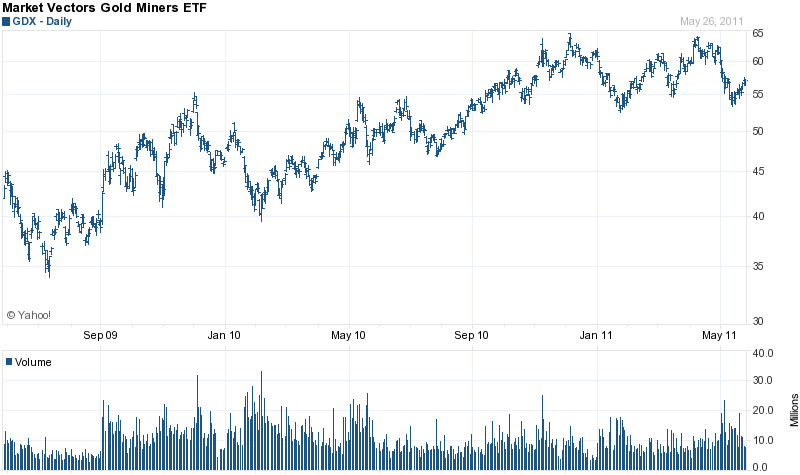

Investors in gold mutual funds have dramatically underperformed the return from holding physical gold over the past three years. For a variety of reasons, many gold mining companies have been unable to turn higher gold prices into increased earnings. As a result, gold stock mutual funds have dramatically underperformed the price gains of gold bullion.

Investors in gold mutual funds have dramatically underperformed the return from holding physical gold over the past three years. For a variety of reasons, many gold mining companies have been unable to turn higher gold prices into increased earnings. As a result, gold stock mutual funds have dramatically underperformed the price gains of gold bullion.

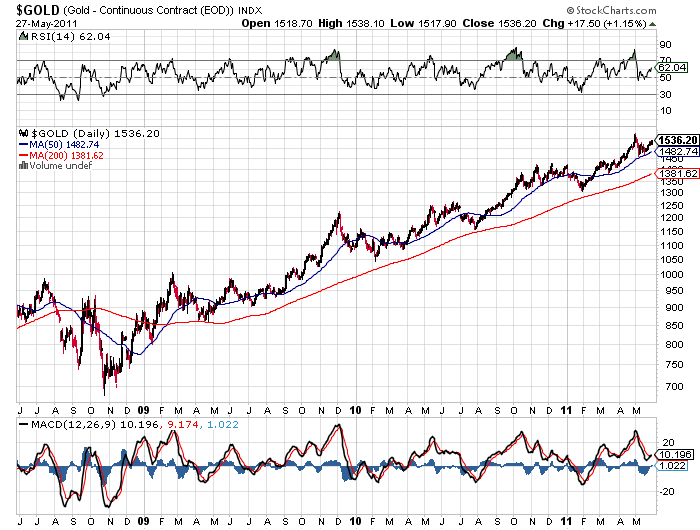

Over the past three years, gold has increased by 80%, from a monthly low of $853 in May 2008 to $1,535 at today’s closing price. Holders of the physical metal have done extremely well while investors in gold mutual funds run by two of the countries largest investment companies (Vanguard and Fidelity) have dramatically underperformed.

