based on continued record setting demand.

- Global gold production increased by only 4% last year to 2,809.5 tonnes. The combined gold demand of 1,703.2 tonnes by China and India consumed 60.6% of all new gold mine production. It is projected that the supply of new gold will remained “restrained” for the foreseeable future.

- The desire to protect wealth accounted for surging gold demand in Europe as the European Central Bank engages in a massive money printing campaign to prop up the insolvent banking system.

- Central banks continued to buy gold during 2011, increasing total purchases to 440 tonnes, up by 77 tonnes from last year.

- The amount of gold available to meet demand is being restrained not only by low mine production but also by reduced supplies of gold from recycling. Despite a 28% increase in gold prices last year, the supply of recycled gold declined by 2% to 1,611.9 tonnes. According to the Gold Council, this implies that “market supplies are drying up and that consumers may be holding on to their gold in the expectation of higher prices.”

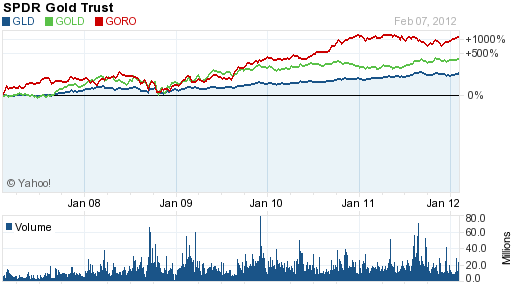

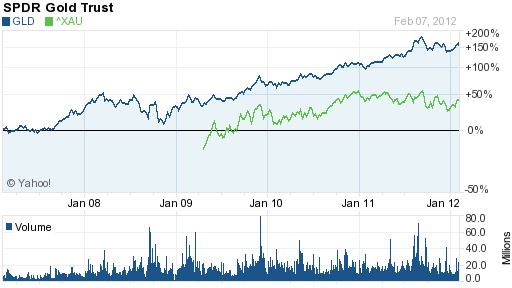

- Investors are showing a strong preference for physical gold as seen by the investment flows into bar and coin compared to ETF demand. Demand for gold bar and coin during 2011 totaled 1,486.7 tonnes compared to ETF demand of only 154.0 tonnes.

- Gold demand by ETFs increased in the 2011 fourth quarter over the comparable period last year, but total demand during 2011 of 154.0 tonnes was far below ETF gold demand of 367.7 tonnes during 2010.

The Gold Council bullishly notes that the gold market is unique in that it is driven by a “diverse set of factors” and multiple sources of demand.