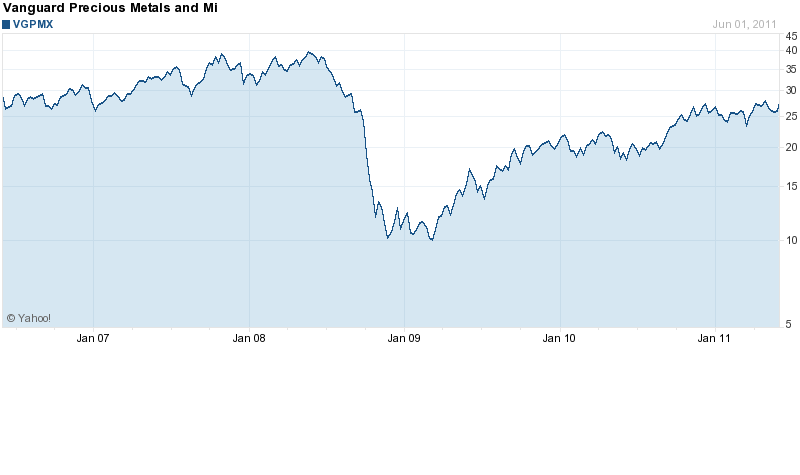

According to the Vanguard web site, the Vanguard Precious Metals and Mining Fund (VGPMX) has a three year average annual performance of -.46%, while the price of gold has soared 80%. Vanguard states that although this fund is not a “pure gold or precious metals fund”, it invests in companies that are ” involved in the mining or of exploration for precious and rare metals and minerals”. The Vanguard precious metals fund invests in 50 different stocks in 14 different countries and foreign holdings total 92% of assets. The fund has net assets of $5.8 billion.

In early May 2008, the VGPMX reached $39 per share compared to today’s closing price of $27.20. The fund has paid out dividends which added to the overall returns of the fund.

The ten year return on the Vanguard gold fund, however, would have outperformed holding physical gold. A $10,000 investment in the Vanguard Precious Metals Fund made in May 2001, would now be worth approximately $76,300. In May 2001, an investor could have purchased almost 38 ounces of gold for $10,000 which today would be valued at $58,330. As noted above, the dividend payments by VGPMX added to the fund’s return.

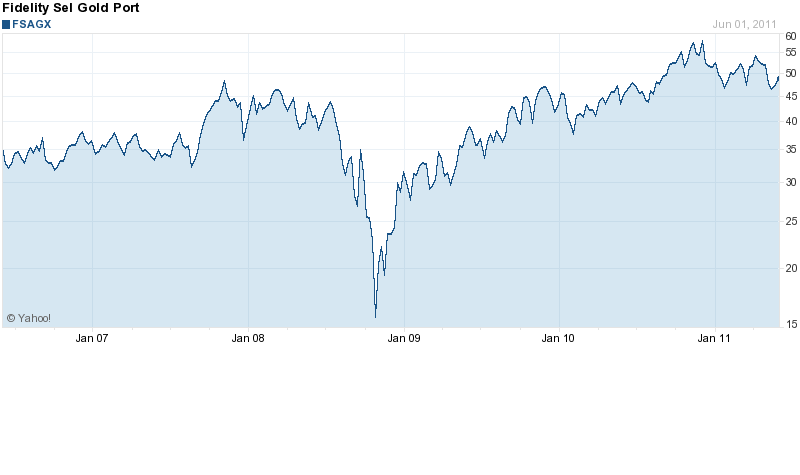

The Fidelity Select Gold Portfolio (FSAGX) has outperformed the Vanguard fund, but still trails the three year return on gold bullion. According to the Fidelity web site, the Fidelity gold portfolio had a 3 year return of 16.2%, compared to an 80% increase in the price of gold.

The Fidelity Fund invests at least 80% of its assets in companies involved in gold mining, exploration or processing. The Fund also invests in gold bullion or coins and to a lesser degree, platinum, silver and diamonds. The FSAGX has net assets of $4.5 billion. The top ten holdings of the Fund at March 31, 2011 were Goldcorp, Barrick Gold, Newcrest Mining, Anglogold Ashanti, Newmont Mining, Kinross Gold, Agnico-Eagle Mines, Yamana Gold, Rangold Resources and Eldorado Gold Corp. The total number of holdings of the Fund is 131.

The long term results of the Fidelity gold fund slightly trail the Vanguard gold fund. Fidelity had a 10 year average annual performance of 22.54% compared to a return of 24.02% for Vanguard. Both the Vanguard and Fidelity fund had returns that exceeded the increase in the value of gold over the past ten years.

Will physical gold or gold mutual funds deliver the best return going forward?

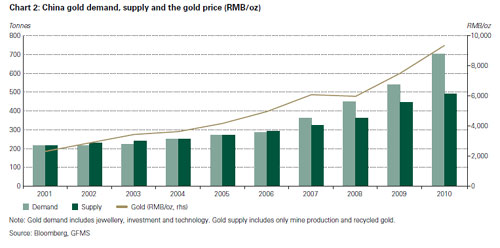

A continued rise in gold prices should eventually translate into higher leveraged profits for gold mining companies, unless the substantial costs of gold mining exceed the increase in gold prices. Inflation is rapidly rising as central banks continue to flood the global economy with cheap money. A continued rise in energy costs and general inflation could negate the benefit of increased gold prices for gold mining companies. Investors who hold physical gold or invest in gold trust ETFs, rather than gold mutual funds, should expect to see continued superior investment performance.

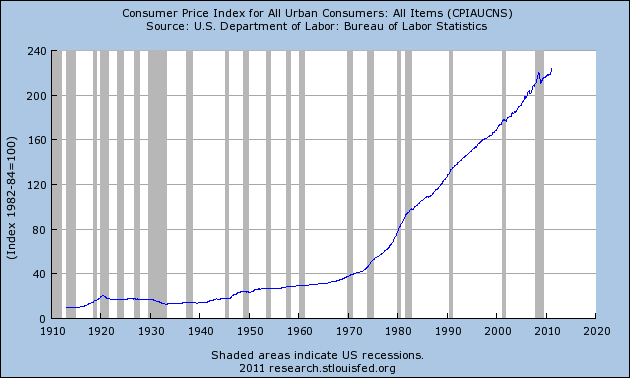

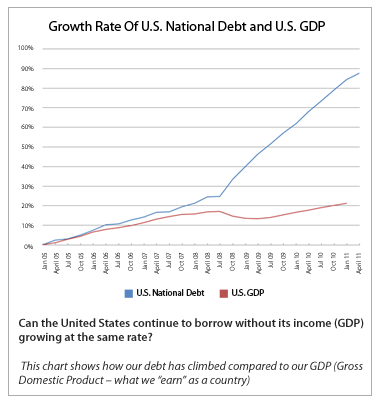

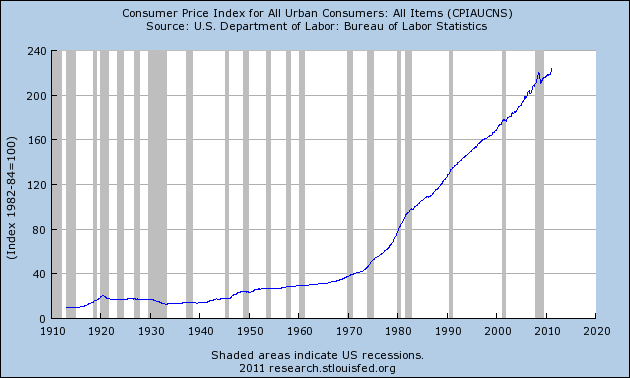

In his press conference on April 27, 2011, Federal Reserve Chairman Bernanke dismissed inflation worries, stating that “Our expectation is that inflation will come down and towards a more normal level”. Should we believe him? Not if you want to preserve your wealth and here’s why.

In his press conference on April 27, 2011, Federal Reserve Chairman Bernanke dismissed inflation worries, stating that “Our expectation is that inflation will come down and towards a more normal level”. Should we believe him? Not if you want to preserve your wealth and here’s why.

The holdings of the iShares Silver Trust (SLV) declined slightly on the week by 53.10 tonnes as silver prices continued to consolidate after the sharp sell off of early May.

The holdings of the iShares Silver Trust (SLV) declined slightly on the week by 53.10 tonnes as silver prices continued to consolidate after the sharp sell off of early May.